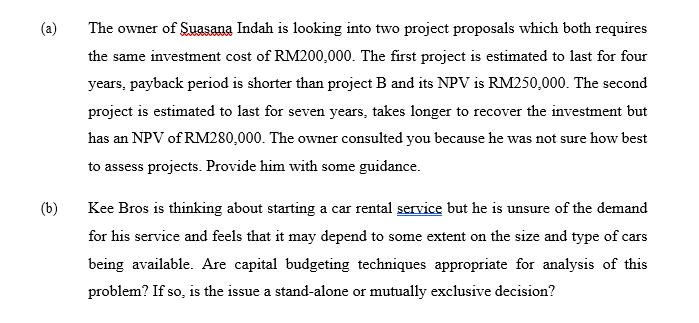

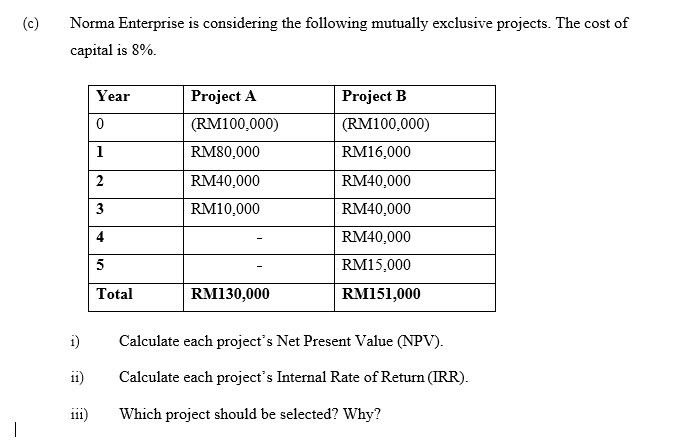

(a) The owner of Suasana Indah is looking into two project proposals which both requires the same investment cost of RM200,000. The first project is estimated to last for four years, payback period is shorter than project B and its NPV is RM250,000. The second project is estimated to last for seven years, takes longer to recover the investment but has an NPV of RM280,000. The owner consulted you because he was not sure how best to assess projects. Provide him with some guidance. (b) Kee Bros is thinking about starting a car rental service but he is unsure of the demand for his service and feels that it may depend to some extent on the size and type of cars being available. Are capital budgeting techniques appropriate for analysis of this problem? If so, is the issue a stand-alone or mutually exclusive decision? (c) Norma Enterprise is considering the following mutually exclusive projects. The cost of capital is 8%. Year 0 1 Project A (RM100,000) RM80,000 RM40,000 RM10.000 Project B (RM100,000) RM16,000 RM40,000 RM40,000 RM40,000 2 3 4 5 RM15,000 Total RM130,000 RM151,000 i) 11) Calculate each project's Net Present Value (NPV). Calculate each project's Internal Rate of Return (IRR). Which project should be selected? Why? 111) (a) The owner of Suasana Indah is looking into two project proposals which both requires the same investment cost of RM200,000. The first project is estimated to last for four years, payback period is shorter than project B and its NPV is RM250,000. The second project is estimated to last for seven years, takes longer to recover the investment but has an NPV of RM280,000. The owner consulted you because he was not sure how best to assess projects. Provide him with some guidance. (b) Kee Bros is thinking about starting a car rental service but he is unsure of the demand for his service and feels that it may depend to some extent on the size and type of cars being available. Are capital budgeting techniques appropriate for analysis of this problem? If so, is the issue a stand-alone or mutually exclusive decision? (c) Norma Enterprise is considering the following mutually exclusive projects. The cost of capital is 8%. Year 0 1 Project A (RM100,000) RM80,000 RM40,000 RM10.000 Project B (RM100,000) RM16,000 RM40,000 RM40,000 RM40,000 2 3 4 5 RM15,000 Total RM130,000 RM151,000 i) 11) Calculate each project's Net Present Value (NPV). Calculate each project's Internal Rate of Return (IRR). Which project should be selected? Why? 111)