Answered step by step

Verified Expert Solution

Question

1 Approved Answer

??? A taxpayer has some spare cash sitting in a checking account (0 return) and would like to put the maximum amount in a IRA

???

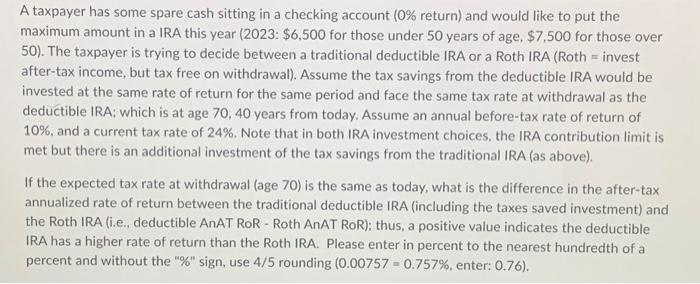

A taxpayer has some spare cash sitting in a checking account \(0 return) and would like to put the maximum amount in a IRA this year (2023: \\( \\$ 6,500 \\) for those under 50 years of age, \\( \\$ 7,500 \\) for those over 50). The taxpayer is trying to decide between a traditional deductible IRA or a Roth IRA (Roth = invest after-tax income, but tax free on withdrawal). Assume the tax savings from the deductible IRA would be invested at the same rate of return for the same period and face the same tax rate at withdrawal as the deductible IRA; which is at age 70, 40 years from today. Assume an annual before-tax rate of return of \10, and a current tax rate of \24. Note that in both IRA investment choices, the IRA contribution limit is met but there is an additional investment of the tax savings from the traditional IRA (as above). If the expected tax rate at withdrawal (age 70) is the same as today, what is the difference in the after-tax annualized rate of return between the traditional deductible IRA (including the taxes saved investment) and the Roth IRA (i.e., deductible AnAT RoR - Roth AnAT RoR); thus, a positive value indicates the deductible IRA has a higher rate of return than the Roth IRA. Please enter in percent to the nearest hundredth of a percent and without the \"\\%\" sign, use \\( 4 / 5 \\) rounding \(0.00757=0.757, enter: 0.76\\( ) \\)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started