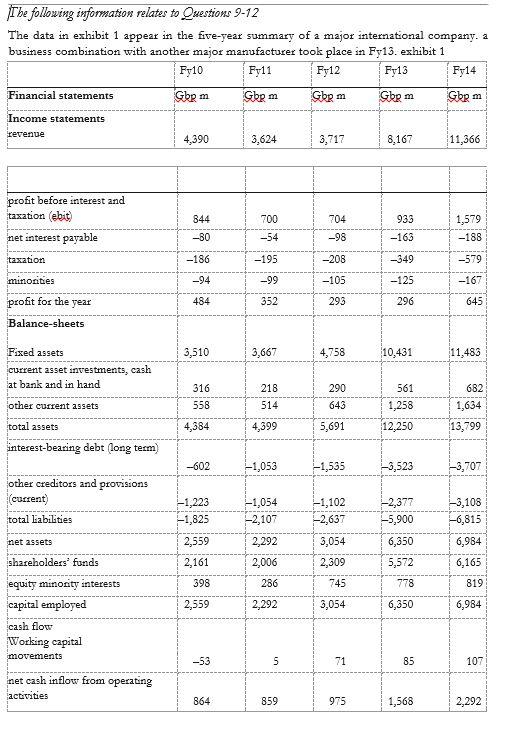

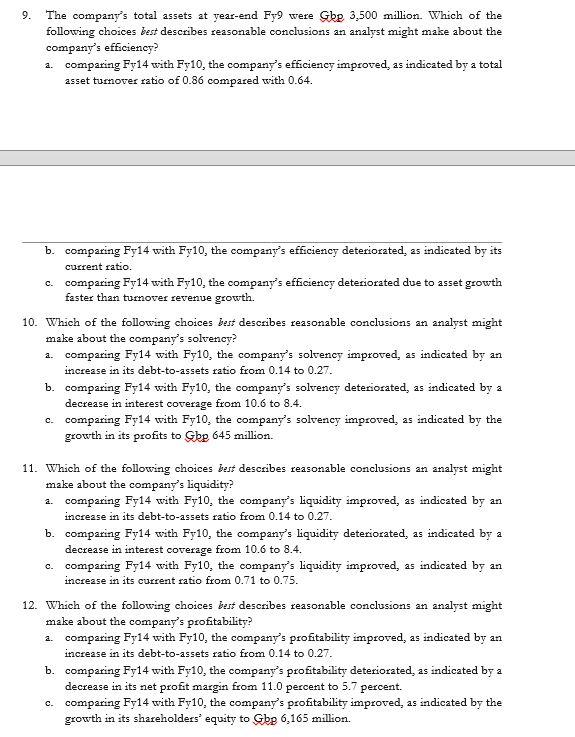

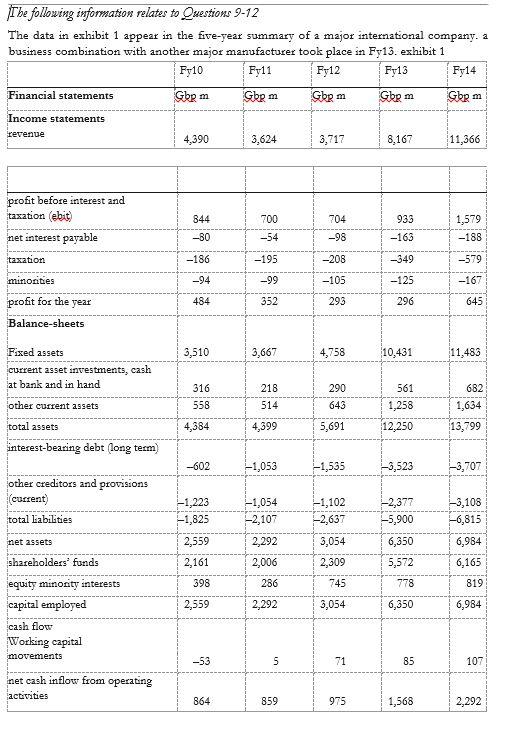

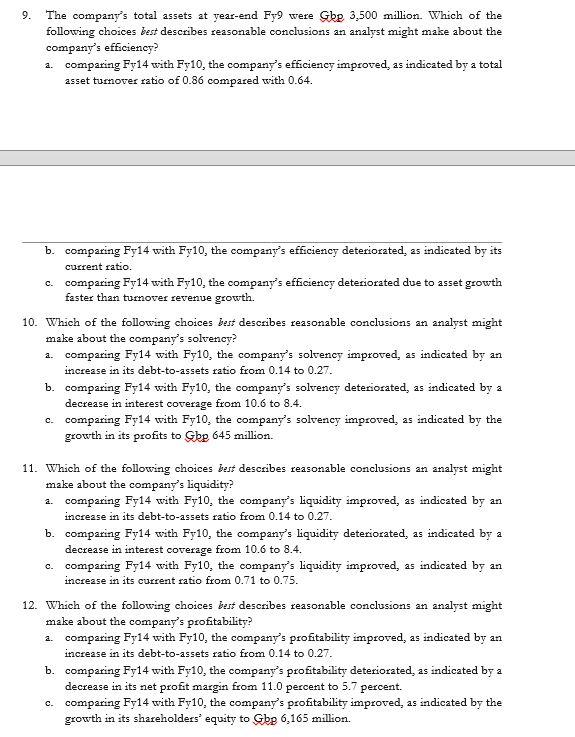

a The following information relates to Questions 9-12 The data in exhibit 1 appear in the five-year summary of a major international company. a business combination with another major manufacturer took place in Fy13. exhibit 1 Fy10 Fy11 Fy12 Fy13 Fy14 Financial statements Gbpm Gbpm Gbgm Gbgm Gbpm Income statements 4,390 3,624 3,717 8.167 11,366 revenue profit before interest and taxation (ebit net interest payable 700 704 935 1,579 844 -B0 -54 -98 -163 -188 taxation -186 -195 -208 -349 -579 minorities -94 -99 -105 -125 -167 484 352 293 296 645 profit for the year Balance-sheets 3,510 3,667 4,758 10,431 11,483 Fixed assets current asset investments, cash at bank and in hand other current assets total assets interest-bearing debt (long term) 316 558 218 514 290 643 561 1,258 12,250 682 1,634 13,799 4,384 4,399 5,691 -602 -1,053 -1,535 -3,523 -3,707 other creditors and provisions (current) total Labilities -1,223 -1,825 -1,054 --2,107 2,292 2,006 -1,102 -2,637 3,054 -2,377 -5,900 6,350 -3,108 -6,815 6,964 6,165 net assets 2,559 shareholders fonds 2,161 5,572 2,309 745 398 286 778 819 2,559 2,292 3,054 6,350 6,984 equity minority interests capital employed cash flow Working capital movements -53 5 71 85 107 net cash inflow from operating activities 864 859 975 1,568 2,292 9. The company's total assets at year-end Fr9 were Gbe 3,500 million. Which of the following choices best describes reasonable conclusions an analyst might make about the company's efficiency? 