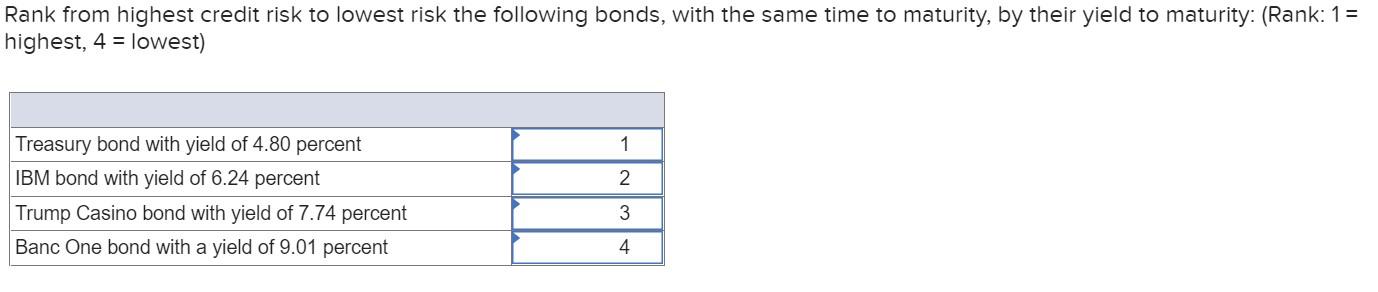

Question

A) The Wall Street Journal reports that the rate on 5-year Treasury securities is 6.45 percent and the rate on 6-year Treasury securities is 6.90

A) The Wall Street Journal reports that the rate on 5-year Treasury securities is 6.45 percent and the rate on 6-year Treasury securities is 6.90 percent. The 1-year interest rate expected in five years is, E(6r1), is 7.50 percent. According to the liquidity premium hypotheses, what is the liquidity premium on the 6-year Treasury security, L6? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

B) Calculate the price of a zero-coupon bond that matures in 25 years if the market interest rate is 5.0 percent. Assume semiannual compounding. (Do not round intermediate calculations and round your final answer to 2 decimal places.)

