Question

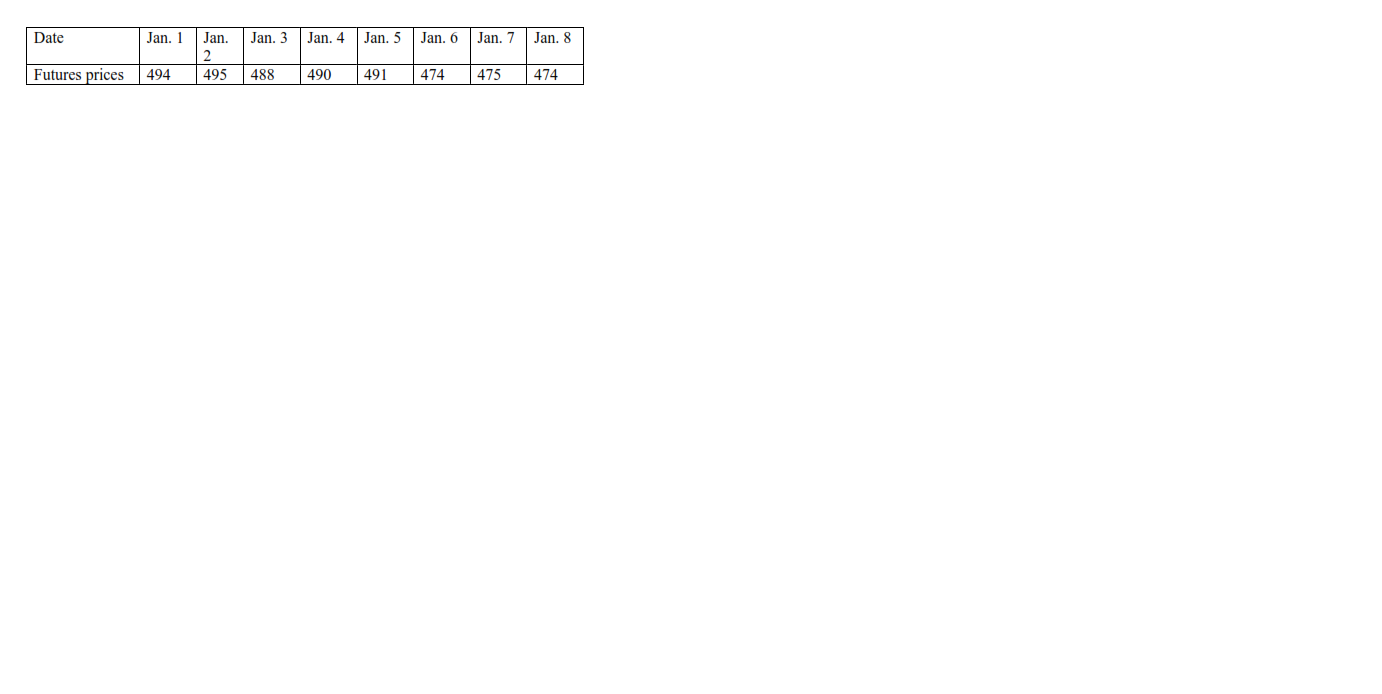

A. Suppose an investor takes a long position in 1 Gold futures contract, and the following information is given: Contract size = 100 ounces. Futures

A. Suppose an investor takes a long position in 1 Gold futures contract, and the following information is given: Contract size = 100 ounces. Futures price = $500 Initial margin = $3,000 per contract. Maintenance margin = $2,000 per contract

i. In which days will there be a margin call? How much will be the variation margin in all cases?

ii. In which days do the balances in the margin account exceed the initial margin?

B. Party A agrees to pay Party B a fixed rate of 4%. Party B agrees to pay Party A a floating rate based on the return of the S&P 500 Index. The payments will be made annually and will be based on a notional principal of $1,000,000.

i. Suppose at the end of the first year, the S&P 500 appreciated by 4.5%. How much will Party B will pay Party A

ii. What will happen in the second year, if the S&P 500 depreciated by 3%

Date Jan. 1 Jan. 3 Jan. 4 Jan. 5 Jan. 6 Jan. 7 Jan. 8 Jan. 2 495 Futures prices 494 488 490 491 474 475 474 Date Jan. 1 Jan. 3 Jan. 4 Jan. 5 Jan. 6 Jan. 7 Jan. 8 Jan. 2 495 Futures prices 494 488 490 491 474 475 474Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started