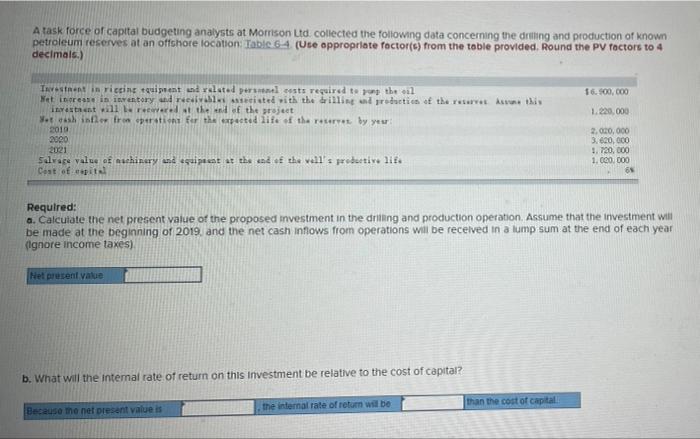

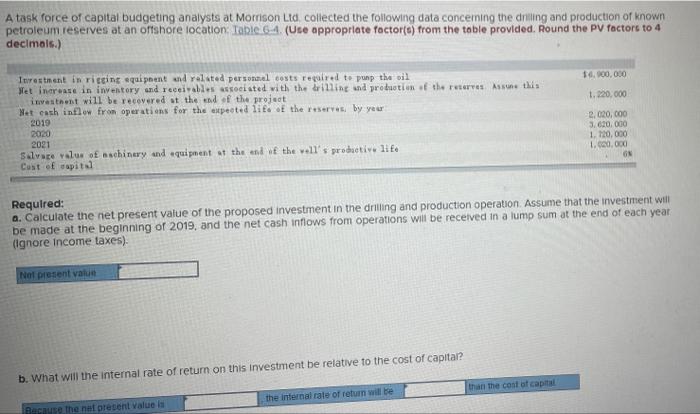

A task force of capital budgeting analysts at Morrison Ltd. collected the following data concerning the drilling and production of known petroleum reserves at an offshore location Table 6-4 (Ute appropriate foctor(e) from the table provided. Round the PV factors to 4 decimals) 16.900,000 1.220.000 Intent in ricing equipment and related prests required to the il Netinerea in inventory udrediste vith the drilling production of the returret Asus this investrant will be rewt the end of the project Set in fronperation for the expected life of the reserved by year 2010 2020 2021 Salvace value of achinery and equipest at the end of the vell's productive lies Cost of it 2.000.000 3.620,000 1.720,000 1.000.000 65 Required: a. Calculate the net present value of the proposed investment in the drilling and production operation. Assume that the investment will be made at the beginning of 2019, and the net cash inflows from operations will be received in a lump sum at the end of each year (ignore income taxes) Nel present value b. What will the internal rate of return on this investment be relative to the cost of capital? Because me ne present value is the internal rate of return will be than the cost of capital A task force of capital budgeting analysts at Morrison Ltd, collected the following data concerning the drilling and production of known petroleum reserves at an offshore location Table 6-4. (Use appropriate foctor(s) from the table provided. Round the PV factors to 4 decimals.) 14.900.000 1.220.000 Turestment in rising equipent and related personal costs required to pup the oil Net increase in inventory and receivable essociated with the line and prodution of the reserve Assets investment will be recovered at the end of the project Net cash inflow from operations for the expected life of the reserves by yeur 2019 2020 Salvare value of aschinery and equipment at the end of the vall's productiv. lite Cost of wapita 2.020,000 3.600.000 1.720,000 1.000.000 ON 2021 Required: a. Calculate the net present value of the proposed investment in the drilling and production operation Assume that the investment will be made at the beginning of 2019, and the net cash inflows from operations will be received in a lump sum at the end of each year (ignore income taxes). Nel present value b. What will the internal rate of return on this investment be relative to the cost of capital? than the cost of capital the internal rate of return will be Because the nel present Value