Answered step by step

Verified Expert Solution

Question

1 Approved Answer

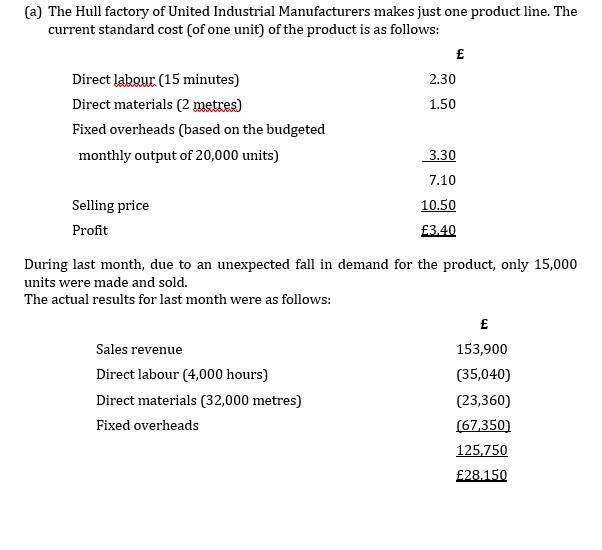

(a) The Hull factory of United Industrial Manufacturers makes just one product line. The current standard cost (of one unit) of the product is

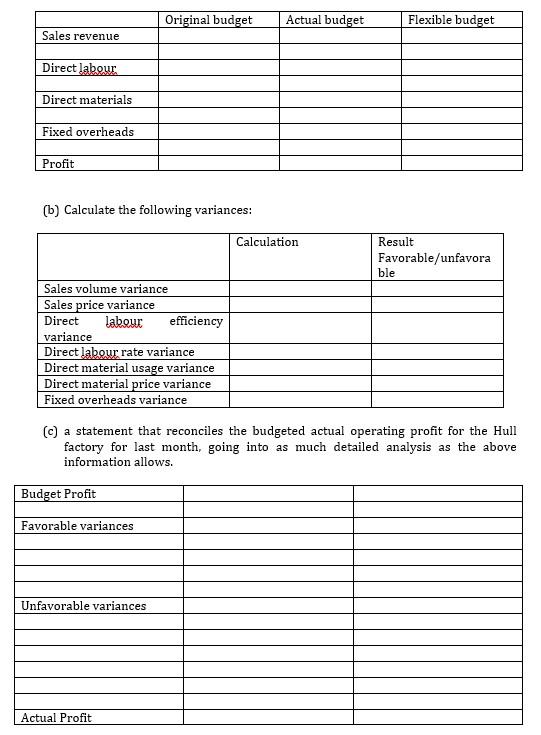

(a) The Hull factory of United Industrial Manufacturers makes just one product line. The current standard cost (of one unit) of the product is as follows: Direct labour (15 minutes) Direct materials (2 metres) Fixed overheads (based on the budgeted monthly output of 20,000 units) Selling price Profit Sales revenue Direct labour (4,000 hours) Direct materials (32,000 metres) Fixed overheads 2.30 1.50 3.30 7.10 10.50 3.40 During last month, due to an unexpected fall in demand for the product, only 15,000 units were made and sold. The actual results for last month were as follows: 153,900 (35,040) (23,360) (67,350) 125,750 28.150 Sales revenue Direct labour Direct materials Fixed overheads Profit (b) Calculate the following variances: Sales volume variance Sales price variance Direct labour Original budget variance Direct labour rate variance Direct material usage variance Direct material price variance. Fixed overheads variance Budget Profit Favorable variances efficiency Unfavorable variances Actual Profit Actual budget Calculation (c) a statement that reconciles the budgeted actual operating profit for the Hull factory for last month, going into as much detailed analysis as the above information allows. Flexible budget Result Favorable/unfavora ble

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To compute the requirement using excel Formula A 1 2 Units 3 Sales 4 Variable Cost 5 Direct Labor 6 Direct material 7 Total variable cost B5B6 Result ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started