Answered step by step

Verified Expert Solution

Question

1 Approved Answer

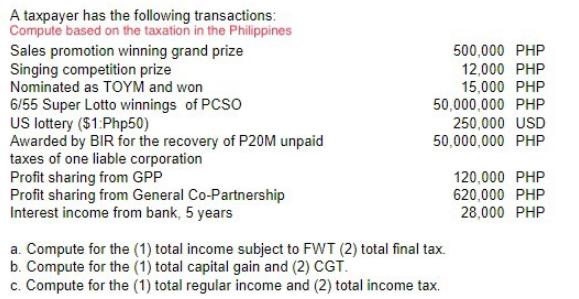

A taxpayer has the following transactions: Compute based on the taxation in the Philippines Sales promotion winning grand prize Singing competition prize Nominated as

A taxpayer has the following transactions: Compute based on the taxation in the Philippines Sales promotion winning grand prize Singing competition prize Nominated as TOYM and won 6/55 Super Lotto winnings of PCSO US lottery ($1:Php50) Awarded by BIR for the recovery of P20M unpaid taxes of one liable corporation Profit sharing from GPP Profit sharing from General Co-Partnership Interest income from bank, 5 years 500,000 PHP 12,000 PHP 15,000 PHP 50,000,000 PHP 250,000 USD 50,000,000 PHP a. Compute for the (1) total income subject to FWT (2) total final tax. b. Compute for the (1) total capital gain and (2) CGT. c. Compute for the (1) total regular income and (2) total income tax. 120,000 PHP 620,000 PHP 28,000 PHP

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Total income subject to FWT The total income subject to FWT is the sum of the following amounts 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started