Answered step by step

Verified Expert Solution

Question

1 Approved Answer

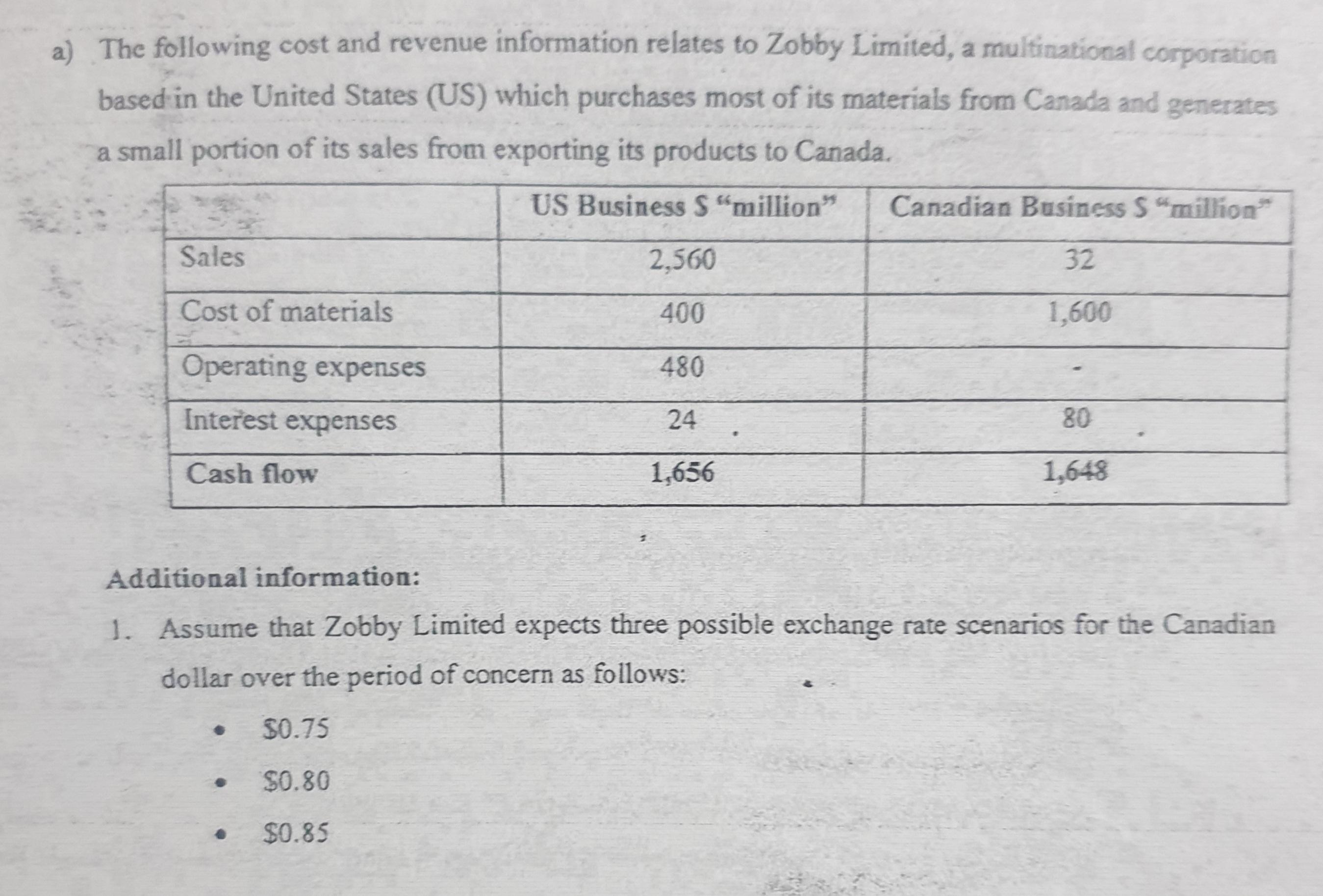

a) The following cost and revenue information relates to Zobby Limited, a multinational corporation based in the United States (US) which purchases most of

