Answered step by step

Verified Expert Solution

Question

1 Approved Answer

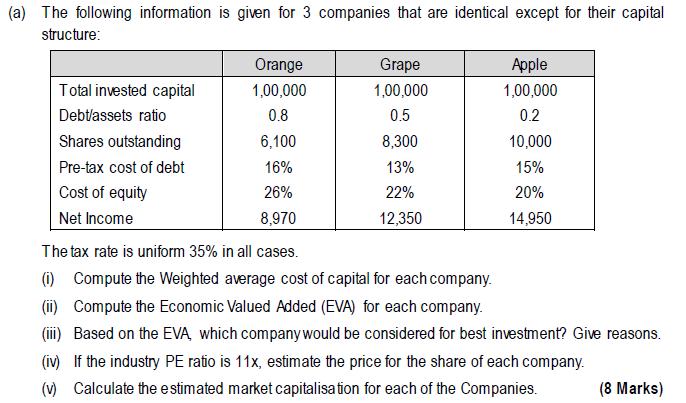

(a) The following information is given for 3 companies that are identical except for their capital structure: Orange Grape Apple Total invested capital 1,00,000

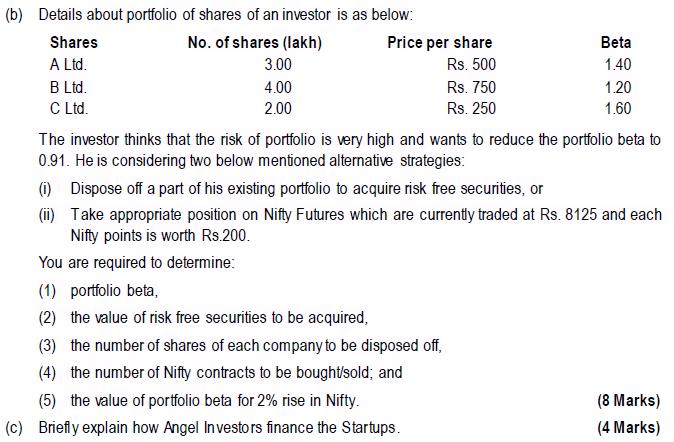

(a) The following information is given for 3 companies that are identical except for their capital structure: Orange Grape Apple Total invested capital 1,00,000 1,00,000 1,00,000 Debt/assets ratio 0.8 0.5 0.2 Shares outstanding 6,100 8,300 10,000 Pre-tax cost of debt 16% 13% 15% Cost of equity 26% 22% 20% Net Income 8,970 12,350 14,950 The tax rate is uniform 35% in all cases. (i) Compute the Weighted average cost of capital for each company. (ii) Compute the Economic Valued Added (EVA) for each company. (iii) Based on the EVA, which company would be considered for best investment? Give reasons. (iv) If the industry PE ratio is 11x, estimate the price for the share of each company. (v) Calculate the estimated market capitalisation for each of the Companies. (8 Marks) (b) Details about portfolio of shares of an investor is as below: Shares A Ltd. B Ltd. C Ltd. No. of shares (lakh) 3.00 4.00 2.00 Price per share Beta Rs. 500 1.40 Rs. 750 1.20 Rs. 250 1.60 The investor thinks that the risk of portfolio is very high and wants to reduce the portfolio beta to 0.91. He is considering two below mentioned alternative strategies: (i) Dispose off a part of his existing portfolio to acquire risk free securities, or (ii) Take appropriate position on Nifty Futures which are currently traded at Rs. 8125 and each Nifty points is worth Rs.200. You are required to determine: (1) portfolio beta, (2) the value of risk free securities to be acquired, (3) the number of shares of each company to be disposed off, (4) the number of Nifty contracts to be bought/sold; and (5) the value of portfolio beta for 2% rise in Nifty. (c) Briefly explain how Angel Investors finance the Startups. (8 Marks) (4 Marks)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a i Weighted Average Cost of Capital WACC for each company Orange WACC 08 16 1 035 02 26 128 52 18 Apple WACC 05 13 1 035 05 22 4225 11 15225 Grape WACC 02 15 1 035 08 20 195 16 1795 ii Economic Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started