Answered step by step

Verified Expert Solution

Question

1 Approved Answer

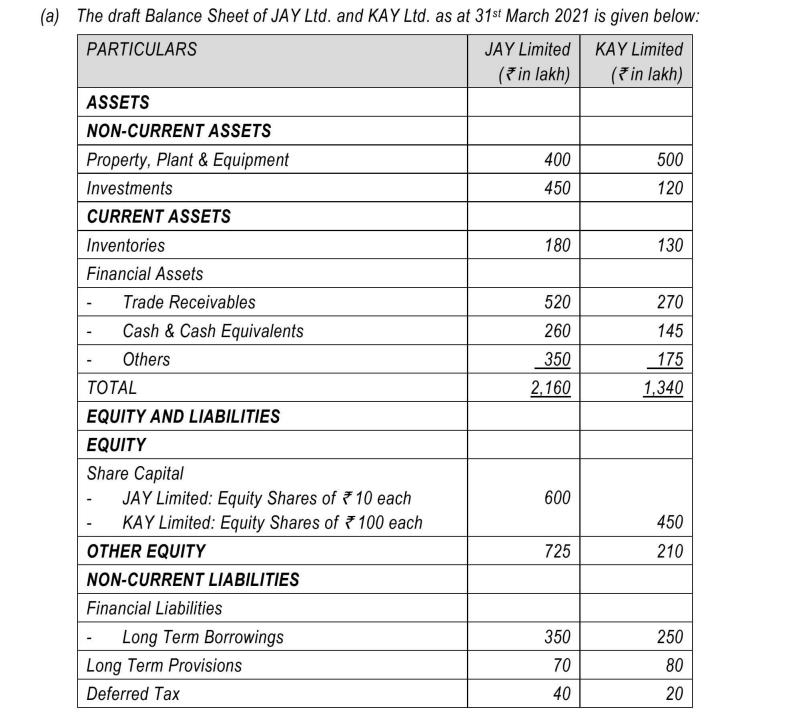

(a) The draft Balance Sheet of JAY Ltd. and KAY Ltd. as at 31st March 2021 is given below: PARTICULARS JAY Limited KAY Limited

