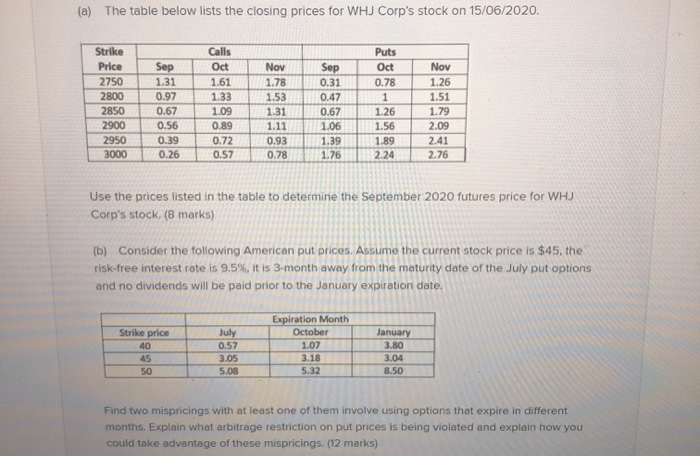

(a) The table below lists the closing prices for WHJ Corp's stock on 15/06/2020. Sep Strike Price 2750 2800 2850 2900 2950 3000 Sep 1.31 0.97 0.67 0.56 0.39 0.26 Calls Oct 1.61 1.33 1.09 0.89 0.72 0.57 Nov 1.78 1.53 1.31 1.11 0.93 0.78 0.31 0.47 0.67 1.06 1.39 1.76 Puts Oct 0.78 1 1.26 1.56 1.89 2.24 Nov 1.26 1.51 1.79 2.09 2.41 2.76 Use the prices listed in the table to determine the September 2020 futures price for WHU Corp's stock. (8 marks) (b) Consider the following American put prices. Assume the current stock price is $45, the risk-free interest rate is 9.5%, it is 3-month away from the maturity date of the July put options and no dividends will be paid prior to the January expiration date. Strike price 40 45 50 July 0.57 3.05 5.08 Expiration Month October 1.07 3.18 5.32 January 3.80 3.04 8.50 Find two mispricings with at least one of them involve using options that expire in different months. Explain what arbitrage restriction on put prices is being violated and explain how you could take advantage of these mispricings. (12 marks) (a) The table below lists the closing prices for WHJ Corp's stock on 15/06/2020. Sep Strike Price 2750 2800 2850 2900 2950 3000 Sep 1.31 0.97 0.67 0.56 0.39 0.26 Calls Oct 1.61 1.33 1.09 0.89 0.72 0.57 Nov 1.78 1.53 1.31 1.11 0.93 0.78 0.31 0.47 0.67 1.06 1.39 1.76 Puts Oct 0.78 1 1.26 1.56 1.89 2.24 Nov 1.26 1.51 1.79 2.09 2.41 2.76 Use the prices listed in the table to determine the September 2020 futures price for WHU Corp's stock. (8 marks) (b) Consider the following American put prices. Assume the current stock price is $45, the risk-free interest rate is 9.5%, it is 3-month away from the maturity date of the July put options and no dividends will be paid prior to the January expiration date. Strike price 40 45 50 July 0.57 3.05 5.08 Expiration Month October 1.07 3.18 5.32 January 3.80 3.04 8.50 Find two mispricings with at least one of them involve using options that expire in different months. Explain what arbitrage restriction on put prices is being violated and explain how you could take advantage of these mispricings. (12 marks)