Question

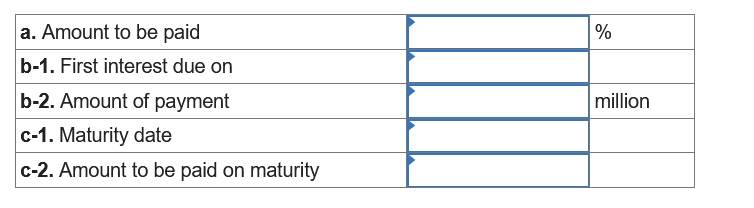

a. The AMAT bond was issued on June 1, 2011, at 99.50%. How much would you have to pay to buy one bond delivered on

a. The AMAT bond was issued on June 1, 2011, at 99.50%. How much would you have to pay to buy one bond delivered on June 15? Dont forget to include accrued interest. Assume a 365-day year.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.

b-1. When is the first interest payment on the bond?

b-2. What is the total dollar amount of the payment?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

c-1. On what date do the bonds finally mature?

c-2. What is the amount to be paid on each bond at maturity?

Note: Do not round intermediate calculations. Enter your answers in dollars, rather than in millions of dollars, rounded to 2 decimal places.

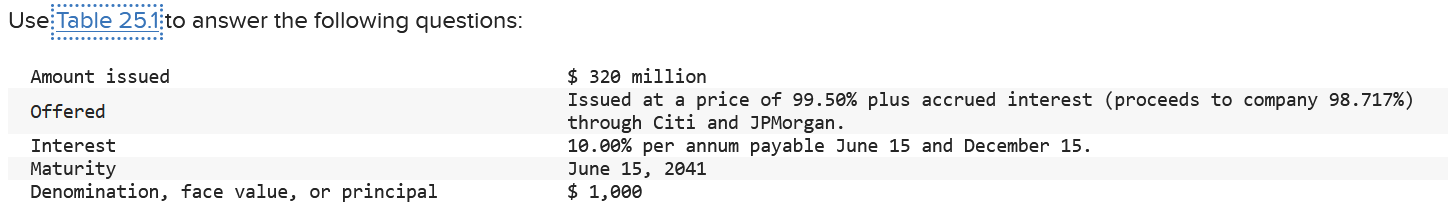

Use:Table 25 : to answer the following questions: AmountissuedOfferedInterestMaturityDenomination,facevalue,orprincipal$320millionIssuedatapriceof99.50%plusaccruedinterest(proceedstocompany98.717%)throughCitiandJPMorgan.10.00%perannumpayableJune15andDecember15.June15,2041$1,000 \begin{tabular}{|l|l|l|} \hline a. Amount to be paid & & % \\ \hline b-1. First interest due on & & \\ \hline b-2. Amount of payment & & million \\ \hline c-1. Maturity date & & \\ \hline c-2. Amount to be paid on maturity & & \\ \hline \end{tabular}

Use:Table 25 : to answer the following questions: AmountissuedOfferedInterestMaturityDenomination,facevalue,orprincipal$320millionIssuedatapriceof99.50%plusaccruedinterest(proceedstocompany98.717%)throughCitiandJPMorgan.10.00%perannumpayableJune15andDecember15.June15,2041$1,000 \begin{tabular}{|l|l|l|} \hline a. Amount to be paid & & % \\ \hline b-1. First interest due on & & \\ \hline b-2. Amount of payment & & million \\ \hline c-1. Maturity date & & \\ \hline c-2. Amount to be paid on maturity & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started