Answered step by step

Verified Expert Solution

Question

1 Approved Answer

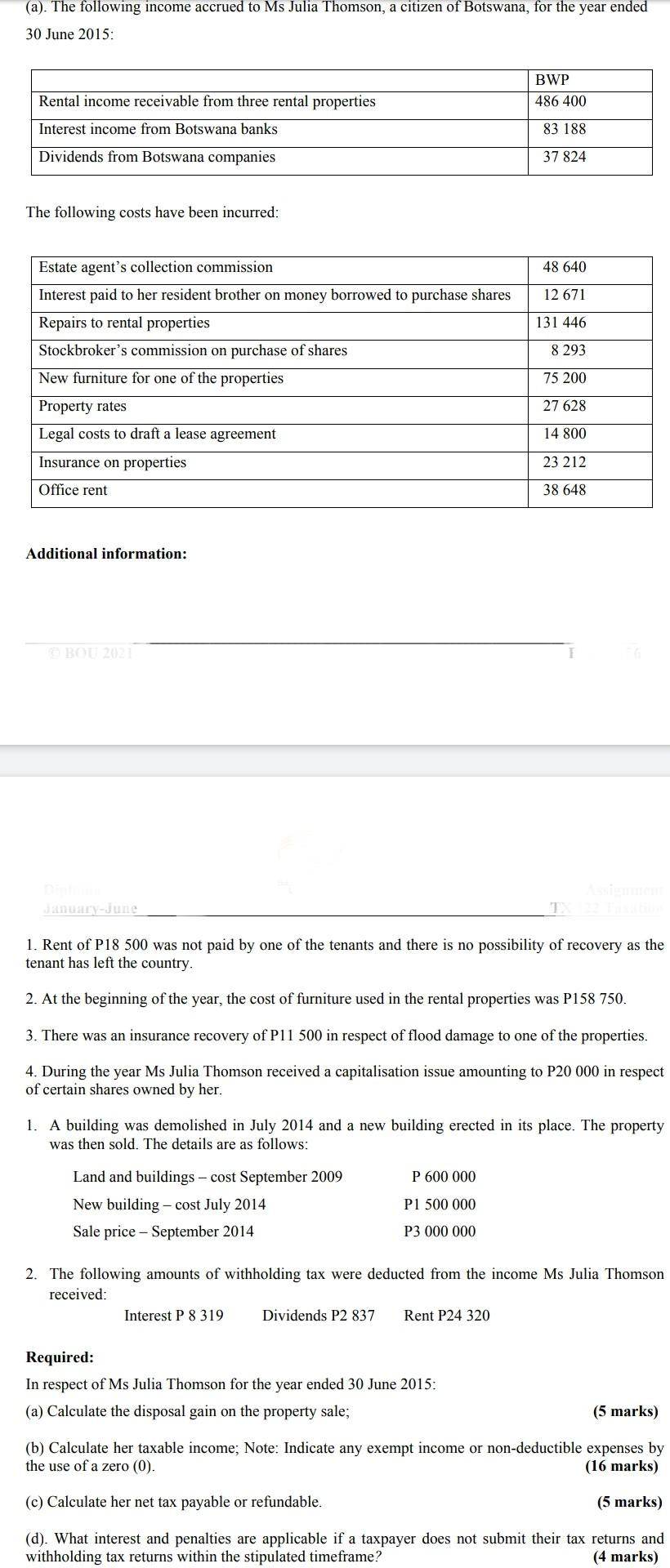

(a). The following income accrued to Ms Julia Thomson, a citizen of Botswana, for the year ended 30 June 2015: BWP 486 400 Rental income

(a). The following income accrued to Ms Julia Thomson, a citizen of Botswana, for the year ended 30 June 2015: BWP 486 400 Rental income receivable from three rental properties Interest income from Botswana banks 83 188 Dividends from Botswana companies 37 824 The following costs have been incurred: 48 640 12 671 131 446 8 293 Estate agent's collection commission Interest paid to her resident brother on money borrowed to purchase shares Repairs to rental properties Stockbroker's commission on purchase of shares New fu for one properties Property rates Legal costs to draft a lease agreement Insurance on properties 75 200 27 628 14 800 23 212 Office rent 38 648 Additional information: 1. Rent of P18 500 was not paid by one of the tenants and there is no possibility of recovery as the tenant has left the country. 2. At the beginning of the year, the cost of furniture used in the rental properties was P158 750. 3. There was an insurance recovery of P11 500 in respect of flood damage to one of the properties. 4. During the year Ms Julia Thomson received a capitalisation issue amounting to P20 000 in respect of certain shares owned by her. 1. A building was demolished in July 2014 and a new building erected in its place. The property was then sold. The details are as follows: P 600 000 Land and buildings - cost September 2009 New building - cost July 2014 Sale price - September 2014 P1 500 000 P3 000 000 2. The following amounts of withholding tax were deducted from the income Ms Julia Thomson received: Interest P 8 319 Dividends P2 837 Rent P24 320 Required: In respect of Ms Julia Thomson for the year ended 30 June 2015: (a) Calculate the disposal gain on the property sale; (5 marks) (b) Calculate her taxable income; Note: Indicate any exempt income or non-deductible expenses by the use of a zero (O). (16 marks) (c) Calculate her net tax payable or refundable. (5 marks) (d). What interest and penalties are applicable if a taxpayer does not submit their tax returns and withholding tax returns within the stipulated timeframe? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started