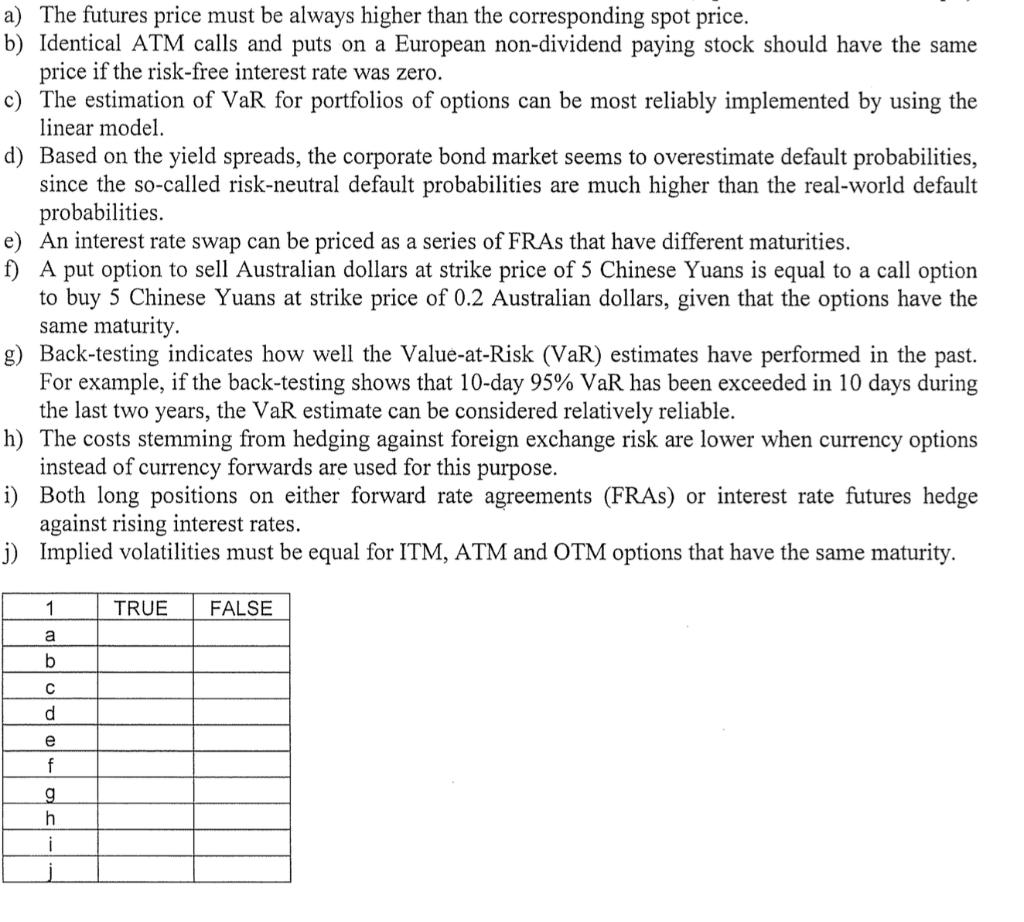

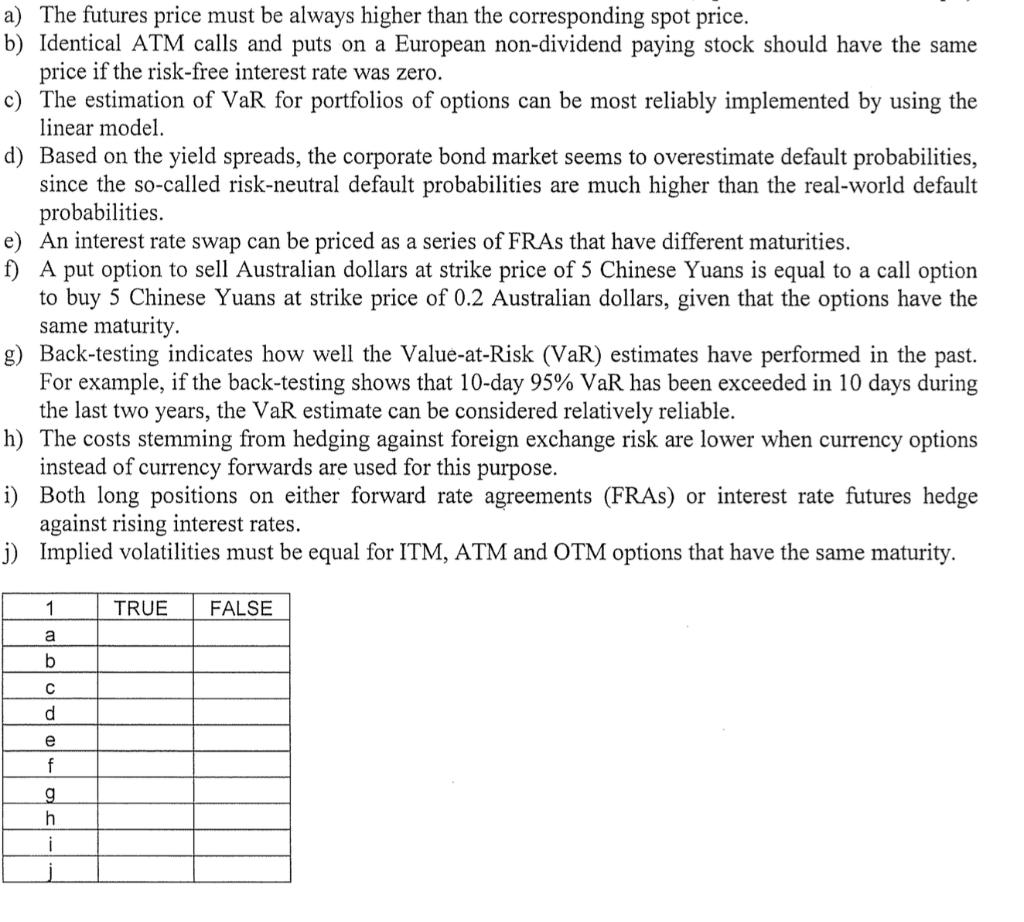

a) The futures price must be always higher than the corresponding spot price. b) Identical ATM calls and puts on a European non-dividend paying stock should have the same price if the risk-free interest rate was zero. c) The estimation of VaR for portfolios of options can be most reliably implemented by using the linear model. d) Based on the yield spreads, the corporate bond market seems to overestimate default probabilities, since the so-called risk-neutral default probabilities are much higher than the real-world default probabilities. e) An interest rate swap can be priced as a series of FRAs that have different maturities. f) A put option to sell Australian dollars at strike price of 5 Chinese Yuans is equal to a call option to buy 5 Chinese Yuans at strike price of 0.2 Australian dollars, given that the options have the same maturity. g) Back-testing indicates how well the Value-at-Risk (VaR) estimates have performed in the past. For example, if the back-testing shows that 10-day 95% VaR has been exceeded in 10 days during the last two years, the VaR estimate can be considered relatively reliable. h) The costs stemming from hedging against foreign exchange risk are lower when currency options instead of currency forwards are used for this purpose. i) Both long positions on either forward rate agreements (FRAs) or interest rate futures hedge against rising interest rates. j) Implied volatilities must be equal for ITM, ATM and OTM options that have the same maturity. 