Question

a) The above extract shows equity and liability positions of CHG. i) Assume that, in fiscal year 2020, CHG issued preference shares that include the

a) The above extract shows equity and liability positions of CHG. i) Assume that, in fiscal year 2020, CHG issued preference shares that include the option for shareholders to require redemption of the initial investment amount at the end of fiscal year 2024. Explain where in the above extract these preference shares are included by referring to the relevant accounting standard from the IFRS. ii) Among the borrowings listed in the above extract are bonds that CHG issued during fiscal year 2021 and that are publicly traded. The bonds have a maturity of five years after which CHG will repay the lenders. Explain which categories for the classification of financial instruments under IFRS 9 are available to classify these bonds.

b). In June 2021, CHG acquired shares that were issued by MVG plc and are traded on the London Stock Exchange as well as smaller exchanges in other countries on which trading is infrequent. CHG acquired the shares for a price of 825,000 and paid transaction costs of 17,500. On 31 December 2021, the shares had a price of 749,000 at the London Stock Exchange and of 801,000 at the smaller exchanges. On 31 December 2022, the shares had a price of 854,500 at the London Stock Exchange and of 876,000 at the smaller exchanges. On the same day, CHG sells the shares for the price of 854,500 at the London Stock Exchange. i) Assume that CHG classifies the shares as Fair value through profit or loss (FVPL) and thus measures the shares subsequently at their fair value. The above information contains two possible prices for the shares at each reporting date. Explain which prices correspond to the fair value under IFRS 13. ii) Assuming that CHG classifies the shares as FVPL, explain the accounting treatment according to IFRS 9 of each element listed above and prepare the journal entries for the initial recognition and subsequent measurement of the shares in CHGs financial statements for fiscal years 2021 and 2022. iii) Now assume that CHG makes use of the option to irrevocably classify the shares as Fair value through other comprehensive income (FVOCI) at initial recognition. Explain how the accounting treatment of the shares under FVOCI differs from the accounting treatment under FVPL. You can, but do not have to, use journal entries to illustrate your points.

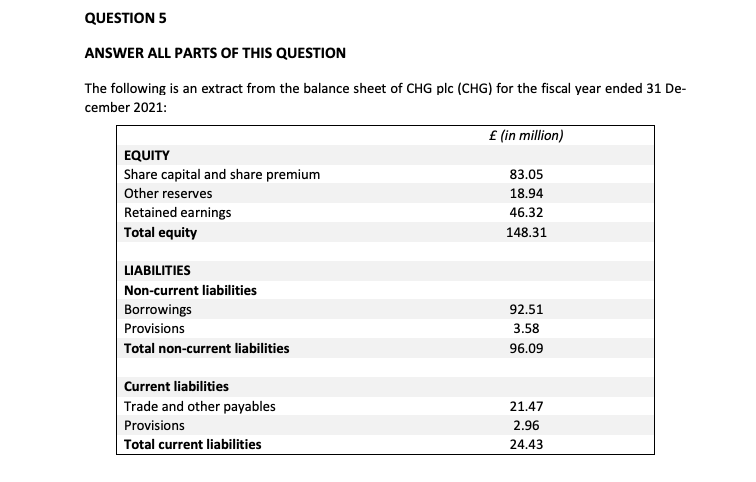

ANSWER ALL PARTS OF THIS QUESTION The following is an extract from the balance sheet of CHG plc (CHG) for the fiscal year ended 31 December 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started