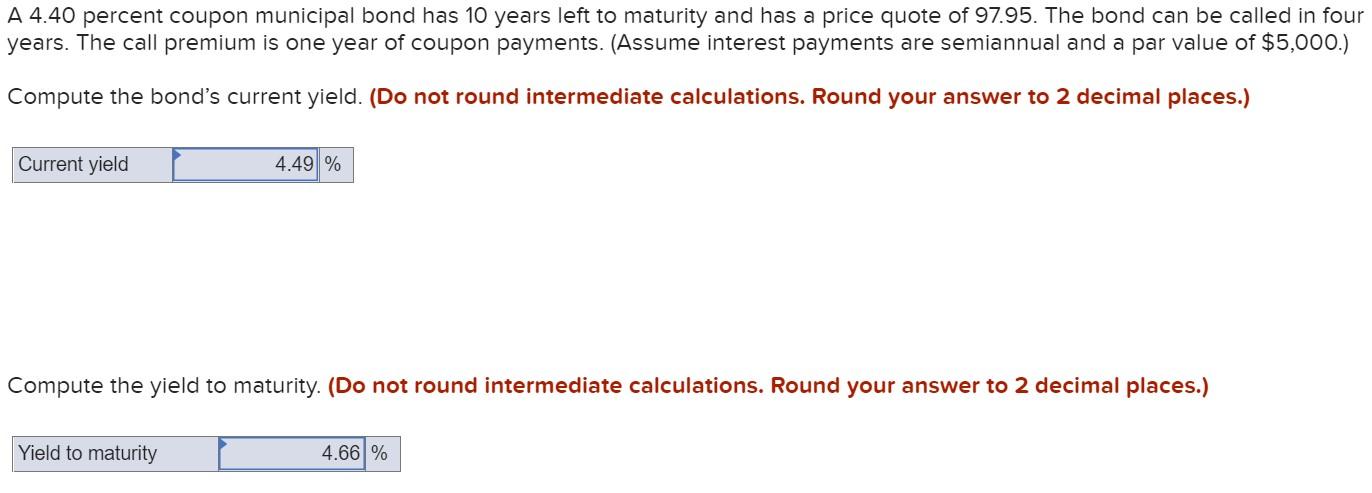

c) these answers are wrong

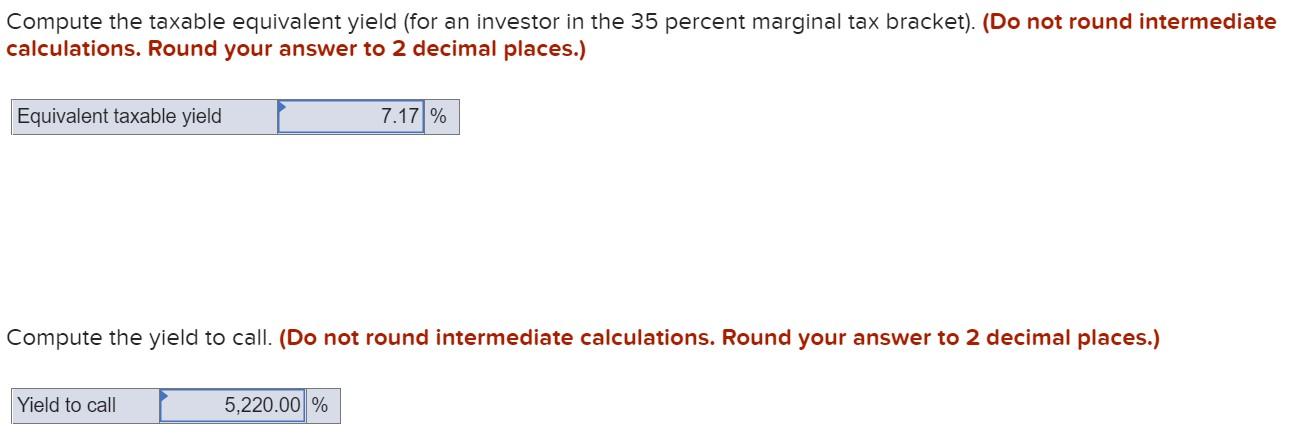

d) only looking for the "compute the yield to call portion"

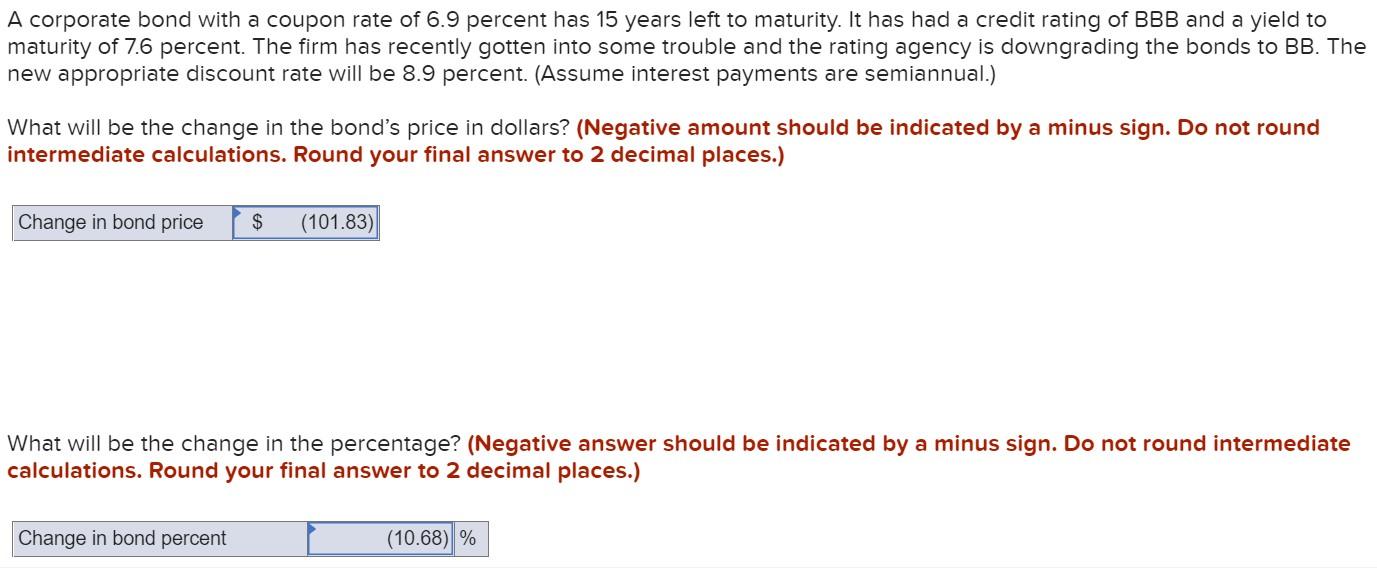

e) Second part of the question wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started