Answered step by step

Verified Expert Solution

Question

1 Approved Answer

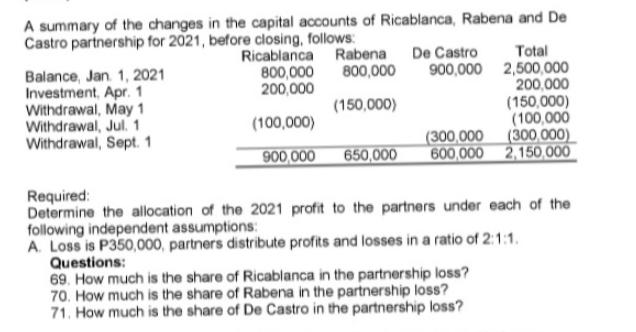

A summary of the changes in the capital accounts of Ricablanca, Rabena and De Castro partnership for 2021, before closing, follows: Ricablanca Balance, Jan

A summary of the changes in the capital accounts of Ricablanca, Rabena and De Castro partnership for 2021, before closing, follows: Ricablanca Balance, Jan 1, 2021 Investment, Apr. 1 Withdrawal, May 1 Withdrawal, Jul. 1 Withdrawal, Sept. 1 Total 900,000 2,500,000 Rabena De Castro 800,000 800,000 200,000 (150,000) (100,000) (300,000 (300,000) 900,000 650,000 600,000 2,150,000 Required: Determine the allocation of the 2021 profit to the partners under each of the following independent assumptions: A. Loss is P350,000, partners distribute profits and losses in a ratio of 2:1:1. Questions: 69. How much is the share of Ricablanca in the partnership loss? 200,000 (150,000) (100,000 70. How much is the share of Rabena in the partnership loss? 71. How much is the share of De Castro in the partnership loss?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started