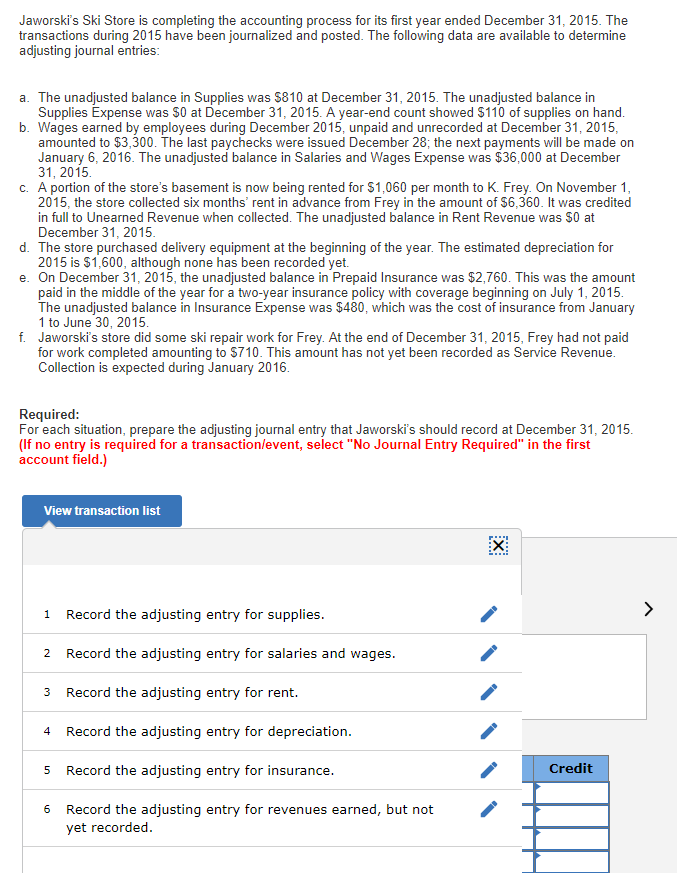

Question

a. The unadjusted balance in Supplies was $810 at December 31, 2015. The unadjusted balance in Supplies Expense was $0 at December 31, 2015. A

| a. | The unadjusted balance in Supplies was $810 at December 31, 2015. The unadjusted balance in Supplies Expense was $0 at December 31, 2015. A year-end count showed $110 of supplies on hand. |

| b. | Wages earned by employees during December 2015, unpaid and unrecorded at December 31, 2015, amounted to $3,300. The last paychecks were issued December 28; the next payments will be made on January 6, 2016. The unadjusted balance in Salaries and Wages Expense was $36,000 at December 31, 2015. |

| c. | A portion of the stores basement is now being rented for $1,060 per month to K. Frey. On November 1, 2015, the store collected six months rent in advance from Frey in the amount of $6,360. It was credited in full to Unearned Revenue when collected. The unadjusted balance in Rent Revenue was $0 at December 31, 2015. |

| d. | The store purchased delivery equipment at the beginning of the year. The estimated depreciation for 2015 is $1,600, although none has been recorded yet. |

| e. | On December 31, 2015, the unadjusted balance in Prepaid Insurance was $2,760. This was the amount paid in the middle of the year for a two-year insurance policy with coverage beginning on July 1, 2015. The unadjusted balance in Insurance Expense was $480, which was the cost of insurance from January 1 to June 30, 2015. |

| f. | Jaworskis store did some ski repair work for Frey. At the end of December 31, 2015, Frey had not paid for work completed amounting to $710. This amount has not yet been recorded as Service Revenue. Collection is expected during January 2016. |

| Required: | |

| For each situation, prepare the adjusting journal entry that Jaworskis should record at December 31, 2015. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started