Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Create a decision tree outlining Scott?s optons. 2. What are the costs/income associated with Scott?s decision each year, over 3 years? a. Rent inclusively

1. Create a decision tree outlining Scott?s optons.

2. What are the costs/income associated with Scott?s decision each year, over 3 years?

a. Rent inclusively (she pays only TV/Internet)

b. Rent non-inclusively (she pays TV/internet and all utlites).

c. Buy and charge rent-inclusively (assume there are not additonal closing costs)

d. Buy and charge rent-non-inclusively (assume there are not additonal closing costs)

3. What happens if the housing market is stagnant and Scott sells the house for the same price for which she bought it?

a. What happens if it depreciates by 2% each year?

4. Based on a three-year horizon, should Scott buy or rent and why?

5. If you were in Scott?s positon, what would you do?

Buy and charge rent inclusively (assume there are no additional closing costs)

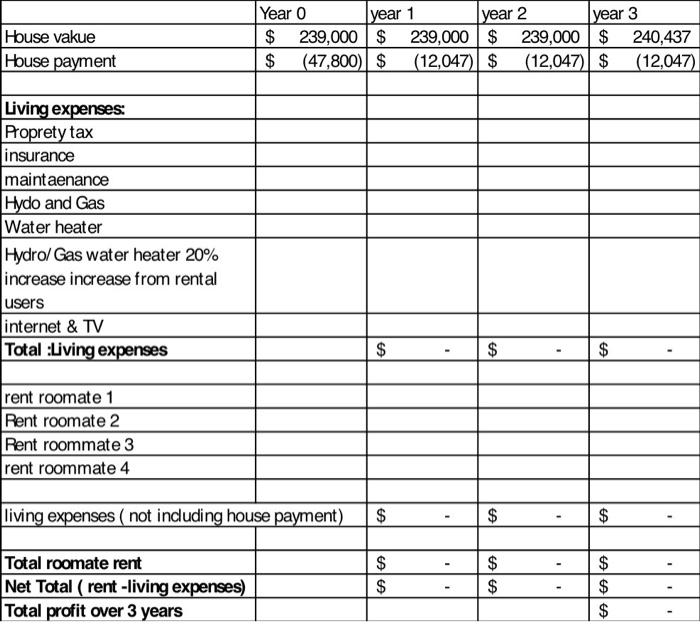

?If Scott chooses to buy a home and charge inclusive rent, her expenses and income will greatly differ than if she had rented. The following charts show her yearly expenses, her profit over 3 years, and then her profit after selling her house.

?If Scott buys a house and rents it to friends for $550 per month per bedroom, she will have $59,971.51 after 3 years as shown below. When she then sells the house, and pays off her loan, her final profit will be $38,355.57 (see chart and calculations on the next page).

House sale

$240,367

Agent 5% commission fee

Already paid on house

Remaining balance

Profit over 3 years

Ending profit

House vakue House payment Living expenses: Proprety tax insurance maintenance Hydo and Gas Water heater Hydro/Gas water heater 20% increase increase from rental users internet & TV Total :Living expenses rent roomate 1 Rent roomate 2 Rent roommate 3 rent roommate 4 Year 0 $ $ Total roomate rent Net Total (rent-living expenses) Total profit over 3 years living expenses (not including house payment) 239,000 $ (47,800) $ year 1 $ $ $ $ year 2 239,000 $ 239,000 (12,047) $ A $ $ GA $ GAGA $ year 3 $ (12,047) $ - $ $ $ LA LA LA $ $ 240,437 (12,047) I I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Decision Tree for Scotts Options Scotts Options Rent Inclusively Rent NonInclusively Buy Prop...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started