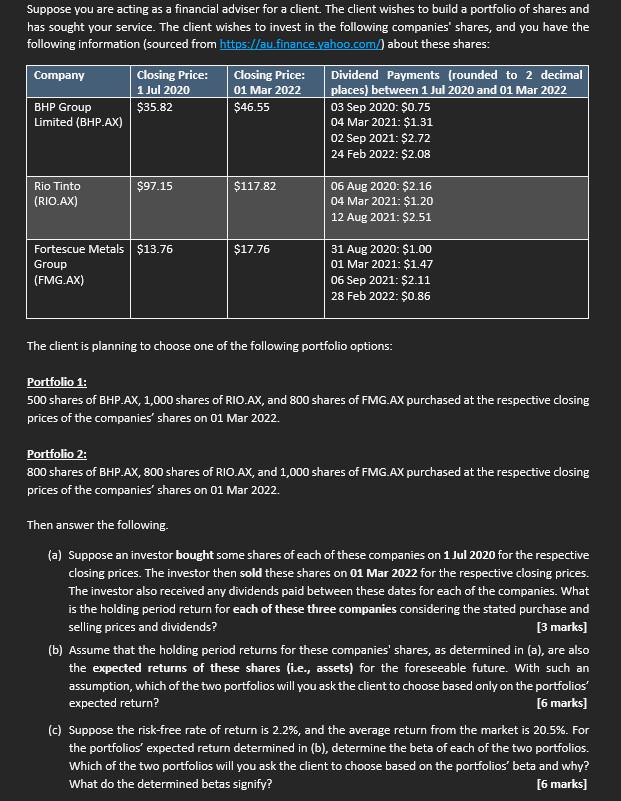

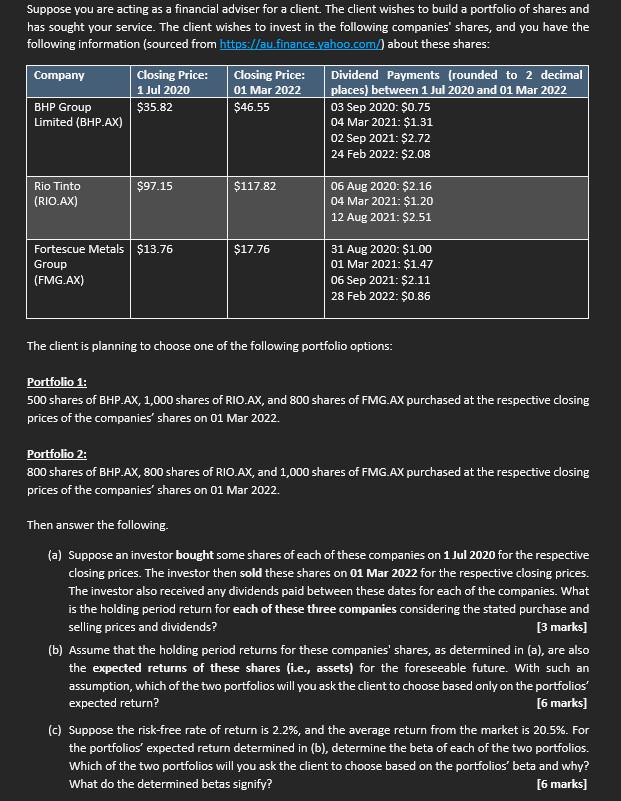

(a) Suppose an investor bought some shares of each of these companies on 1 Jul 2020 for the respective closing prices. The investor then sold these shares on 01 Mar 2022 for the respective closing prices. The investor also received any dividends paid between these dates for each of the companies. What is the holding period return for each of these three companies considering the stated purchase and selling prices and dividends? [3 marks] (b) Assume that the holding period returns for these companies' shares, as determined in (a), are also the expected returns of these shares (i.e., assets) for the foreseeable future. With such an assumption, which of the two portfolios will you ask the client to choose based only on the portfolios expected return? [6 marks] (c) Suppose the risk-free rate of return is 2.2%, and the average return from the market is 20.5%. For the portfolios' expected return determined in (b), determine the beta of each of the two portfolios. Which of the two portfolios will you ask the client to choose based on the portfolios' beta and why? What do the determined betas signify? [6 marks] (d) You may have noted that your client wishes to invest in companies all belonging to the same industry (i.e., mining industry). Do you think such type of diversification with all investments in the same industry is a good idea to reduce risks? Why or why not? Explain. [5 marks) Suppose you are acting as a financial adviser for a client. The client wishes to build a portfolio of shares and has sought your service. The client wishes to invest in the following companies' shares, and you have the following information (sourced from https://au.finance.yahoo.com/) about these shares: Company Closing Price: 1 Jul 2020 $35.82 Closing Price: 01 Mar 2022 $46.55 BHP Group Limited (BHP.AX) Dividend Payments (rounded to 2 decimal places) between 1 Jul 2020 and 01 Mar 2022 03 Sep 2020: $0.75 04 Mar 2021: $1.31 02 Sep 2021: $2.72 24 Feb 2022: $2.08 $97.15 $117.82 Rio Tinto (RIO.AX) 06 Aug 2020: $2.16 04 Mar 2021: $1.20 12 Aug 2021: $2.51 $17.76 Fortescue Metals $13.76 Group (FMG.AX) 31 Aug 2020: $1.00 01 Mar 2021: $1.47 06 Sep 2021: $2.11 28 Feb 2022: $0.86 The client is planning to choose one of the following portfolio options: Portfolio 1: 500 shares of BHP.AX, 1,000 shares of RIO.AX, and 800 shares of FMG.AX purchased at the respective closing prices of the companies' shares on 01 Mar 2022. Portfolio 2: 800 shares of BHP.AX, 800 shares of RIO.AX, and 1,000 shares of FMG.AX purchased at the respective closing prices of the companies' shares on 01 Mar 2022. Then answer the following (a) Suppose an investor bought some shares of each of these companies on 1 Jul 2020 for the respective closing prices. The investor then sold these shares on 01 Mar 2022 for the respective closing prices. The investor also received any dividends paid between these dates for each of the companies. What is the holding period return for each of these three companies considering the stated purchase and selling prices and dividends? [3 marks] (b) Assume that the holding period returns for these companies' shares, as determined in (a), are also the expected returns of these shares (i.e., assets) for the foreseeable future. With such an assumption, which of the two portfolios will you ask the client to choose based only on the portfolios' expected return? [6 marks) (c) Suppose the risk-free rate of return is 2.2%, and the average return from the market is 20.5%. For the portfolios' expected return determined in (b), determine the beta of each of the two portfolios. Which of the two portfolios will you ask the client to choose based on the portfolios beta and why? What