Answered step by step

Verified Expert Solution

Question

1 Approved Answer

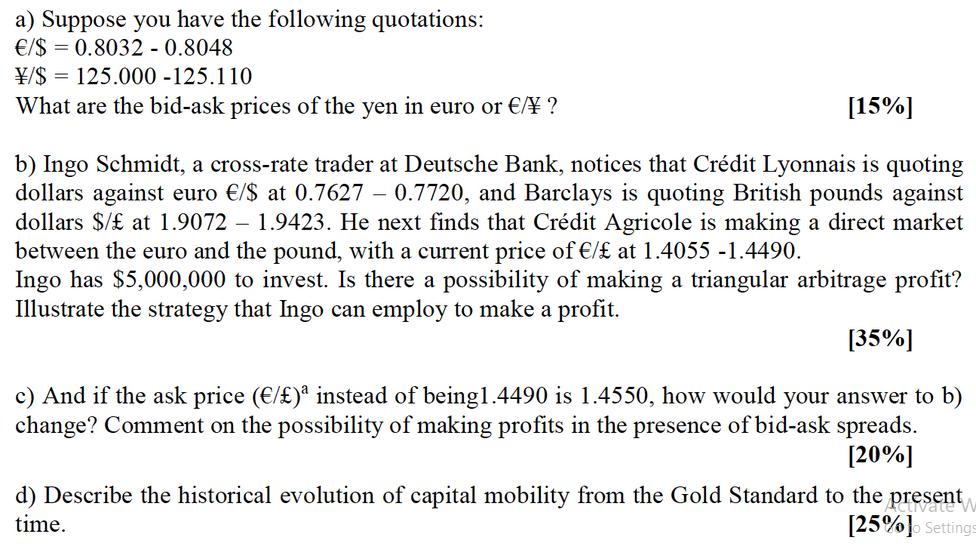

a) Suppose you have the following quotations: /$ /$ 0.8032 -0.8048 125.000 -125.110 What are the bid-ask prices of the yen in euro or

a) Suppose you have the following quotations: /$ /$ 0.8032 -0.8048 125.000 -125.110 What are the bid-ask prices of the yen in euro or / ? [15%] b) Ingo Schmidt, a cross-rate trader at Deutsche Bank, notices that Crdit Lyonnais is quoting dollars against euro /$ at 0.7627 - 0.7720, and Barclays is quoting British pounds against dollars $/ at 1.9072 - 1.9423. He next finds that Crdit Agricole is making a direct market between the euro and the pound, with a current price of / at 1.4055 -1.4490. Ingo has $5,000,000 to invest. Is there a possibility of making a triangular arbitrage profit? Illustrate the strategy that Ingo can employ to make a profit. [35%] c) And if the ask price (/) instead of being1.4490 is 1.4550, how would your answer to b) change? Comment on the possibility of making profits in the presence of bid-ask spreads. [20%] activate W d) Describe the historical evolution of capital mobility from the Gold Standard to the present time. [25%] Settings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each part of the questions step by step a BidAsk Prices of Yen in Euro The bidask prices are given as 50803208048 125000125110 To find the bidask prices of the yen in euros we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started