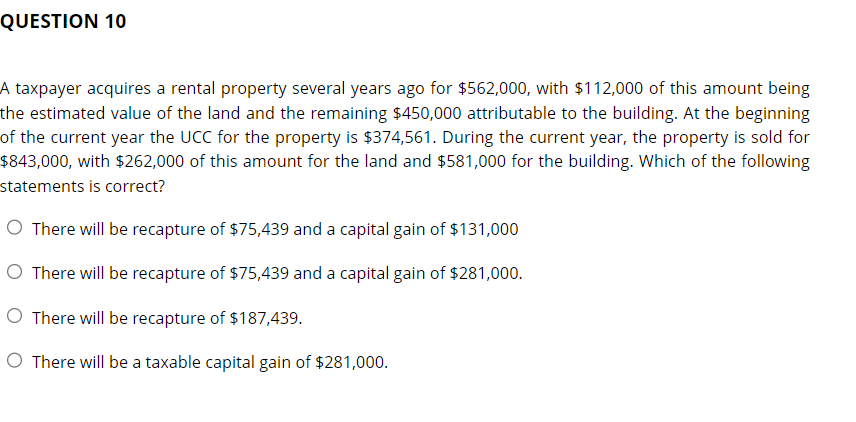

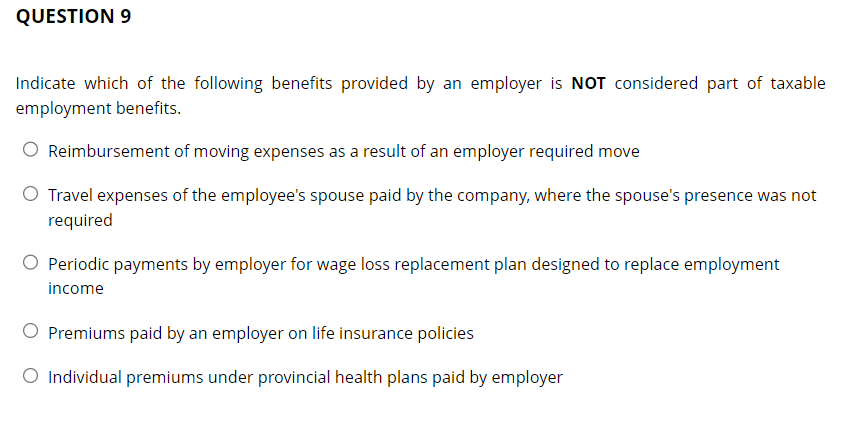

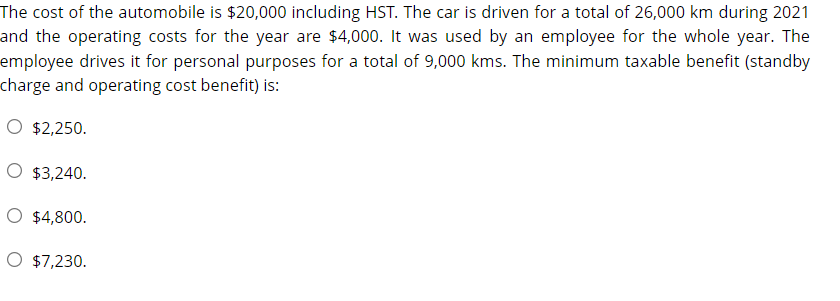

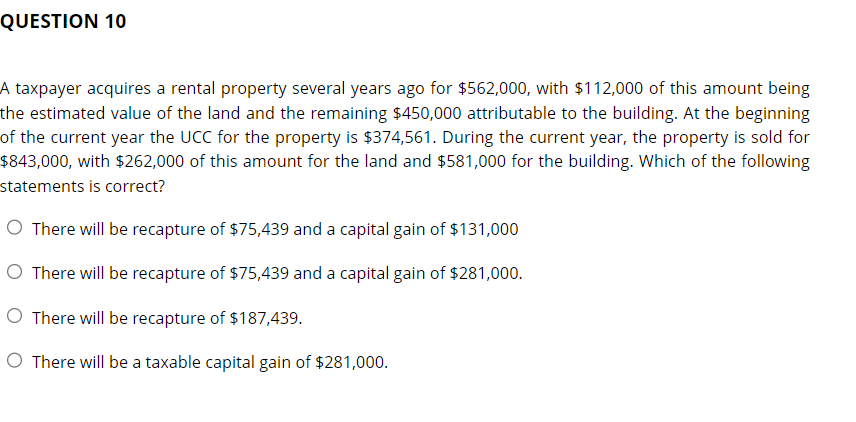

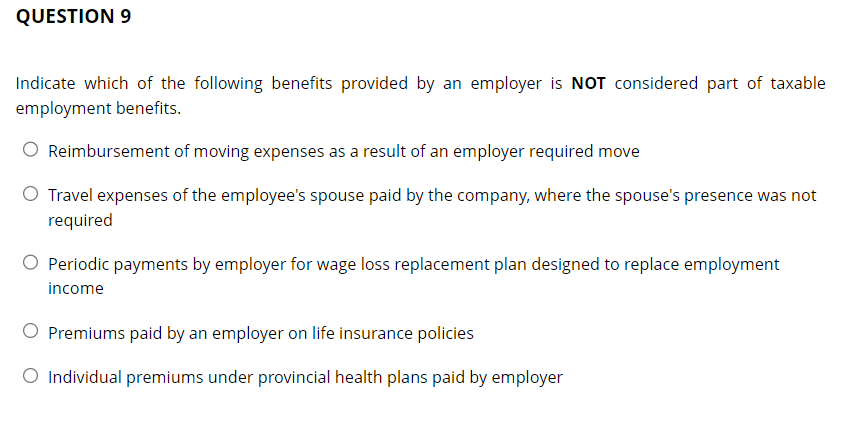

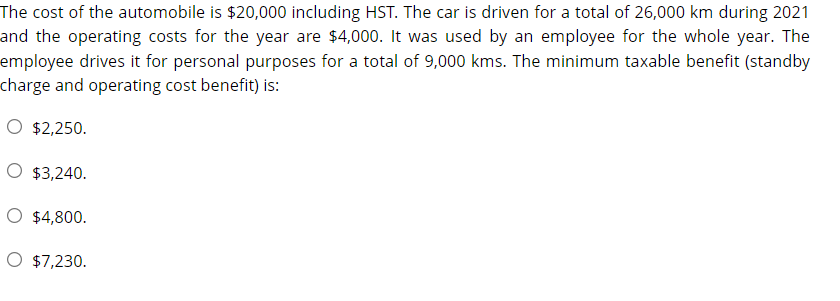

A taxpayer acquires a rental property several years ago for $562,000, with $112,000 of this amount being the estimated value of the land and the remaining $450,000 attributable to the building. At the beginning of the current year the UCC for the property is $374,561. During the current year, the property is sold for $843,000, with $262,000 of this amount for the land and $581,000 for the building. Which of the following statements is correct? There will be recapture of $75,439 and a capital gain of $131,000 There will be recapture of $75,439 and a capital gain of $281,000. There will be recapture of $187,439. There will be a taxable capital gain of $281,000. Indicate which of the following benefits provided by an employer is NOT considered part of taxable employment benefits. Reimbursement of moving expenses as a result of an employer required move Travel expenses of the employee's spouse paid by the company, where the spouse's presence was not required Periodic payments by employer for wage loss replacement plan designed to replace employment income Premiums paid by an employer on life insurance policies Individual premiums under provincial health plans paid by employer The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000km during 2021 and the operating costs for the year are $4,000. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000kms. The minimum taxable benefit (standby charge and operating cost benefit) is: $2,250. $3,240. $4,800. $7,230. A taxpayer acquires a rental property several years ago for $562,000, with $112,000 of this amount being the estimated value of the land and the remaining $450,000 attributable to the building. At the beginning of the current year the UCC for the property is $374,561. During the current year, the property is sold for $843,000, with $262,000 of this amount for the land and $581,000 for the building. Which of the following statements is correct? There will be recapture of $75,439 and a capital gain of $131,000 There will be recapture of $75,439 and a capital gain of $281,000. There will be recapture of $187,439. There will be a taxable capital gain of $281,000. Indicate which of the following benefits provided by an employer is NOT considered part of taxable employment benefits. Reimbursement of moving expenses as a result of an employer required move Travel expenses of the employee's spouse paid by the company, where the spouse's presence was not required Periodic payments by employer for wage loss replacement plan designed to replace employment income Premiums paid by an employer on life insurance policies Individual premiums under provincial health plans paid by employer The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000km during 2021 and the operating costs for the year are $4,000. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000kms. The minimum taxable benefit (standby charge and operating cost benefit) is: $2,250. $3,240. $4,800. $7,230