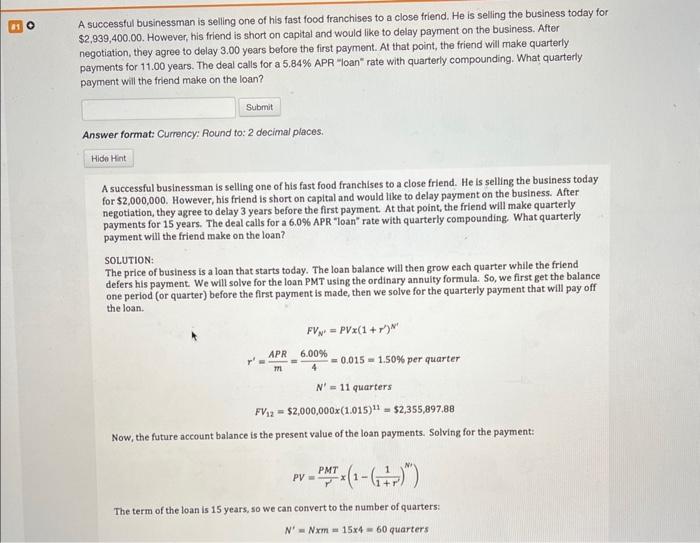

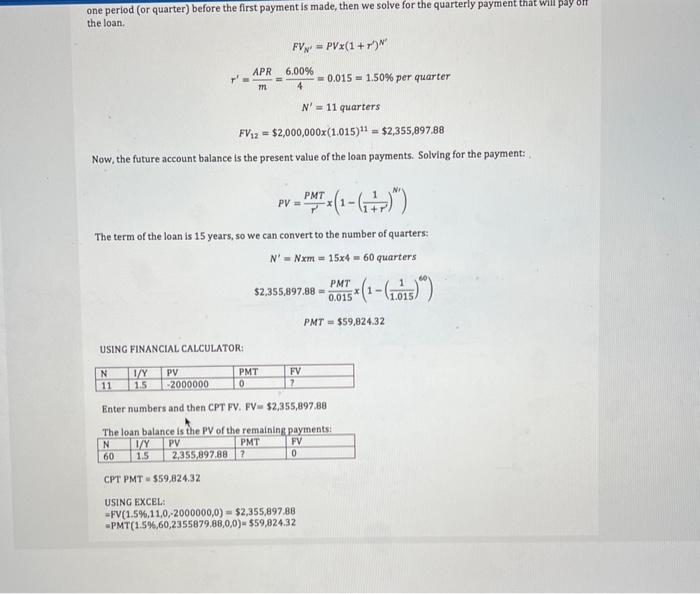

A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for $2,939,400,00. However, his friend is short on capital and would like to delay payment on the business. After negotiation, they agree to delay 3.00 years before the first payment. At that point, the friend will make quarterly payments for 11.00 years. The deal calls for a 5.84% APR =loan" rate with quarterly compounding. What quarterly payment will the friend make on the loan? Answer format: Currency: Round to: 2 decimal places. A successful businessman is selling one of his fast food franchises to a close friend. He is selling the business today for $2,000,000. However, his friend is short on capital and would like to delay payment on the business. After negotiation, they agree to delay 3 years before the first payment. At that point, the friend will make quarterly payments for 15 years. The deal calls for a 6.0% APR "loan" rate with quarterly compounding. What quarterly payment will the friend make on the loan? SOLUTION: The price of business is a loan that starts today. The loan balance will then grow each quarter while the friend defers his payment. We will solve for the loan PMT using the ordinary annuity formula. So, we first get the balance one period (or quarter) before the first payment is made, then we solve for the quarterly payment that will pay off the loan. FVN=PVx(1+r)Nr=mAPR=46.00%=0.015=1.50%perquarterN=11quartersFV12=$2,000,000(1.015)11=$2,355,897,88 Now, the future account balance is the present value of the loan payments. Solving for the payment: PV=rPMTx(1(1+r1)N) The term of the loan is 15 years, so we can convert to the number of quarters: N=Nxm=154=60quarters one period (or quarter) before the first payment is made, then we solve for the quarterly payment that will pay oir the loan. FVN=PVx(1+r)Nr=mAPR=46.00%=0.015=1.50%perquarterN=11quartersFV12=$2,000,000(1.015)11=$2,355,897.88 Now, the future account balance is the present value of the loan payments. Solving for the payment: PV=rPMTx(1(1+r1)N) The term of the loan is 15 years, so we can convert to the number of quarters: N=Nm=154=60quarters$2,355,897.88=0.015PMTx(1(1.0151)0)PMT=$59,824.32 USING FINANCIAL CALCULATOR: Enter numbers and then CPT FV. FV =$2,355,897.88