1 TRUE FALSE a b d e f g h i a) The futures price must be always higher than the corresponding spot price. b) Identical ATM calls and puts on a European non-dividend paying stock should have the same price if the risk-free interest rate was zero. c) The estimation of VaR for portfolios of options can be most reliably implemented by using the linear model. d) Based on the yield spreads, the corporate bond market seems to overestimate default probabilities, since the so-called risk-neutral default probabilities are much higher than the real-world default probabilities. e) An interest rate swap can be priced as a series of FRAs that have different maturities. f) A put option to sell Australian dollars at strike price of 5 Chinese Yuans is equal to a call option to buy 5 Chinese Yuans at strike price of 0.2 Australian dollars, given that the options have the same maturity. g) Back-testing indicates how well the Value-at-Risk (VaR) estimates have performed in the past. For example, if the back-testing shows that 10-day 95% VaR has been exceeded in 10 days during the last two years, the VaR estimate can be considered relatively reliable. h) The costs stemming from hedging against foreign exchange risk are lower when currency options instead of currency forwards are used for this purpose. i) Both long positions on either forward rate agreements (FRAs) or interest rate futures hedge against rising interest rates. j) Implied volatilities must be equal for ITM, ATM and OTM options that have the same maturity. 1 TRUE FALSE a b d e f g h