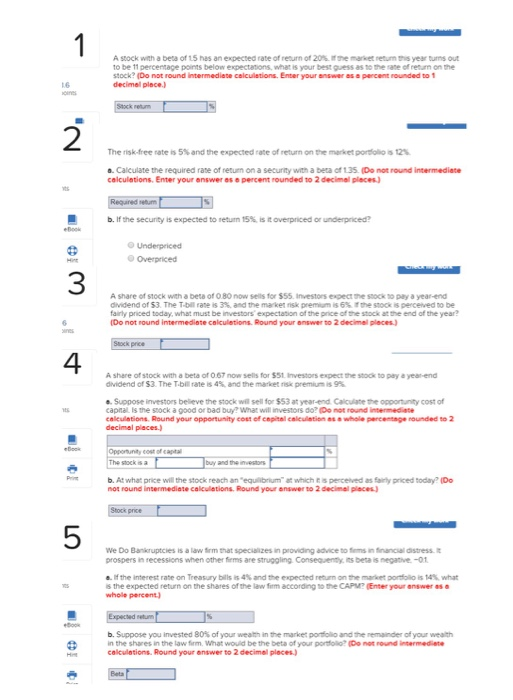

A stock with a beta of 15 has an expected rate of return of 20% ifthe market returm this year turns out to be 11 percentage points below expectations, what is your best guess as to the sate of retun on the stock? (Do not round intermediate celculetions. Enter your answer as o percent rounded to 1 decimel place ) 1.6 2 The risk-free rate is 5% and the expected rate of return on te market portio s t21 o. Calculate the required rate of return on a security with a beta of 135. (Do not round intermediate celculetions. Enter your enswer as e percent rounded to 2 declimal pleces b. If the security is expected to return 15% is it overpriced or underpriced? 3 A share of stock with a beta of 0 80 now sells for $55. Investors expect the sock to pay a year-end dvdend of S3 The Ton rate is 3% and the marker nsk prenum is 6%fthe stock s perceived to be fairly priced today, what must be investors expectation of the price of the stock at the end of the year? Do not round intermediete celculetions. Round your onswer to 2 decimel pleces) 4 A share of stock with a beta of 0.67 now sells for $51. Investors expect the stock to pay a year-end dividend of $3. The T-bil rate is 4%, and the market rsk premiu,is9% a. Suppose investors believe the stock will sell for $53 at year-end Calculate the opportunity cost of capnal is the snock a good or bad buy? What will investors do? (Do not round intermediate calculations. Round your opportunity cost of cepital caliculation es o whale percemnge rounded to 2 stock is a Pb.At what price will the stock reach an "equlibrium at which t s perceived as fairly priced today? (Do not round intermediate calculetions. Round your answer to 2 decimal places) 5 We Do Banikruptcies is a law rm that specializes in providing advice to fems in financial distress. prospers in recessions when other firms are struggling Consequenty, ins beta is negative-01 softhe interest rate on Treasury bills is 4% ad the erpected retrn on te maket porte ists what s the expected return on the shares of the law frm according to the CAPM (Enter your answer as a whole percent) . Suppose you invested 80% of your weatinthe market potolo and he remander of your weath in the shares in the law firm. What would be the beta of your porsfolio? (Do not round intermediate calculations, Round your enswer to 2 decimel pleces)