Question

a). The cost of debt is determined as the interest expense/average debt balance and is taken to be 4.3%. Assuming all Nikes cash flows are

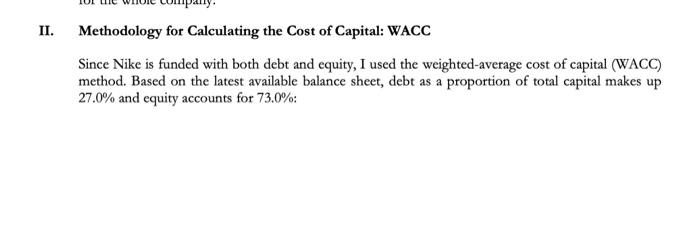

a). The cost of debt is determined as the interest expense/average debt balance and is taken to be 4.3%.

Assuming all Nikes cash flows are earned in USD (for simplicity/clarity),

- briefly explain if this is a sensible way to measure the cost of debt?

- What other (sensible) alternative is possible for measuring the cost of debt?

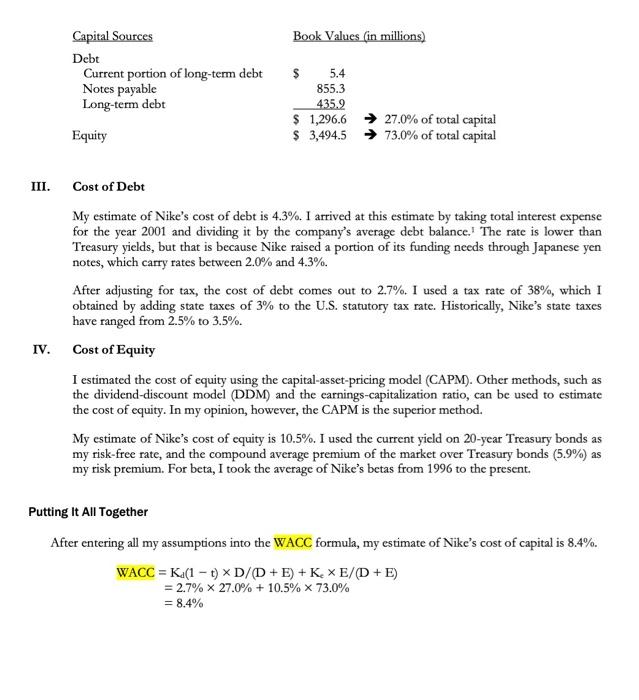

b). Explain (briefly) how the WACC is determined and why is it used here as a discount rate?

c). Explain (briefly) how the equity value per share obtained?

d). (Briefly) mention two key things you might do to try and improve the methodology used to estimate the fair value of Nikes equity.

You may use standard abbreviations (eg. CAPM. SIM, WACC, DDM etc)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started