Answered step by step

Verified Expert Solution

Question

1 Approved Answer

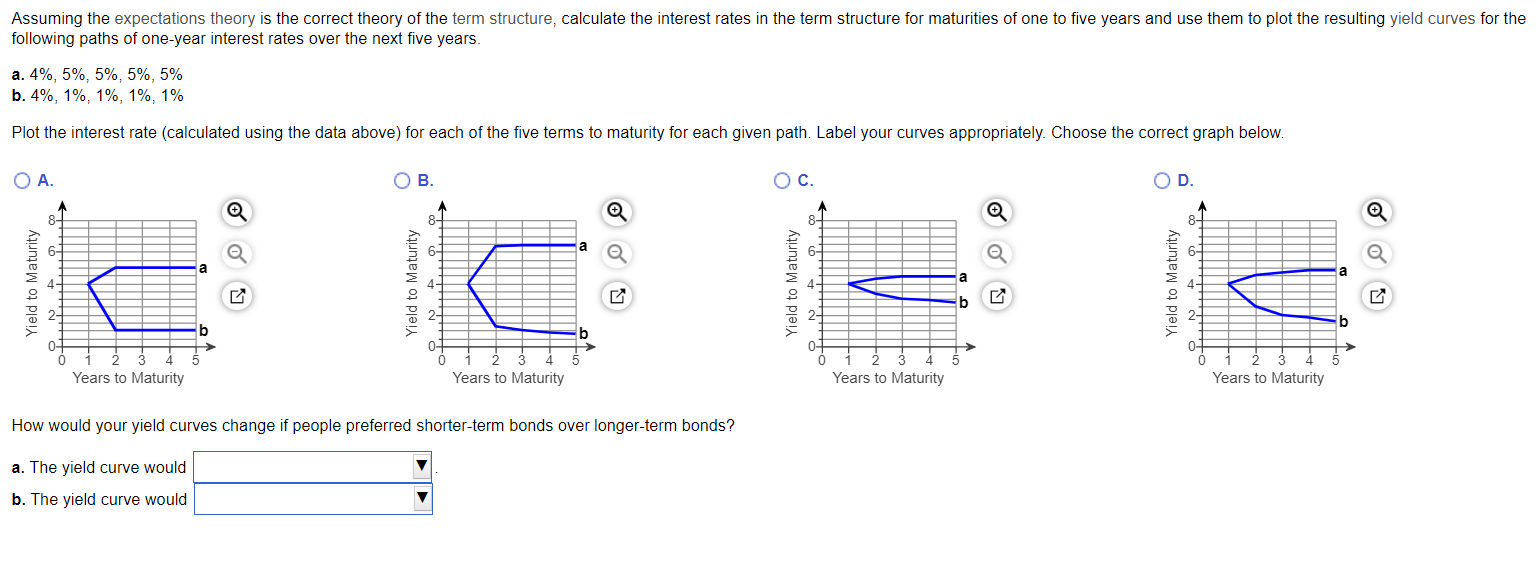

a. the yield curve would (no change, become steeper, become flatter, experience a parallel shift up, experience a parallel shift down) b. the yield curve

a. the yield curve would (no change, become steeper, become flatter, experience a parallel shift up, experience a parallel shift down)

b. the yield curve would (no change, become steeper, become flatter, experience a parallel shift up, experience a parallel shift down)

following paths of one-year interest rates over the next five years. a. 4%,5%,5%,5%,5% b. 4%,1%,1%,1%,1% Plot the interest rate (calculated using the data above) for each of the five terms to maturity for each given path. Label your curves appropriately. Choose the correct graph below. A. B. r D. How would your yield curves change if people preferred shorter-term bonds over longer-term bonds? a. The yield curve would b. The yield curve wouldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started