Question

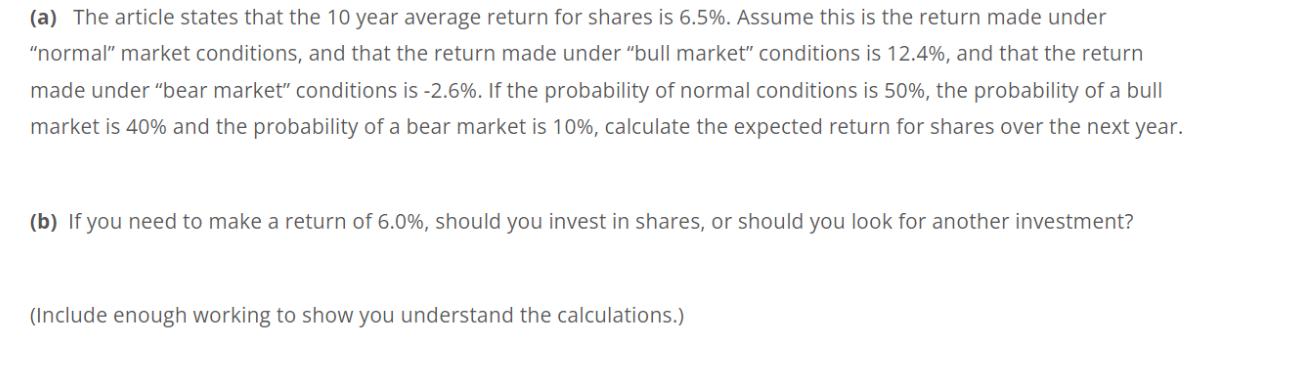

(a) The article states that the 10 year average return for shares is 6.5%. Assume this is the return made under normal market conditions,

(a) The article states that the 10 year average return for shares is 6.5%. Assume this is the return made under "normal" market conditions, and that the return made under "bull market" conditions is 12.4%, and that the return made under "bear market" conditions is -2.6%. If the probability of normal conditions is 50%, the probability of a bull market is 40% and the probability of a bear market is 10%, calculate the expected return for shares over the next year. (b) If you need to make a return of 6.0%, should you invest in shares, or should you look for another investment? (Include enough working to show you understand the calculations.)

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return for shares over the next year we need to use the weighted average ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics Learning From Data

Authors: Roxy Peck

1st Edition

495553263, 978-1285966083, 1285966082, 978-0495553267

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App