Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) The equity share of VCC Ltd. is quoted at Rs. 210. A 3-month call option is available at a premium of Rs. 6

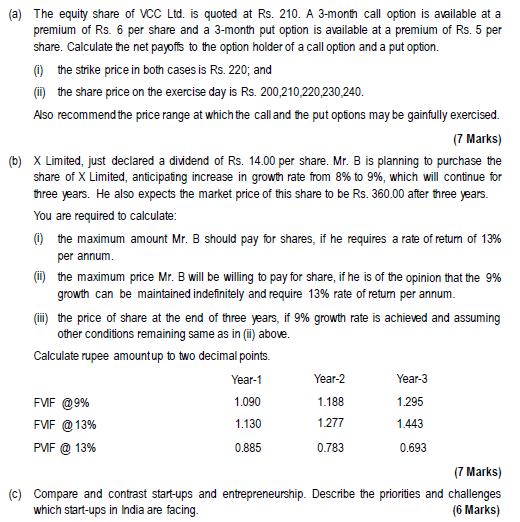

(a) The equity share of VCC Ltd. is quoted at Rs. 210. A 3-month call option is available at a premium of Rs. 6 per share and a 3-month put option is available at a premium of Rs. 5 per share. Calculate the net payoffs to the option holder of a call option and a put option. (i) the strike price in both cases is Rs. 220; and (ii) the share price on the exercise day is Rs. 200,210,220,230,240. Also recommend the price range at which the call and the put options may be gainfully exercised. (7 Marks) (b) X Limited, just declared a dividend of Rs. 14.00 per share. Mr. B is planning to purchase the share of X Limited, anticipating increase in growth rate from 8% to 9%, which will continue for three years. He also expects the market price of this share to be Rs. 360.00 after three years. You are required to calculate: (i) the maximum amount Mr. B should pay for shares, if he requires a rate of return of 13% per annum. (ii) the maximum price Mr. B will be willing to pay for share, if he is of the opinion that the 9% growth can be maintained indefinitely and require 13% rate of return per annum. (iii) the price of share at the end of three years, if 9% growth rate is achieved and assuming other conditions remaining same as in (ii) above. Calculate rupee amount up to two decimal points. FVF 99% FVF 13% PVF 13% Year-1 Year-2 Year-3 1.090 1.188 1.295 1.130 1.277 1.443 0.885 0.783 0.693 (7 Marks) (c) Compare and contrast start-ups and entrepreneurship. Describe the priorities and challenges which start-ups in India are facing. (6 Marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Net Payoffs to the Option Holder For the call option Net Payoff Share Price on Exercise Day Strike Price Premium For the put option Net Payoff Strike Price Share Price on Exercise Day Premium Given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started