Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A thirty year term life premium for a 35 year old is roughly 0.1%. What would be the monthly premium for a $1 million

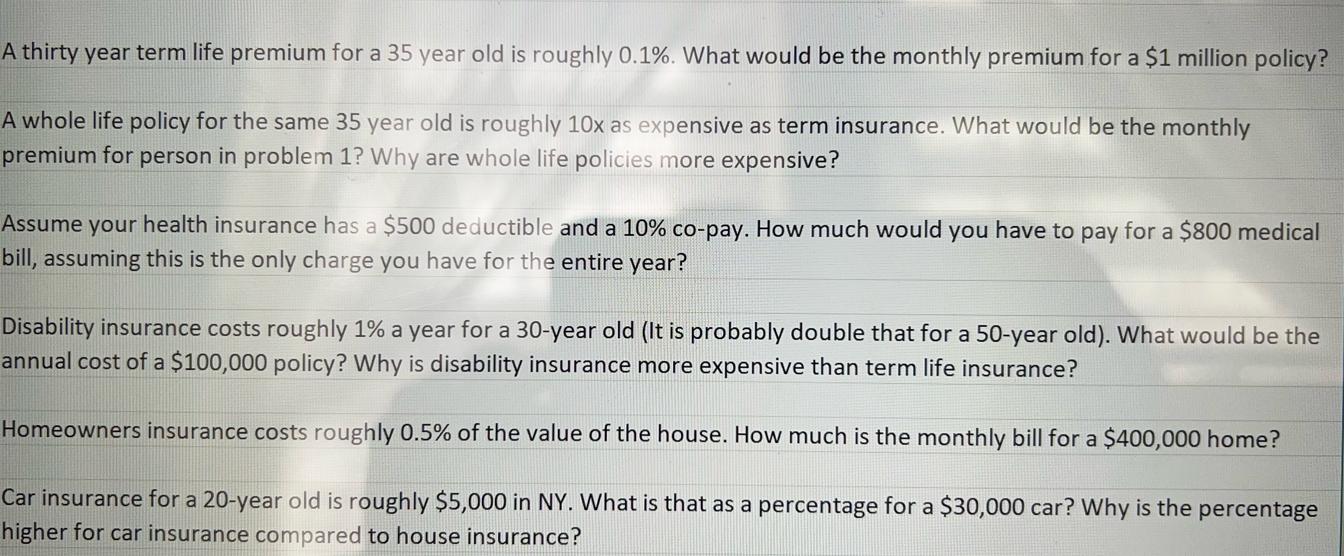

A thirty year term life premium for a 35 year old is roughly 0.1%. What would be the monthly premium for a $1 million policy? A whole life policy for the same 35 year old is roughly 10x as expensive as term insurance. What would be the monthly premium for person in problem 1? Why are whole life policies more expensive? Assume your health insurance has a $500 deductible and a 10% co-pay. How much would you have to pay for a $800 medical bill, assuming this is the only charge you have for the entire year? Disability insurance costs roughly 1% a year for a 30-year old (It is probably double that for a 50-year old). What would be the annual cost of a $100,000 policy? Why is disability insurance more expensive than term life insurance? Homeowners insurance costs roughly 0.5% of the value of the house. How much is the monthly bill for a $400,000 home? Car insurance for a 20-year old is roughly $5,000 in NY. What is that as a percentage for a $30,000 car? Why is the percentage higher for car insurance compared to house insurance?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Term Life Insurance The premium for a 1 million policy can be calculated by multiplying the policy amount by the premium rate The premium rate is 01 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started