Question

A. The following information is available for ABC Company relating to 2020 operations: Accounts receivable, January1: P4,000,000; Accounts receivable collected, P6,300,000; Cash sales, P1,900,000; Inventory,

A. The following information is available for ABC Company relating to 2020 operations: Accounts receivable, January1: P4,000,000; Accounts receivable collected, P6,300,000; Cash sales, P1,900,000; Inventory, Jan. 1, P3,200,000; Inventory, Dec. 31, P1,900,000; Purchases, P5,950,000; Gross margin on sales, P2,450,000. The balance of the accounts receivable on Dec. 31, 2020 is ____________.

B. XYZ Companys accounts receivable balance at January 1, 2020 was P1,450,000 net of allowances totaling P75,000. During 2020, XYZ Company reported sales of P5,200,000. 15% of sales in 2020 were cash sales and the rest were on account under a 3/10, n/30 credit term. Sales returns amounted to P80,000 for cash sales in which the customers were refunded and P95,000 for credit sales. Total debit to cash during the period P5,740,000 which recoveries of previously written-off accounts totaling P110,000. 40% of the collections from its current customers were made within the discount period. Receivables written off in 2020, P90,000. The gross accounts receivable of XYZ Company at December 31, 2020 is ____________.

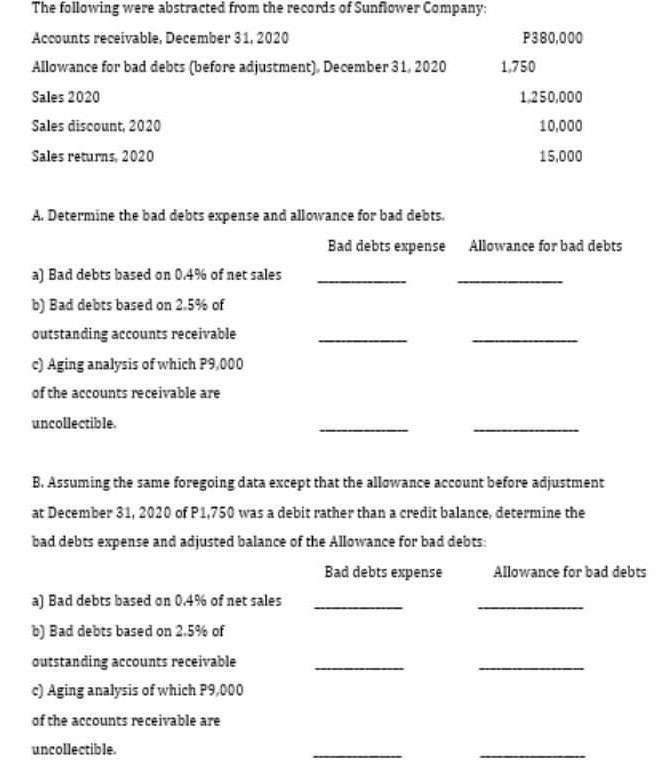

The following were abstracted from the records of Sunflower Company: Accounts receivable, December 31, 2020 P380,000 Allowance for bad debts (before adjustment), December 31, 2020 1.750 Sales 2020 1.250,000 Sales discount, 2020 10,000 Sales returns 2020 15,000 A. Determine the bad debts expense and allowance for bad debts. Bad debts expense Allowance for bad debts a) Bad debts based on 0.4% of net sales b) Bad debts based on 2.5% of outstanding accounts receivable c) Aging analysis of which P9,000 of the accounts receivable are uncollectible. B. Assuming the same foregoing data except that the allowance account before adjustment at December 31, 2020 of P1,750 was a debit rather than a credit balance determine the bad debts expense and adjusted balance of the Allowance for bad debts. Bad debts expense Allowance for bad debts a) Bad debts based on 0.4% of net sales b) Bad debts based on 2.5% of outstanding accounts receivable c) Aging analysis of which P9,000 of the accounts receivable are uncollectibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started