Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A taxpayer moved over 5 0 0 miles at the request of the taxpayer's employer, a major oil and gas company. The taxpayer incurred and

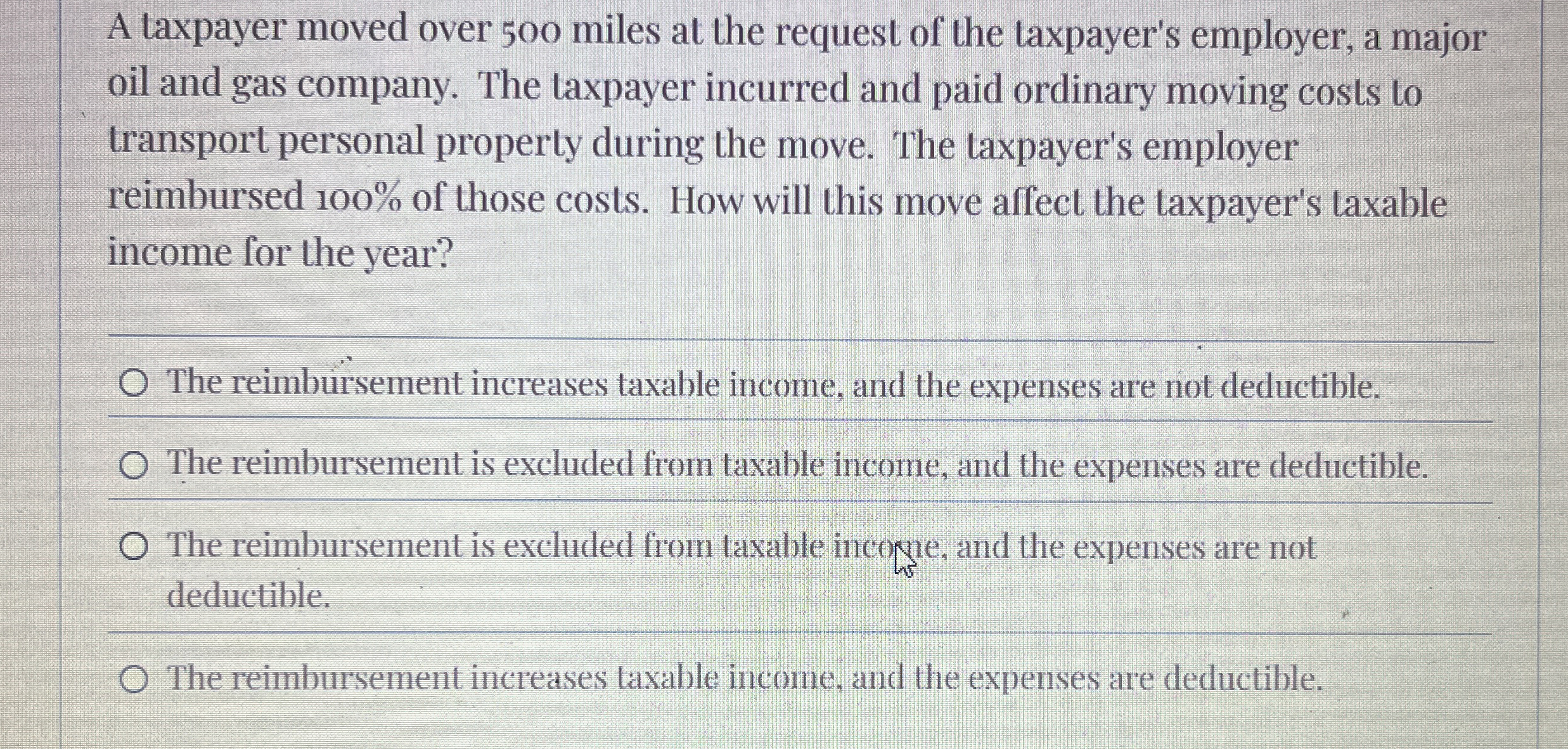

A taxpayer moved over miles at the request of the taxpayer's employer, a major

oil and gas company. The taxpayer incurred and paid ordinary moving costs to

transport personal property during the move. The taxpayer's employer

reimbursed of those costs. How will this move affect the taxpayer's taxable

income for the year?

The reimbursement increases taxable income, and the expenses are not deductible.

The reimbursement is excluded from taxable income, and the expenses are deductible.

The reimbursement is excluded from taxable incopre, and the expenses are not

deductible.

The reimbursement increases taxable income, and the expenses are deductible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started