Question

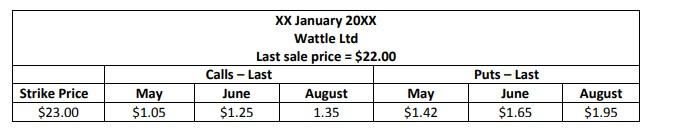

a. The following information regarding option quotes is available in January for Wattle Ltd: Is the June put option now in the money? Why? Show

a. The following information regarding option quotes is available in January for Wattle Ltd:

Is the June put option now in the money? Why? Show all calculations for one contract.

b. Following are the yields (YTMs) of three government bond:

YTM of a 1 year Bond = 5.00%

YTM of a 2 year Bond = 4.50%

YTM of a 3 year Bond = 5.5%

Calculate the one year rate, one year from now, that is 1r2 implied by this yield curve

c. It is January 20XX, a cattle farmer anticipates buying 4,000 cattle in September, 20XX. Assume a cattle futures contract is for 2,000 cattle and the price today of a September 20XX futures contract is $420 an animal. The farmer decides to hedge all of his intended purchase, so as to protect himself from rises in the cattle price between now and purchase time. Assume that In September, 20XX, the auction price of cattle is $434 each and the June futures contract is trading at $432 a head.

Calculate the value of the farmers net purchase cost in September 20XX, including the profit or loss from his futures trading. Show all calculations.

XX January 20xx Wattle Ltd Last sale price = $22.00 Calls - Last June August $1.25 1.35 Strike Price $23.00 May $1.05 May $1.42 Puts - Last June $1.65 August $1.95 XX January 20xx Wattle Ltd Last sale price = $22.00 Calls - Last June August $1.25 1.35 Strike Price $23.00 May $1.05 May $1.42 Puts - Last June $1.65 August $1.95Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started