Question

A. the company provided $3,000 in services to customers that I expected to pay the company sometime in January following the company's year-end. B. Wage

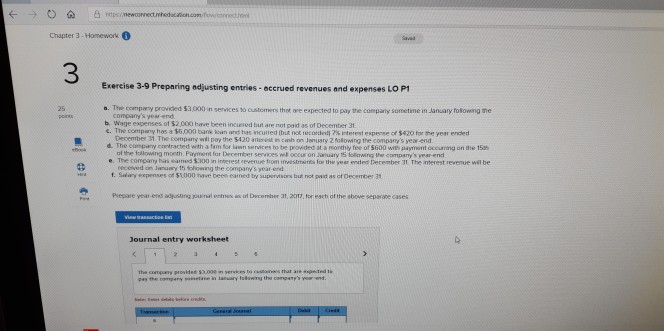

A. the company provided $3,000 in services to customers that I expected to pay the company sometime in January following the company's year-end. B. Wage expenses of $2,000 have been incurred but are not paid as of December 31st. C. The company has a $6,000 bank loan and has incurred (but not recorded) 7% interest expense of $420 for the year ended December 31st. The company will pay the $420 interest in cash on January 2nd following the company's year-end. D. The company contracted with a firm for lawn services to be provided at a monthly fee of $600 for the payment occurring on the 15th of the following month. Payment for December Services will occur on January 15th following the company's year-end. E. The company has earned $300 in interest revenue from Investments for the year ended December 31. The interest Revenue will be received on January 15th following the companies year end. F. Salary expenses of $1,000 have been earned by supervisors but not paid as of December 31. **Prepare year-end adjusting journal entries as of December 31, 2017, for each of the above separate cases.

Chapter 3-Homework 0 aves 3 Exercise 3-9 Preparing adjusting entries accrued revenues and expenses LO P1 a. The compary provided 53,000 in services to customers thot are expected to paly the company sometime in Jancary foowing she company's year-end b. Wage expenses of $2.000 have been incured but are not paid as of December 31 e. The company has a $6,000 barik kan ird has ncured tut not recueled interest expense of $420fr me year ened December 31. The company wil poy the $420 atst in ch on Jenuary 2 following the company's year-end company contracted with a fom for lawen services to be prowded at a monhy fee of $600 with paymsnt occuring cn the 15h ot the fallowing month. Payment for December services wt oocur on Jaruary 15 followng the company's year end e. The company hars eamed $300 n interest revenue tioni iess for the year ended December 3t The interest revenue wl be eeceived on January 15 tolowing the company's year-end t. Sadlary eepenses of sL000 have been eamed by supervisors but not paid as of december 31 Plepare year-eres aduslirng yeurrlentrves an of December 31, 2012 for eacth of the abowe separane cases Journal entry worksheet provided Pty the r in lanuary folawing theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started