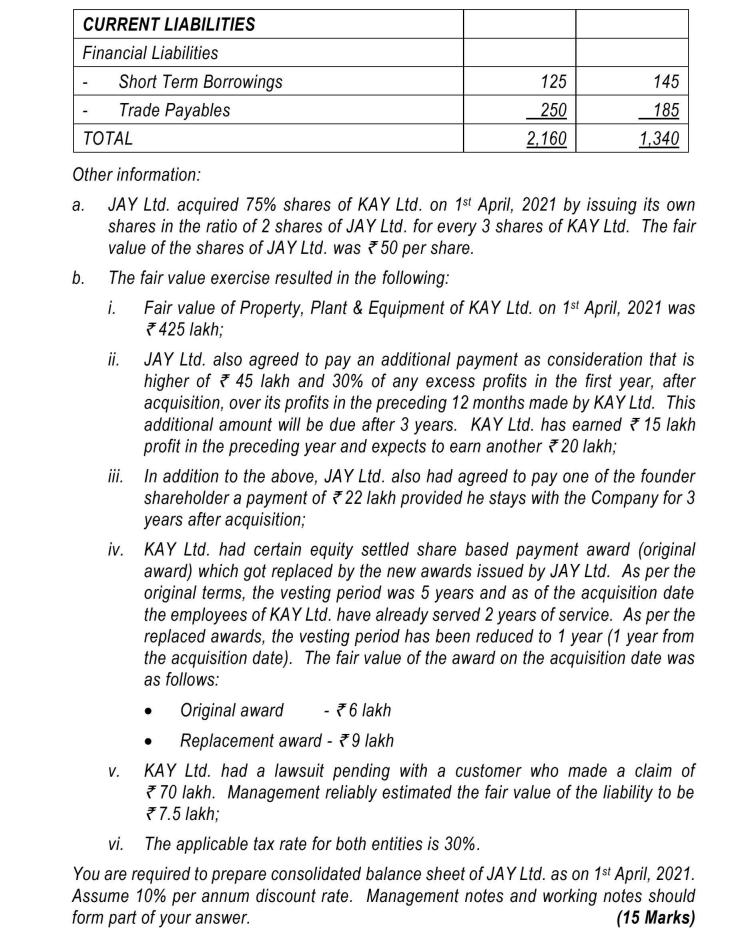

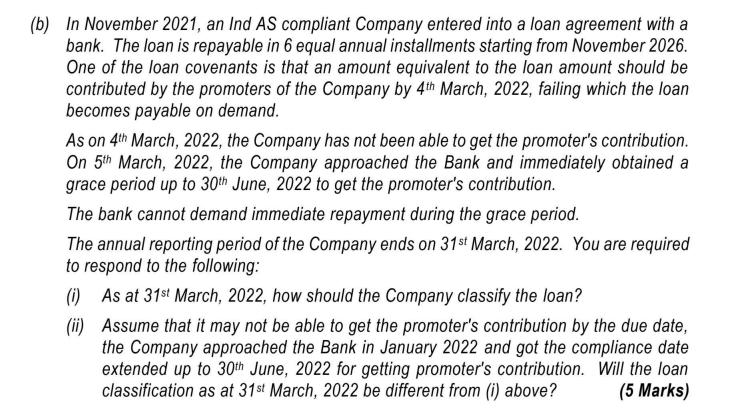

(a) The draft Balance Sheet of JAY Ltd. and KAY Ltd. as at 31st March 2021 is given below: PARTICULARS JAY Limited KAY Limited (in lakh) (in lakh) ASSETS NON-CURRENT ASSETS Property, Plant & Equipment Investments CURRENT ASSETS Inventories Financial Assets - Trade Receivables Cash & Cash Equivalents Others TOTAL EQUITY AND LIABILITIES EQUITY Share Capital JAY Limited: Equity Shares of 10 each KAY Limited: Equity Shares of 100 each OTHER EQUITY NON-CURRENT LIABILITIES Financial Liabilities - Long Term Borrowings Long Term Provisions Deferred Tax 400 450 180 520 260 350 2,160 600 725 350 70 40 500 120 130 270 145 175 1,340 450 210 250 80 20 CURRENT LIABILITIES Financial Liabilities a. Short Term Borrowings Trade Payables b. TOTAL Other information: JAY Ltd. acquired 75% shares of KAY Ltd. on 1st April, 2021 by issuing its own shares in the ratio of 2 shares of JAY Ltd. for every 3 shares of KAY Ltd. The fair value of the shares of JAY Ltd. was 50 per share. The fair value exercise resulted in the following: i. Fair value of Property, Plant & Equipment of KAY Ltd. on 1st April, 2021 was *425 lakh; ii. 125 250 2,160 145 185 1,340 V. JAY Ltd. also agreed to pay an additional payment as consideration that is higher of 45 lakh and 30% of any excess profits in the first year, after acquisition, over its profits in the preceding 12 months made by KAY Ltd. This additional amount will be due after 3 years. KAY Ltd. has earned 15 lakh profit in the preceding year and expects to earn another 20 lakh; iii. In addition to the above, JAY Ltd. also had agreed to pay one of the founder shareholder a payment of 22 lakh provided he stays with the Company for 3 years after acquisition; iv. KAY Ltd. had certain equity settled share based payment award (original award) which got replaced by the new awards issued by JAY Ltd. As per the original terms, the vesting period was 5 years and as of the acquisition date the employees of KAY Ltd. have already served 2 years of service. As per the replaced awards, the vesting period has been reduced to 1 year (1 year from the acquisition date). The fair value of the award on the acquisition date was as follows: Original award - 76 lakh Replacement award - 9 lakh KAY Ltd. had a lawsuit pending with a customer who made a claim of 70 lakh. Management reliably estimated the fair value of the liability to be *7.5 lakh; vi. The applicable tax rate for both entities is 30%. You are required to prepare consolidated balance sheet of JAY Ltd. as on 1st April, 2021. Assume 10% per annum discount rate. Management notes and working notes should form part of your answer. (15 Marks) (b) In November 2021, an Ind AS compliant Company entered into a loan agreement with a bank. The loan is repayable in 6 equal annual installments starting from November 2026. One of the loan covenants is that an amount equivalent to the loan amount should be contributed by the promoters of the Company by 4th March, 2022, failing which the loan becomes payable on demand. As on 4th March, 2022, the Company has not been able to get the promoter's contribution. On 5th March, 2022, the Company approached the Bank and immediately obtained a grace period up to 30th June, 2022 to get the promoter's contribution. The bank cannot demand immediate repayment during the grace period. The annual reporting period of the Company ends on 31st March, 2022. You are required to respond to the following: (i) As at 31st March, 2022, how should the Company classify the loan? (ii) Assume that it may not be able to get the promoter's contribution by the due date, the Company approached the Bank in January 2022 and got the compliance date extended up to 30th June, 2022 for getting promoter's contribution. Will the loan classification as at 31st March, 2022 be different from (i) above? (5 Marks)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started