Answered step by step

Verified Expert Solution

Question

1 Approved Answer

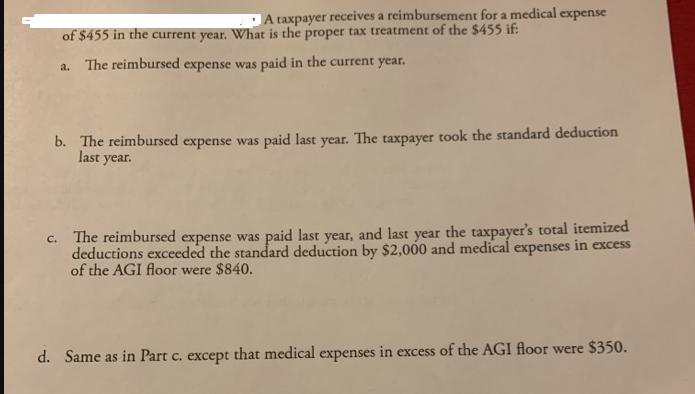

A taxpayer receives a reimbursement for a medical expense of $455 in the current year. What is the proper tax treatment of the $455

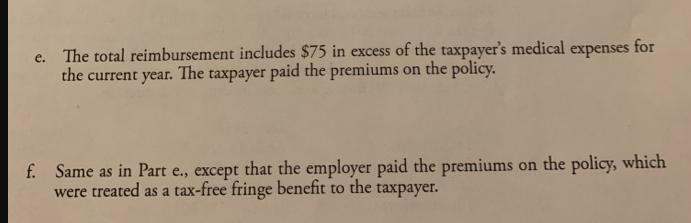

A taxpayer receives a reimbursement for a medical expense of $455 in the current year. What is the proper tax treatment of the $455 if: a. The reimbursed expense was paid in the current year. b. The reimbursed expense was paid last year. The taxpayer took the standard deduction last year. c. The reimbursed expense was paid last year, and last year the taxpayer's total itemized deductions exceeded the standard deduction by $2,000 and medical expenses in excess of the AGI floor were $840. d. Same as in Part c. except that medical expenses in excess of the AGI floor were $350. e. The total reimbursement includes $75 in excess of the taxpayer's medical expenses for the current year. The taxpayer paid the premiums on the policy. f. Same as in Part e., except that the employer paid the premiums on the policy, which were treated as a tax-free fringe benefit to the taxpayer.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SOLUTION a If the reimbursed expense was paid in the current year the proper tax treatment of the 455 reimbursement depends on whether the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started