Answered step by step

Verified Expert Solution

Question

1 Approved Answer

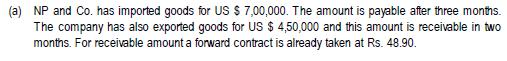

(a) NP and Co. has imported goods for US $ 7,00,000. The amount is payable after three months. The company has also exported goods

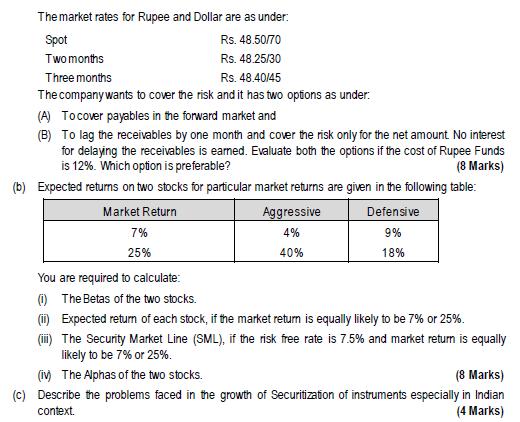

(a) NP and Co. has imported goods for US $ 7,00,000. The amount is payable after three months. The company has also exported goods for US $ 4,50,000 and this amount is receivable in two months. For receivable amount a forward contract is already taken at Rs. 48.90. The market rates for Rupee and Dollar are as under: Spot Two months Three months Rs. 48.50/70 Rs. 48.25/30 Rs. 48.40/45 The company wants to cover the risk and it has two options as under: (A) To cover payables in the forward market and (B) To lag the receivables by one month and cover the risk only for the net amount. No interest for delaying the receivables is earned. Evaluate both the options if the cost of Rupee Funds is 12%. Which option is preferable? (8 Marks) (b) Expected returns on two stocks for particular market returns are given in the following table: Market Return 7% 25% You are required to calculate: Aggressive Defensive 4% 9% 40% 18% (i) The Betas of the two stocks. (ii) Expected return of each stock, if the market return is equally likely to be 7% or 25%. (iii) The Security Market Line (SML), if the risk free rate is 7.5% and market return is equally likely to be 7% or 25%. (iv) The Alphas of the two stocks. (8 Marks) (c) Describe the problems faced in the growth of Securitization of instruments especially in Indian context. (4 Marks)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To evaluate the two options for covering the risk of the company in the foreign exchange market we need to calculate the cost of each option and compare them The options are Option A Covering payabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started