do the determined betas signify? [6 marks] (a) Suppose an investor bought some shares of each of these companies on 1 Jul 2020 for the respective closing prices. The investor then sold these shares on 01 Mar 2022 for the respective closing prices. The investor also received any dividends paid between these dates for each of the companies. What is the holding period return for each of these three companies considering the stated purchase and selling prices and dividends? [3 marks] (b) Assume that the holding period returns for these companies' shares, as determined in (a), are also the expected returns of these shares (i.e., assets) for the foreseeable future. With such an assumption, which of the two portfolios will you ask the client to choose based only on the portfolios expected return? [6 marks] (c) Suppose the risk-free rate of return is 2.2%, and the average return from the market is 20.5%. For the portfolios' expected return determined in (b), determine the beta of each of the two portfolios. Which of the two portfolios will you ask the client to choose based on the portfolios' beta and why? What do the determined betas signify? [6 marks] (d) You may have noted that your client wishes to invest in companies all belonging to the same industry (i.e., mining industry). Do you think such type of diversification with all investments in the same industry is a good idea to reduce risks? Why or why not? Explain. [5 marks) Suppose you are acting as a financial adviser for a client. The client wishes to build a portfolio of shares and has sought your service. The client wishes to invest in the following companies' shares, and you have the following information (sourced from https://au.finance.yahoo.com/) about these shares: Company Closing Price: 1 Jul 2020 $35.82 Closing Price: 01 Mar 2022 $46.55 BHP Group Limited (BHP.AX) Dividend Payments (rounded to 2 decimal places) between 1 Jul 2020 and 01 Mar 2022 03 Sep 2020: $0.75 04 Mar 2021: $1.31 02 Sep 2021: $2.72 24 Feb 2022: $2.08 $97.15 $117.82 Rio Tinto (RIO.AX) 06 Aug 2020: $2.16 04 Mar 2021: $1.20 12 Aug 2021: $2.51 $17.76 Fortescue Metals $13.76 Group (FMG.AX) 31 Aug 2020: $1.00 01 Mar 2021: $1.47 06 Sep 2021: $2.11 28 Feb 2022: $0.86 The client is planning to choose one of the following portfolio options: Portfolio 1: 500 shares of BHP.AX, 1,000 shares of RIO.AX, and 800 shares of FMG.AX purchased at the respective closing prices of the companies' shares on 01 Mar 2022. Portfolio 2: 800 shares of BHP.AX, 800 shares of RIO.AX, and 1,000 shares of FMG.AX purchased at the respective closing prices of the companies' shares on 01 Mar 2022. Then answer the following (a) Suppose an investor bought some shares of each of these companies on 1 Jul 2020 for the respective closing prices. The investor then sold these shares on 01 Mar 2022 for the respective closing prices. The investor also received any dividends paid between these dates for each of the companies. What is the holding period return for each of these three companies considering the stated purchase and selling prices and dividends? [3 marks] (b) Assume that the holding period returns for these companies' shares, as determined in (a), are also the expected returns of these shares (i.e., assets) for the foreseeable future. With such an assumption, which of the two portfolios will you ask the client to choose based only on the portfolios' expected return? [6 marks) (c) Suppose the risk-free rate of return is 2.2%, and the average return from the market is 20.5%. For the portfolios' expected return determined in (b), determine the beta of each of the two portfolios. Which of the two portfolios will you ask the client to choose based on the portfolios beta and why? What do the determined betas signify? [6 marks]