(a) The newest project to be undertaken by MGMT2023 is forecasted to be financed with common stock, preferred stock and bonds of face value

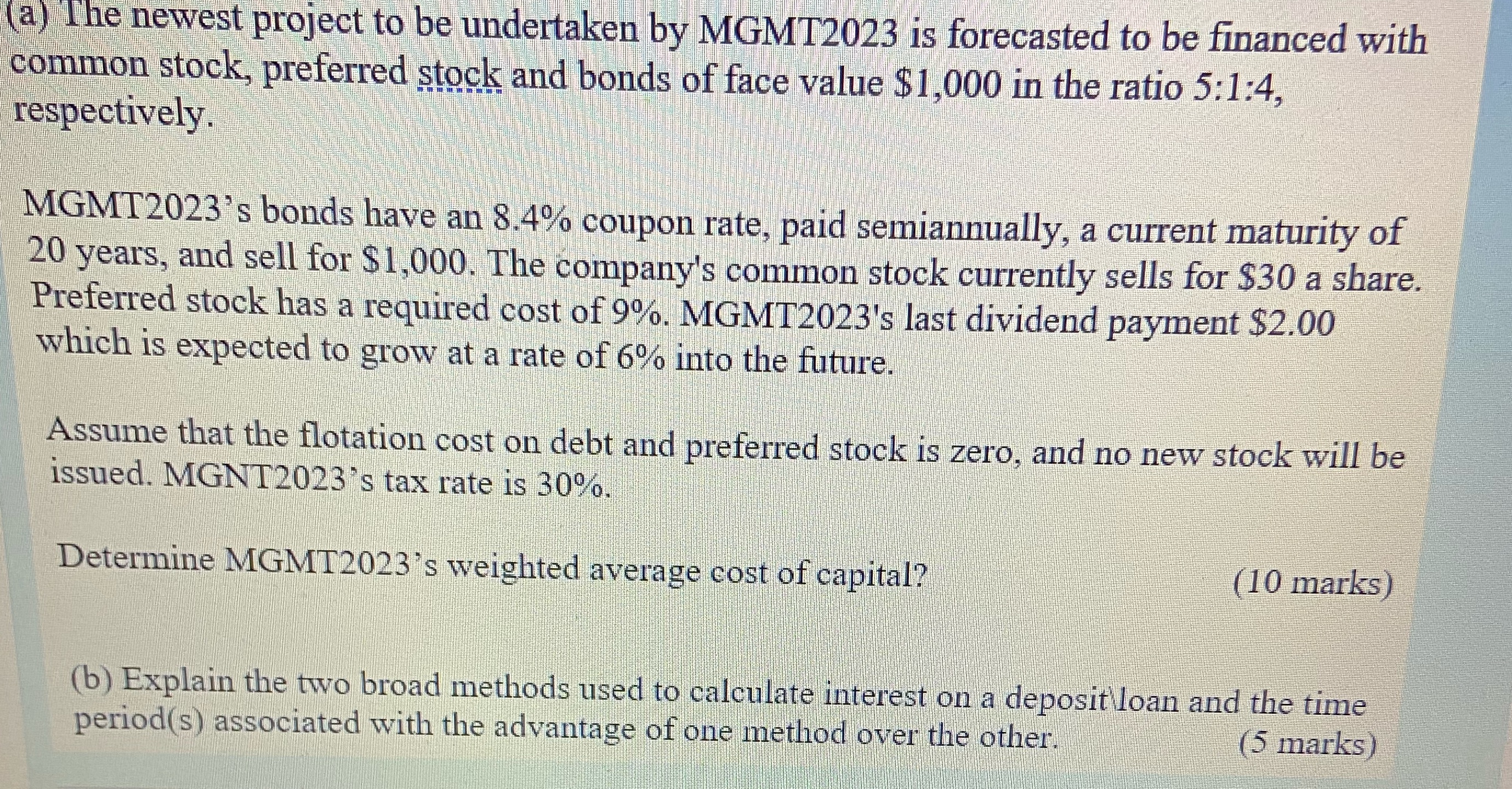

(a) The newest project to be undertaken by MGMT2023 is forecasted to be financed with common stock, preferred stock and bonds of face value $1,000 in the ratio 5:1:4, respectively. MGMT2023's bonds have an 8.4% coupon rate, paid semiannually, a current maturity of 20 years, and sell for $1,000. The company's common stock currently sells for $30 a share. Preferred stock has a required cost of 9%. MGMT2023's last dividend payment $2.00 which is expected to grow at a rate of 6% into the future. Assume that the flotation cost on debt and preferred stock is zero, and no new stock will be issued. MGNT2023's tax rate is 30%. Determine MGMT2023's weighted average cost of capital? (10 marks) (b) Explain the two broad methods used to calculate interest on a deposit loan and the time period(s) associated with the advantage of one method over the other. (5 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the weighted average cost of capital WACC we need to calculate the cost of each compo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started