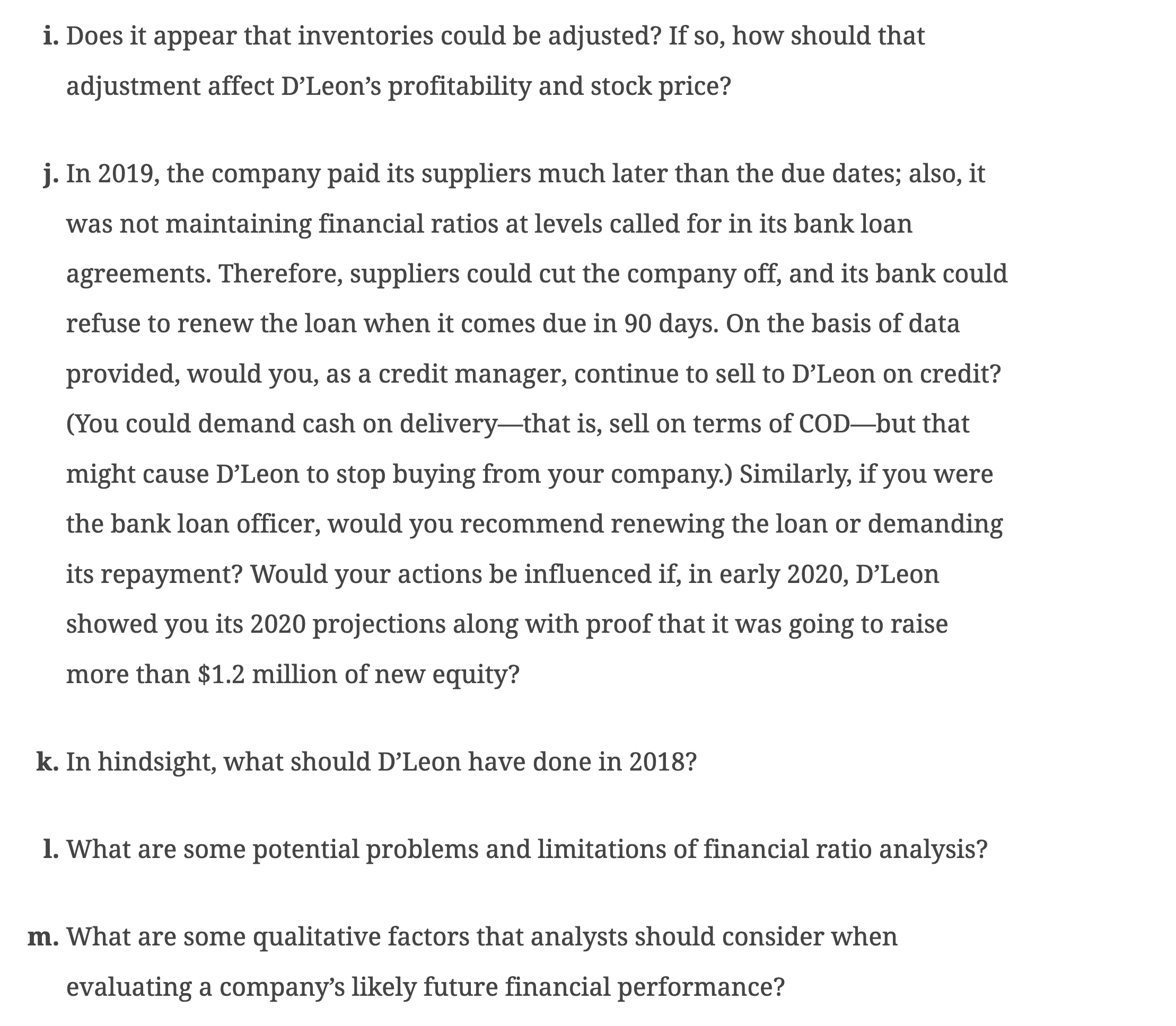

Question

A table shows the Balance Sheets of D'Leon for the years 2017(Estimated), 2016, and 2015. Left side of the table shows different components of the