2. comparing Fy14 with Fy10, the company's efficiency improved, as indicated by a total asset turnover ratio of 0.86 compared with 0.64. b. comparing Fy14 with Fy10, the company's efficiency deteriorated, as indicated by its current ratio. c. comparing Fy14 with Fy10, the company's efficiency deteriorated due to asset growth faster than tumoves revenue growth. 10. Which of the following choices best describes reasonable conclusions an analyst might make about the company's solvency? 2. comparing Fy14 with Fy10, the company's solvency improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27. b. comparing Fy14 with Fy10, the company's solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4. c. comparing Fy14 with Fy10, the company's solvency improved, as indicated by the growth in its profits to Gbe 645 million. 11. Which of the following choices best describes reasonable conclusions an analyst might make about the company's liquidity? 2. comparing Fy14 with Fy10, the company's liquidity improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27. b. comparing Fy14 with Fy10, the company's liquidity deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4. c. comparing Fy14 with Fy10, the company's liquidity improved, as indicated by an increase in its current ratio from 0.71 to 0.75. 12. Which of the following choices best describes reasonable conclusions an analyst might make about the company's profitability? 2. comparing Fy14 with Fy10, the company's profitability improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27. b. comparing Fy14 with Fy10, the company's profitability deteriorated, as indicated by a decrease in its net profit margin from 11.0 percent to 5.7 percent. c. comparing Fy14 with Fy10, the company's profitability improved, as indicated by the growth in its shareholders' equity to Gbe 6,165 million