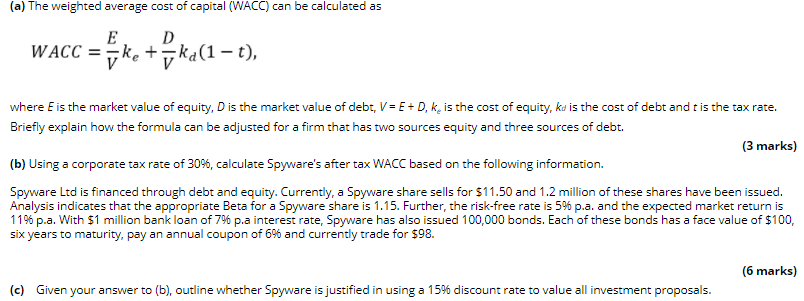

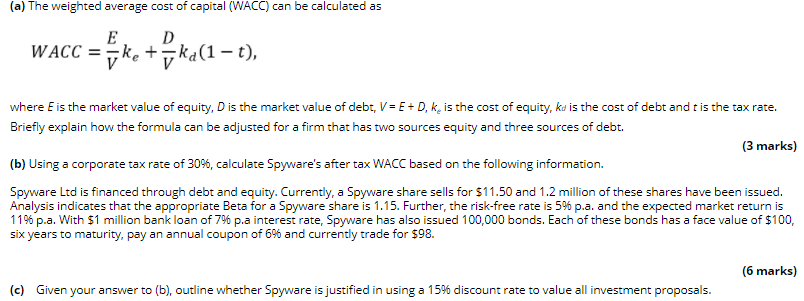

(a) The weighted average cost of capital (WACC) can be calculated as E D WACC = ke + ,ka(1 t), V ka(10 = t where Eis the market value of equity, D is the market value of debt, V = E + D, k, is the cost of equity, ku is the cost of debt and t is the tax rate. Briefly explain how the formula can be adjusted for a firm that has two sources equity and three sources of debt. (3 marks) (b) Using a corporate tax rate of 30%, calculate Spyware's after tax WACC based on the following information. Spyware Ltd is financed through debt and equity. Currently, a Spyware share sells for $11.50 and 1.2 million of these shares have been issued. Analysis indicates that the appropriate Beta for a Spyware share is 1.15. Further, the risk-free rate is 5% p.a. and the expected market return is 119 p.a. With $1 million bank loan of 796 p.a interest rate, Spyware has also issued 100,000 bonds. Each of these bonds has a face value of $100, six years to maturity, pay an annual coupon of 6% and currently trade for $98. (6 marks) (c) Given your answer to (b), outline whether Spyware is justified in using a 15% discount rate to value all investment proposals. (a) The weighted average cost of capital (WACC) can be calculated as E D WACC = ke + ,ka(1 t), V ka(10 = t where Eis the market value of equity, D is the market value of debt, V = E + D, k, is the cost of equity, ku is the cost of debt and t is the tax rate. Briefly explain how the formula can be adjusted for a firm that has two sources equity and three sources of debt. (3 marks) (b) Using a corporate tax rate of 30%, calculate Spyware's after tax WACC based on the following information. Spyware Ltd is financed through debt and equity. Currently, a Spyware share sells for $11.50 and 1.2 million of these shares have been issued. Analysis indicates that the appropriate Beta for a Spyware share is 1.15. Further, the risk-free rate is 5% p.a. and the expected market return is 119 p.a. With $1 million bank loan of 796 p.a interest rate, Spyware has also issued 100,000 bonds. Each of these bonds has a face value of $100, six years to maturity, pay an annual coupon of 6% and currently trade for $98. (6 marks) (c) Given your answer to (b), outline whether Spyware is justified in using a 15% discount rate to value all investment proposals