Answered step by step

Verified Expert Solution

Question

1 Approved Answer

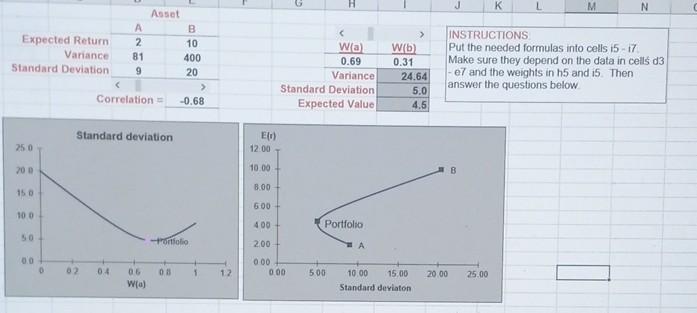

A straight line B curve C kinked line H K L M N Expected Return Variance Standard Deviation 2 81 9 Asset B 10 400

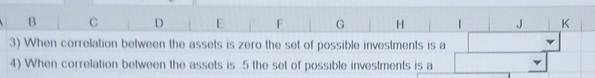

A straight line B curve C kinked line

H K L M N Expected Return Variance Standard Deviation 2 81 9 Asset B 10 400 20 Wa 0.69 Variance Standard Deviation Expected Value W(b) 0.31 24.64 5.0 4.5 INSTRUCTIONS Put the needed formulas into cells i5 - 17 Make sure they depend on the data in cells d3 e7 and the weights in 15 and 15. Then answer the questions below Correlation > -0.68 Standard deviation E) 250 12.00 200 10.00 B 8.00 150 600 10 0 400 Portfolio -ortolio 200 0.0 0 000 0 00 04 08 1 12 500 06 Wa) 20.00 25.00 10.00 15.00 Standard deviaton K B C D G H 3) When correlation between the assets is zero the set of possible investments is a 4) When correlation between the assets is 5 the set of possible investments is a H K L M N Expected Return Variance Standard Deviation 2 81 9 Asset B 10 400 20 Wa 0.69 Variance Standard Deviation Expected Value W(b) 0.31 24.64 5.0 4.5 INSTRUCTIONS Put the needed formulas into cells i5 - 17 Make sure they depend on the data in cells d3 e7 and the weights in 15 and 15. Then answer the questions below Correlation > -0.68 Standard deviation E) 250 12.00 200 10.00 B 8.00 150 600 10 0 400 Portfolio -ortolio 200 0.0 0 000 0 00 04 08 1 12 500 06 Wa) 20.00 25.00 10.00 15.00 Standard deviaton K B C D G H 3) When correlation between the assets is zero the set of possible investments is a 4) When correlation between the assets is 5 the set of possible investments is aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started