Answered step by step

Verified Expert Solution

Question

1 Approved Answer

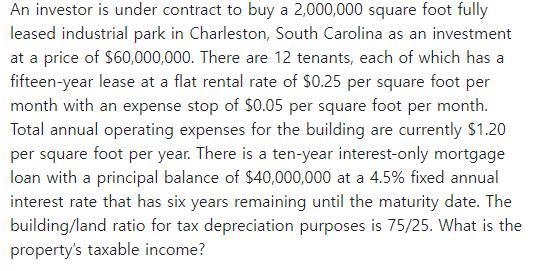

An investor is under contract to buy a 2,000,000 square foot fully leased industrial park in Charleston, South Carolina as an investment at a

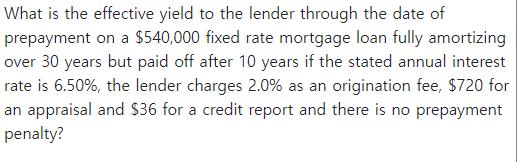

An investor is under contract to buy a 2,000,000 square foot fully leased industrial park in Charleston, South Carolina as an investment at a price of $60,000,000. There are 12 tenants, each of which has a fifteen-year lease at a flat rental rate of $0.25 per square foot per month with an expense stop of $0.05 per square foot per month. Total annual operating expenses for the building are currently $1.20 per square foot per year. There is a ten-year interest-only mortgage loan with a principal balance of $40,000,000 at a 4.5% fixed annual interest rate that has six years remaining until the maturity date. The building/land ratio for tax depreciation purposes is 75/25. What is the property's taxable income? What is the effective yield to the lender through the date of prepayment on a $540,000 fixed rate mortgage loan fully amortizing over 30 years but paid off after 10 years if the stated annual interest rate is 6.50%, the lender charges 2.0% as an origination fee, $720 for an appraisal and $36 for a credit report and there is no prepayment penalty?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the propertys taxable income we need to determine the propertys gross rental income operating expenses and depreciation expense Gross Ren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started