Answered step by step

Verified Expert Solution

Question

1 Approved Answer

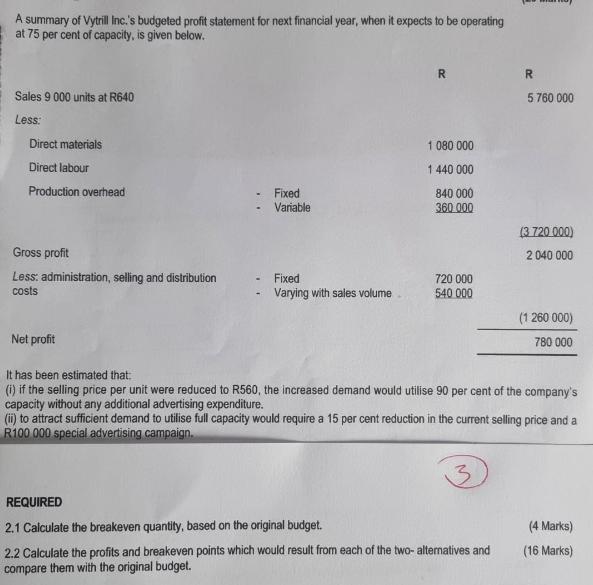

A summary of Vytrill Inc.'s budgeted profit statement for next financial year, when it expects to be operating at 75 per cent of capacity,

