Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. The CIA profit potential is ____ % which tells Casper Landsten he should borrow _______ and invest in the_____ yielding currency, the ______, and

A. The CIA profit potential is ____ % which tells Casper Landsten he should borrow _______ and invest in the_____ yielding currency, the ______, and then sell the ______ principal and interest forward three months locking in a CIA profit. (Round to three decimal places and select from the drop-down menus.)

B. The CIA profit amount is $_________ (Round to nearest cent).

C. Should he enter into a covered interest arbitrage (CIA) investment?

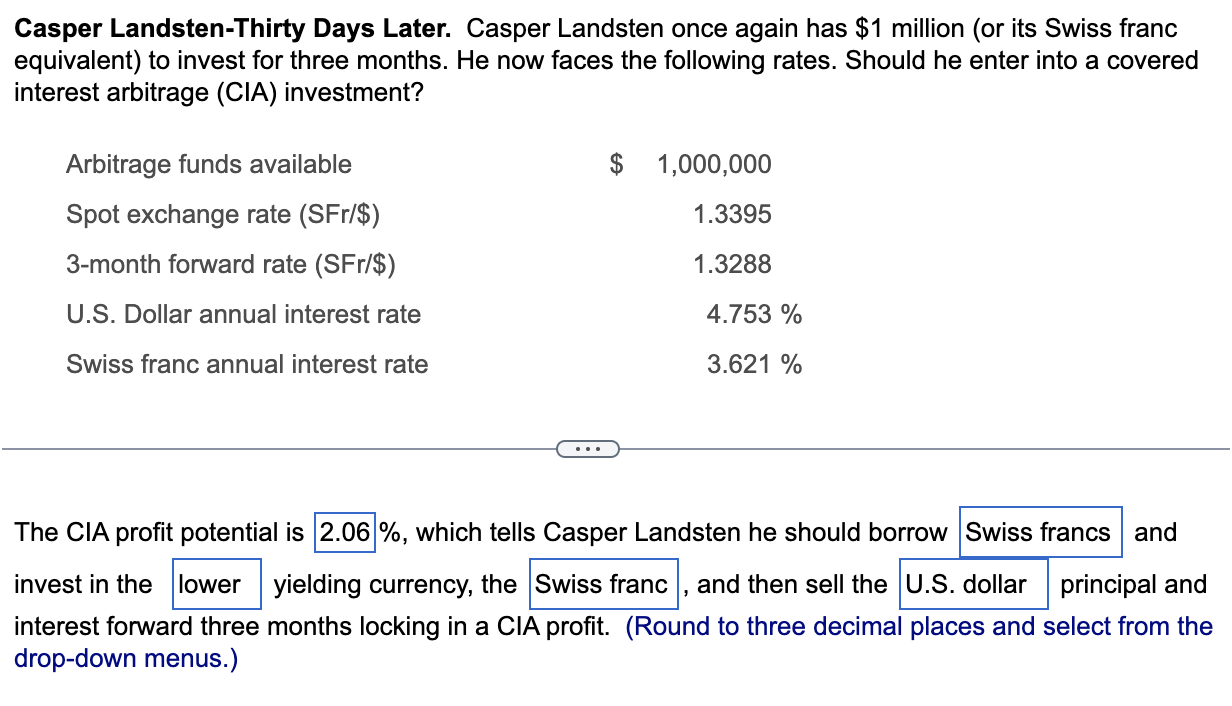

Casper Landsten-Thirty Days Later. Casper Landsten once again has $1 million (or its Swiss franc equivalent) to invest for three months. He now faces the following rates. Should he enter into a covered interest arbitrage (CIA) investment? Arbitrage funds available $ 1,000,000 Spot exchange rate (SFr/$) 1.3395 3-month forward rate (SFr/$) 1.3288 U.S. Dollar annual interest rate 4.753 % Swiss franc annual interest rate 3.621 % ... The CIA profit potential is 2.06 %, which tells Casper Landsten he should borrow Swiss francs and invest in the lower yielding currency, the Swiss franc, and then sell the U.S. dollar principal and interest forward three months locking in a CIA profit. (Round to three decimal places and select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started