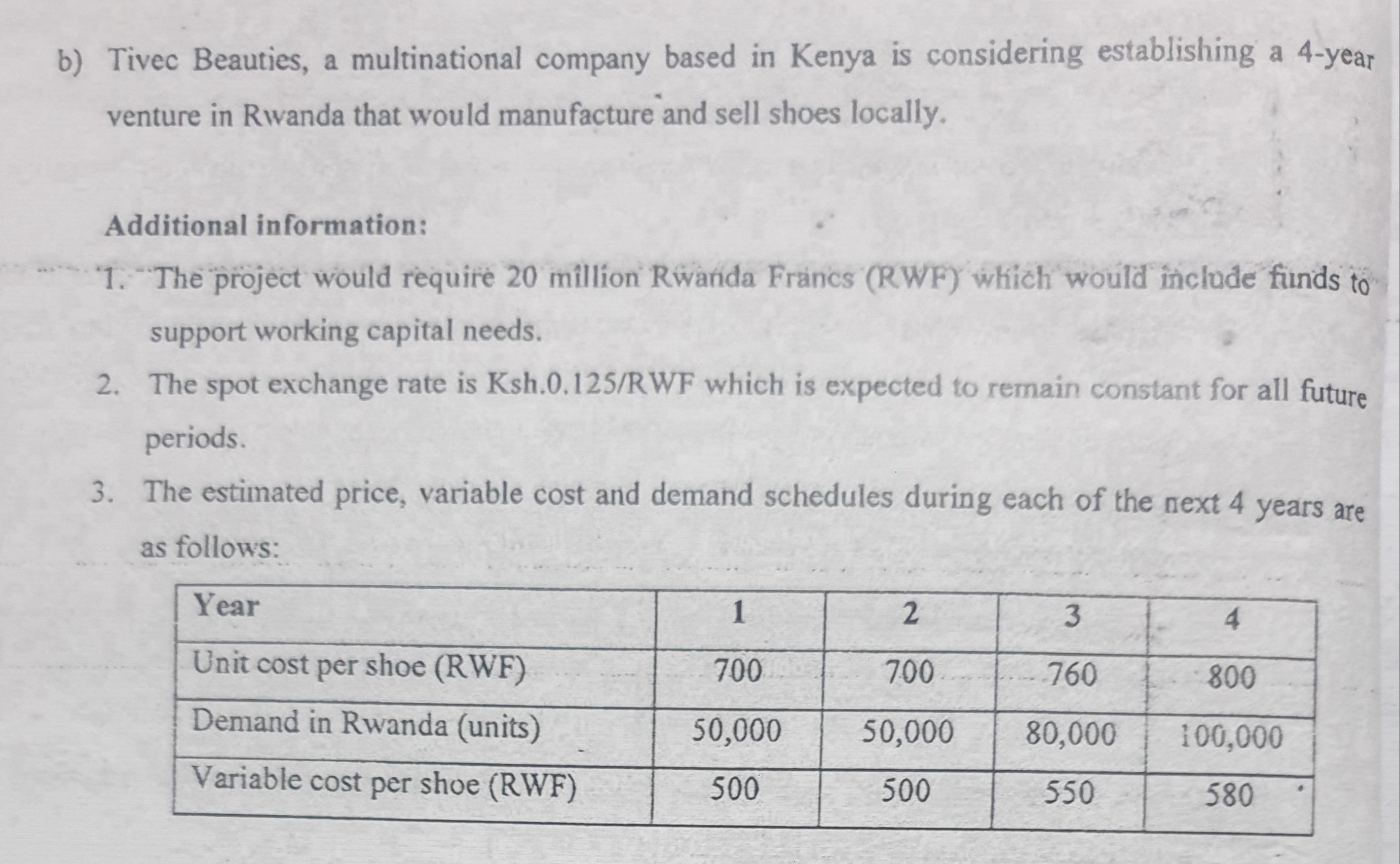

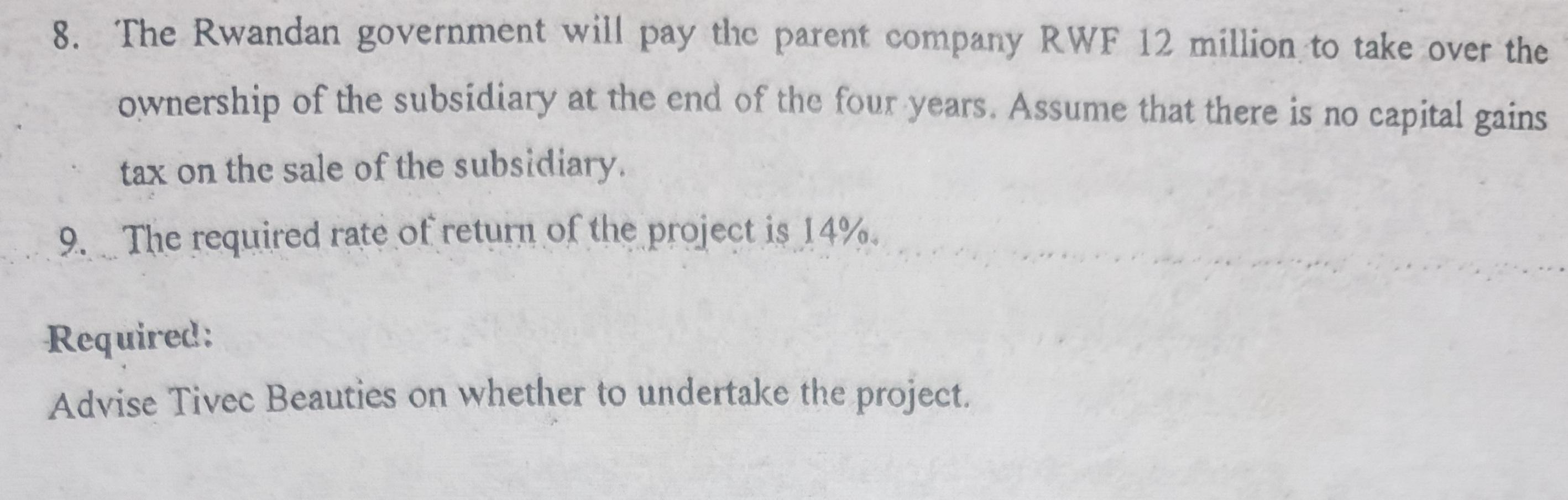

a) The following cost and revenue information relates to Zobby Limited, a multinational corporation based in the United States (US) which purchases most of its materials from Canada and generates a small portion of its sales from exporting its products to Canada. US Business S "million" Sales Cost of materials Operating expenses Interest expenses Cash flow 2,560 400 480 24 1,656 Canadian Business S "million" 32 1,600 80 1,648 Additional information: 1. Assume that Zobby Limited expects three possible exchange rate scenarios for the Canadian dollar over the period of concern as follows: $0.75 $0.80 $0.85 2. Assume that U.S sales will be unaffected by the exchange rates 3. Assume that the Canadian dollars (C$) earnings will be remitted to the U.S parent company at the end of the period. 4. Ignore possible tax effects. Required: i. ii. Using relevant computations, assess Zobby Limited's economic exposure under the above three scenarios. Comment on the results obtained in (a) (i) above. b) Tivec Beauties, a multinational company based in Kenya is considering establishing a 4-year venture in Rwanda that would manufacture and sell shoes locally. Additional information: 1. The project would require 20 million Rwanda Francs (RWF) which would include funds to support working capital needs. 2. The spot exchange rate is Ksh.0.125/RWF which is expected to remain constant for all future periods. 