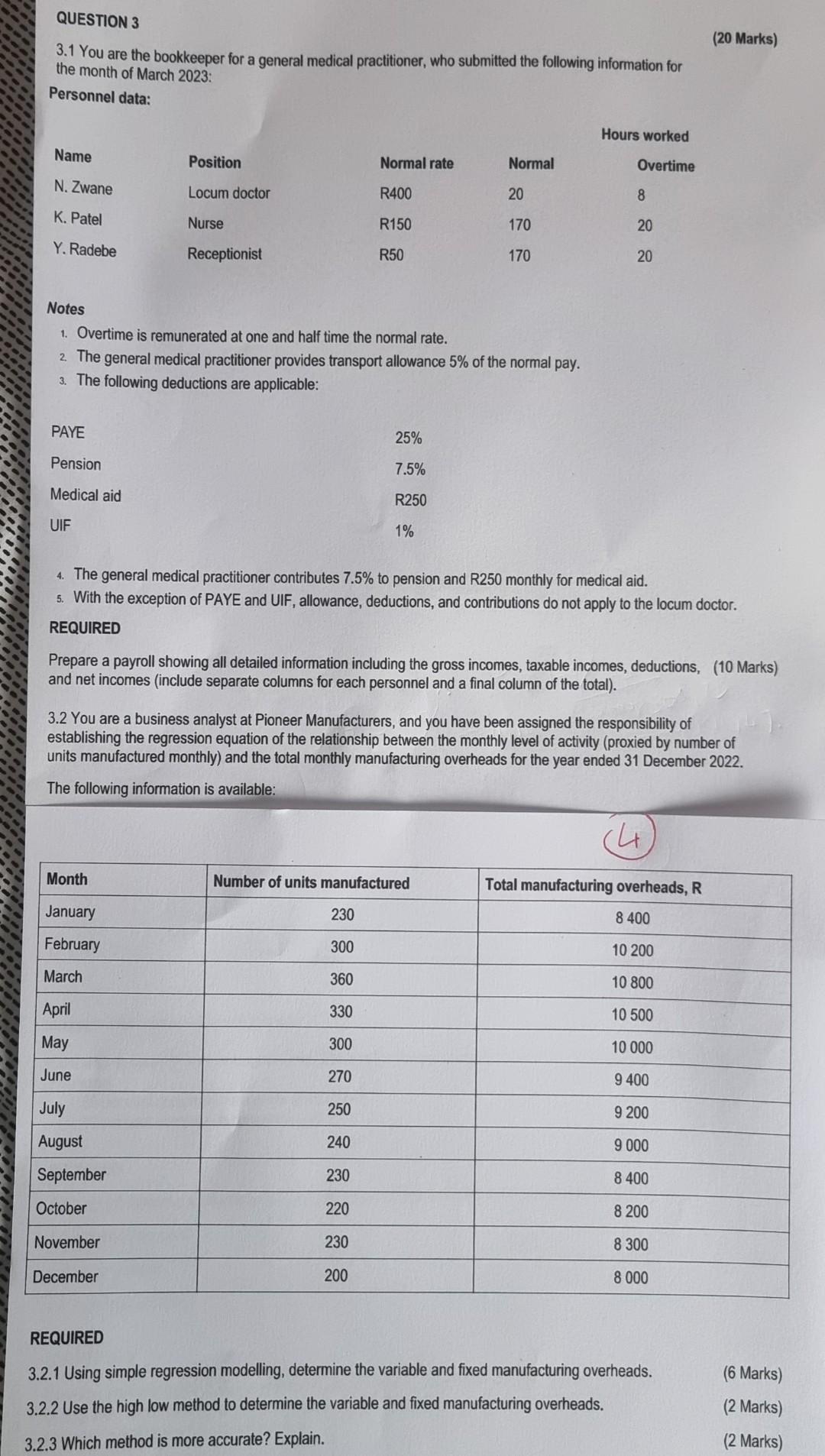

A summary of Vytrill Inc.'s budgeted profit statement for next financial year, when it expects to be operating at 75 per cent of capacity, is given below. Sales 9 000 units at R640 Less: Direct materials Direct labour Production overhead Gross profit Less: administration, selling and distribution costs Net profit Fixed - Variable Fixed Varying with sales volume R 1 080 000 1 440 000 840 000 360 000 720 000 540 000 R 5 760 000 REQUIRED 2.1 Calculate the breakeven quantity, based on the original budget. 2.2 Calculate the profits and breakeven points which would result from each of the two- alternatives and compare them with the original budget. (3 720 000) 2 040 000 (1 260 000) 780 000 It has been estimated that: (i) if the selling price per unit were reduced to R560, the increased demand would utilise 90 per cent of the company's capacity without any additional advertising expenditure. (ii) to attract sufficient demand to utilise full capacity would require a 15 per cent reduction in the current selling price and a R100 000 special advertising campaign. 3 (4 Marks) (16 Marks) QUESTION 3 3.1 You are the bookkeeper for a general medical practitioner, who submitted the following information for the month of March 2023: Personnel data: Name N. Zwane K. Patel Y. Radebe PAYE Pension Medical aid UIF Position Locum doctor Nurse Receptionist Notes 1. Overtime is remunerated at one and half time the normal rate. 2. The general medical practitioner provides transport allowance 5% of the normal pay. 3. The following deductions are applicable: Month January February March April May June Normal rate R400 R150 R50 July August September October November December 25% 7.5% R250 1% Normal 230 300 360 330 300 270 20 170 170 Number of units manufactured 250 240 230 220 230 200 4. The general medical practitioner contributes 7.5% to pension and R250 monthly for medical aid. 5. With the exception of PAYE and UIF, allowance, deductions, and contributions do not apply to the locum doctor. REQUIRED Hours worked Overtime Prepare a payroll showing all detailed information including the gross incomes, taxable incomes, deductions, (10 Marks) and net incomes (include separate columns for each personnel and a final column of the total). 8 20 3.2 You are a business analyst at Pioneer Manufacturers, and you have been assigned the responsibility of establishing the regression equation of the relationship between the monthly level of activity (proxied by number of units manufactured monthly) and the total monthly manufacturing overheads for the year ended 31 December 2022. The following information is available: 20 (20 Marks) 4 Total manufacturing overheads, R 8 400 10 200 10 800 10 500 10 000 9 400 9 200 9 000 8 400 8 200 8 300 8 000 REQUIRED 3.2.1 Using simple regression modelling, determine the variable and fixed manufacturing overheads. 3.2.2 Use the high low method to determine the variable and fixed manufacturing overheads. 3.2.3 Which method is more accurate? Explain. (6 Marks) (2 Marks) (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 To calculate the breakeven quantity based on the original budget we need to determine the total cost and the contribution margin per unit Total cost Direct materials Direct labor Production overhea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started