Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A student is trying to value an internship opportunity for the upcoming summer. The internship will last three months and pay her $ 2 ,

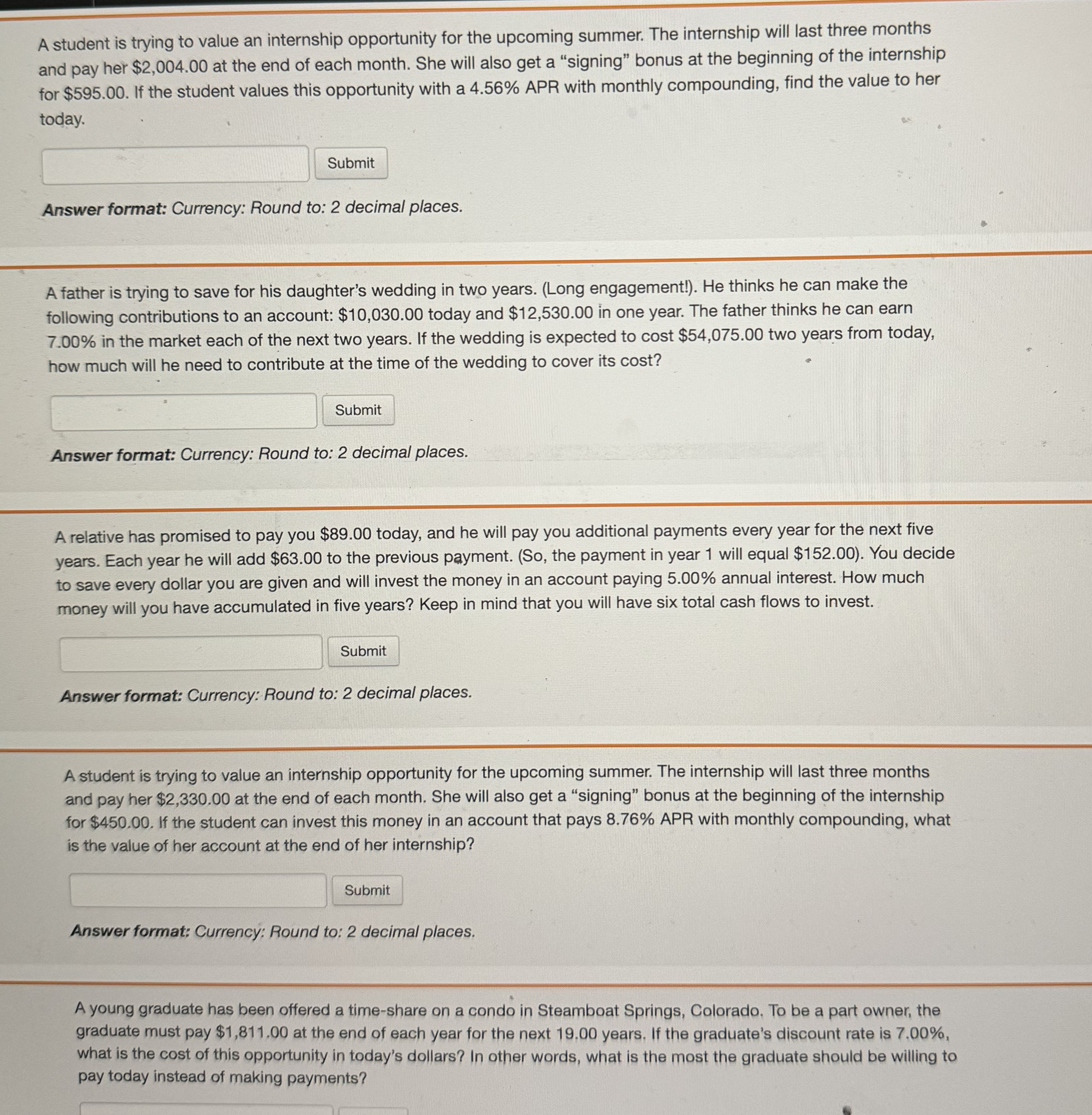

A student is trying to value an internship opportunity for the upcoming summer. The internship will last three months and pay her $ at the end of each month. She will also get a "signing" bonus at the beginning of the internship for $ If the student values this opportunity with a APR with monthly compounding, find the value to her today.

Answer format: Currency: Round to: decimal places.

A father is trying to save for his daughter's wedding in two years. Long engagement! He thinks he can make the following contributions to an account: $ today and $ in one year. The father thinks he can earn in the market each of the next two years. If the wedding is expected to cost $ two years from today, how much will he need to contribute at the time of the wedding to cover its cost?

Answer format: Currency: Round to: decimal places.

A relative has promised to pay you $ today, and he will pay you additional payments every year for the next five years. Each year he will add $ to the previous payment. So the payment in year will equal $ You decide to save every dollar you are given and will invest the money in an account paying annual interest. How much money will you have accumulated in five years? Keep in mind that you will have six total cash flows to invest.

Answer format: Currency: Round to: decimal places.

A student is trying to value an internship opportunity for the upcoming summer. The internship will last three months and pay her $ at the end of each month. She will also get a "signing" bonus at the beginning of the internship for $ If the student can invest this money in an account that pays APR with monthly compounding, what is the value of her account at the end of her internship?

Answer format: Currency: Round to: decimal places.

A young graduate has been offered a timeshare on a condo in Steamboat Springs, Colorado. To be a part owner, the graduate must pay $ at the end of each year for the next years. If the graduate's discount rate is what is the cost of this opportunity in today's dollars? In other words, what is the most the graduate should be willing to pay today instead of making payments?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started