3. The estimated price, variable cost and demand schedules during each of the next 4 years are as follows: Year Unit cost per shoe (RWF) Demand in Rwanda (units) Variable cost per shoe (RWF) 1 700 50,000 500 2 3 700 760 50,000 80,000 500 550 4 800 100,000 580 4. The expenses of leasing extra office space is RWF 2 million per annum. Other annual overhead expenses are expected to be RWF 2 million per annum. 5. Depreciation on plant and machinery in Rwanda has been fixed at a maximum rate of RWF 4 million per annum. 6. The Rwandan government will impose a corporate tax at a rate of 20% on income. In addition it will impose a 10% withholding tax on any funds remitted by the subsidiary to the parent. The Kenyan government will allow a tax credit on taxes paid in Rwanda, therefore, earnings remitted to the Kenyan parent will not be taxed. 7. The subsidiary plans to send all net cash flows received to the parent company at the end of each year. 8. The Rwandan government will pay the parent company RWF 12 million to take over the ownership of the subsidiary at the end of the four years. Assume that there is no capital gains tax on the sale of the subsidiary. 9. The required rate of return of the project is 14%. Required: Advise Tivec Beauties on whether to undertake the project.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The following cost and revenue information relates to Zobby Limited a multinational corporation based in the United States US which purchases most of its materials from Canada and generates a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started