Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A technology giant is planning to acquire a small but cutting edge startup, which would complement their virtual reality (VR) solutions. Valuation for this

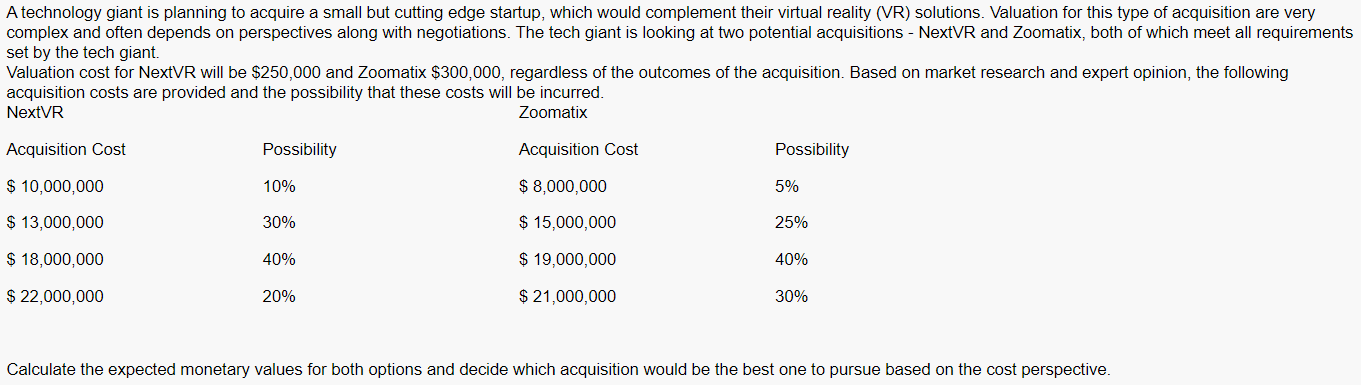

A technology giant is planning to acquire a small but cutting edge startup, which would complement their virtual reality (VR) solutions. Valuation for this type of acquisition are very complex and often depends on perspectives along with negotiations. The tech giant is looking at two potential acquisitions - NextVR and Zoomatix, both of which meet all requirements set by the tech giant. Valuation cost for NextVR will be $250,000 and Zoomatix $300,000, regardless of the outcomes of the acquisition. Based on market research and expert opinion, the following acquisition costs are provided and the possibility that these costs will be incurred. NextVR Zoomatix Acquisition Cost $ 10,000,000 $ 13,000,000 $ 18,000,000 $ 22,000,000 Possibility 10% 30% 40% 20% Acquisition Cost $ 8,000,000 $ 15,000,000 $ 19,000,000 $ 21,000,000 Possibility 5% 25% 40% 30% Calculate the expected monetary values for both options and decide which acquisition would be the best one to pursue based on the cost perspective.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

For NextVR Acquisition cost 250000 Possibility of 10M cost 10 EMV of 10M cost 10M 10 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started