Question

An investor holds long position of 500 shares of MSFT and would like to use a put option to hedge the downside risk. Given

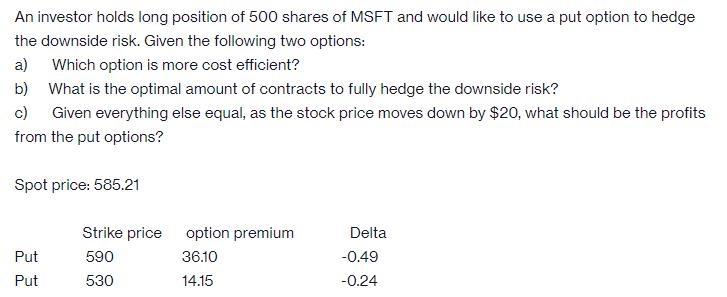

An investor holds long position of 500 shares of MSFT and would like to use a put option to hedge the downside risk. Given the following two options: a) Which option is more cost efficient? b) What is the optimal amount of contracts to fully hedge the downside risk? c) Given everything else equal, as the stock price moves down by $20, what should be the profits from the put options? Spot price: 585.21 Put Put Strike price 590 530 option premium 36.10 14.15 Delta -0.49 -0.24

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To determine which option is more cost efficient we can compare their prices relative to their deltas The delta of an option represents the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App