Answered step by step

Verified Expert Solution

Question

1 Approved Answer

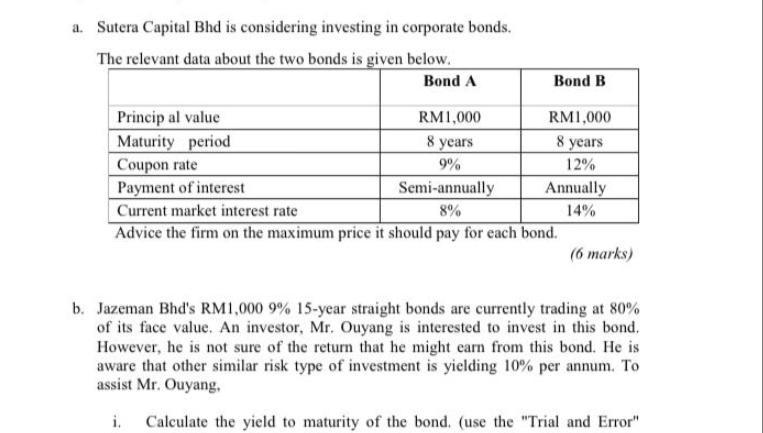

a. Sutera Capital Bhd is considering investing in corporate bonds. The relevant data about the two bonds is given below. Bond A RM1,000 8

a. Sutera Capital Bhd is considering investing in corporate bonds. The relevant data about the two bonds is given below. Bond A RM1,000 8 years 9% Semi-annually 8% Bond B Princip al value Maturity period Coupon rate Payment of interest Current market interest rate Advice the firm on the maximum price it should pay for each bond. RM1,000 8 years 12% Annually 14% (6 marks) b. Jazeman Bhd's RM1,000 9% 15-year straight bonds are currently trading at 80% of its face value. An investor, Mr. Ouyang is interested to invest in this bond. However, he is not sure of the return that he might earn from this bond. He is aware that other similar risk type of investment is yielding 10% per annum. To assist Mr. Ouyang. i. Calculate the yield to maturity of the bond. (use the "Trial and Error" ii. Advice Mr. Ouyang whether he should invest in this bond. c. A portfolio consists of three bonds as follows Amount Invested RM5,000 RM4,000 RM1,000 Calculate the duration of the bond portfolio. Bond A Bond B Bond C Bond Duration(years) 8.6 4.2 11.4 (2 marks) (2 marks)

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Bond A Coupon rate 9 Coupon payment Semiannually Coupon per year 9 of RM1000 RM90 Maturity 8 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started