A table shows the Balance Sheets of D'Leon for the years 2017(Estimated), 2016, and 2015. Left side of the table shows different components of the balance sheet and the right side shows three columns with values for 2020E, 2019, and 2018. The first section on the left shows "Assets." Below it, Cash: 85,632, 7,282, and 57,600, Accounts receivable: 878,000, 632,160, and 351,200, and Inventories: 1,716,480, 1,287,360, and 715,200 are shown. These are totaled and shown below as Total current assets: 2,680,112, 1,926,802, and 1,124,000. Below this, Gross fixed assets: 1,197,160, 1,202,950, and 491,000 is shown. Less accumulated depreciation: 380,120, 263,160, and 146,200 is subtracted from gross fixed assets to show Net fixed assets: 817,040, 939,790, and 344,800All these assets are totaled and shown as Total Assets: 3,497,152, 2,866,592, and 1,468,800. The second section shows "Liabilities and Equity." Below it, Accounts payable: 436,800, 524,160, and 145,600, Accruals: 408,000, 489,600, and 136,000, and Notes Payable: 300,000, 636,808, 200,000, are shown. These are totaled and shown below as Total current liabilities: 1,144,800, 1,650,568, and 481,600. Below this, Long-term debt: 400,000, 723,432, and 323,432 is shown. Below this, Common stock: 1,718,986, 460,000, and 460,000, Retained earnings: 233,366 32,592, and 203,768 are shown. These are totaled and shown as Total equity: 1,952,352, 492,592, and 663,768. The liabilities and equity are totaled and shown as Total liabilities and equity: 3,497,152, 2,866,592, and 1,468,800. An income statement shows data for 20 18, 20 19, and estimated 20 20. The data from the income statement, presented in the format, 20 20 estimated, 20 19 value, 20 18 value, are as follows. Sales $6,900,600 $6,126,796 $3,432,000. Cost of goods sold 5,875,992 5,528,000 2,864,000. Other expenses 550,000 519,988 358,672. Total operating costs excluding depreciation and amortization $6,425,992 $6,047,988 $3,222,672. EBITDA $474,608 $78,808 $209,328. Depreciation and amortization 116,960 116,960 18,900. EBIT $357,648 ($38,152) $190,428. Interest expense 70,008 122,024 43,828. EBT $287,640 ($160,176) $146,600. Taxes (25 percent) 31,866a 0a 36,650. Net income $255,774 ($160,176) $109,950. EPS $1.023 ($1.602) $1.100. DPS $0.220 $0.110 $0.275. Book value per share $7.809 $4.926 $6.638. Stock price $12.17 $2.25 $8.50. Shares outstanding 250,000 100,000 100,000. Tax rate 25.00 percent 25.00 percent 25.00 percent. Lease payments $40,000 $40,000 $40,000. Sinking fund payments 0 0 0.

A table shows the Balance Sheets of D'Leon for the years 2017(Estimated), 2016, and 2015. Left side of the table shows different components of the balance sheet and the right side shows three columns with values for 2020E, 2019, and 2018. The first section on the left shows "Assets." Below it, Cash: 85,632, 7,282, and 57,600, Accounts receivable: 878,000, 632,160, and 351,200, and Inventories: 1,716,480, 1,287,360, and 715,200 are shown. These are totaled and shown below as Total current assets: 2,680,112, 1,926,802, and 1,124,000. Below this, Gross fixed assets: 1,197,160, 1,202,950, and 491,000 is shown. Less accumulated depreciation: 380,120, 263,160, and 146,200 is subtracted from gross fixed assets to show Net fixed assets: 817,040, 939,790, and 344,800All these assets are totaled and shown as Total Assets: 3,497,152, 2,866,592, and 1,468,800. The second section shows "Liabilities and Equity." Below it, Accounts payable: 436,800, 524,160, and 145,600, Accruals: 408,000, 489,600, and 136,000, and Notes Payable: 300,000, 636,808, 200,000, are shown. These are totaled and shown below as Total current liabilities: 1,144,800, 1,650,568, and 481,600. Below this, Long-term debt: 400,000, 723,432, and 323,432 is shown. Below this, Common stock: 1,718,986, 460,000, and 460,000, Retained earnings: 233,366 32,592, and 203,768 are shown. These are totaled and shown as Total equity: 1,952,352, 492,592, and 663,768. The liabilities and equity are totaled and shown as Total liabilities and equity: 3,497,152, 2,866,592, and 1,468,800. An income statement shows data for 20 18, 20 19, and estimated 20 20. The data from the income statement, presented in the format, 20 20 estimated, 20 19 value, 20 18 value, are as follows. Sales $6,900,600 $6,126,796 $3,432,000. Cost of goods sold 5,875,992 5,528,000 2,864,000. Other expenses 550,000 519,988 358,672. Total operating costs excluding depreciation and amortization $6,425,992 $6,047,988 $3,222,672. EBITDA $474,608 $78,808 $209,328. Depreciation and amortization 116,960 116,960 18,900. EBIT $357,648 ($38,152) $190,428. Interest expense 70,008 122,024 43,828. EBT $287,640 ($160,176) $146,600. Taxes (25 percent) 31,866a 0a 36,650. Net income $255,774 ($160,176) $109,950. EPS $1.023 ($1.602) $1.100. DPS $0.220 $0.110 $0.275. Book value per share $7.809 $4.926 $6.638. Stock price $12.17 $2.25 $8.50. Shares outstanding 250,000 100,000 100,000. Tax rate 25.00 percent 25.00 percent 25.00 percent. Lease payments $40,000 $40,000 $40,000. Sinking fund payments 0 0 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started