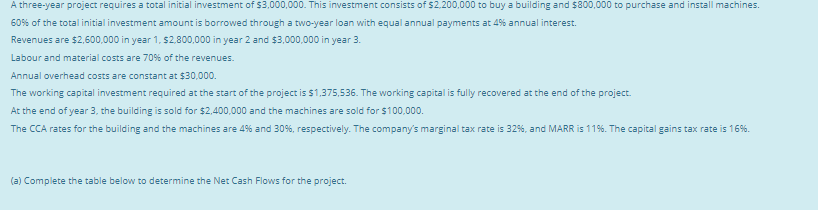

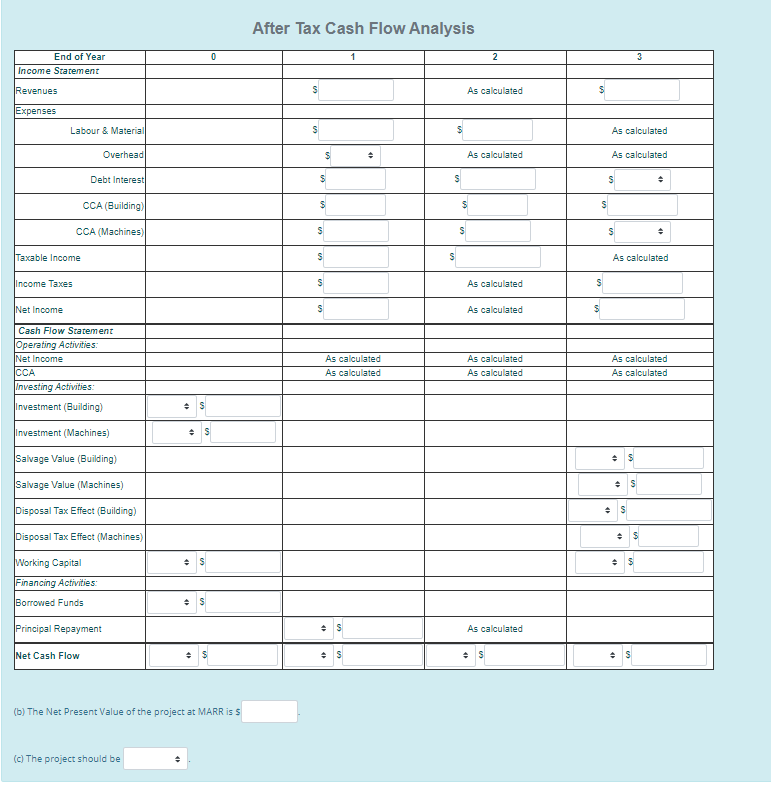

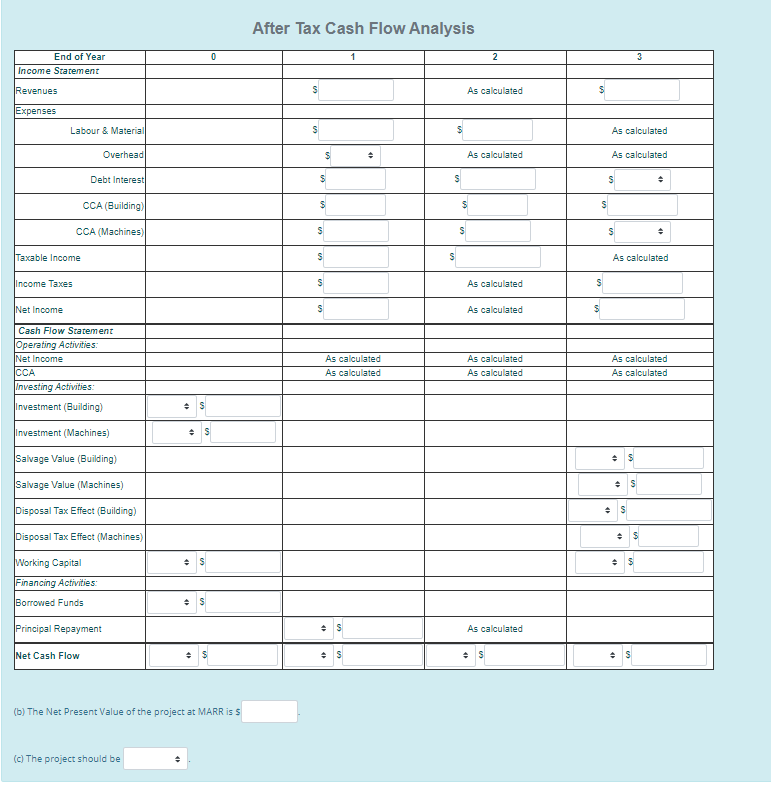

A three-year project requires a total initial investment of $3,000,000. This investment consists of $2.200,000 to buy a building and $800,000 to purchase and install machines. 60% of the total initial investment amount is borrowed through a two-year loan with equal annual payments at 4% annual interest. Revenues are $2,600,000 in year 1, 52,800,000 in year 2 and $3,000,000 in year 3. Labour and material costs are 70% of the revenues. Annual overhead costs are constant at $30,000. The working capital investment required at the start of the project is $1,375,536. The working capital is fully recovered at the end of the project. At the end of year 3, the building is sold for $2,400,000 and the machines are sold for $100.000. The CCA rates for the building and the machines are 4% and 30%, respectively. The company's marginal tax rate is 32%, and MARR is 11%. The capital gains tax rate is 16%. (a) Complete the table below to determine the Net Cash Flows for the project. After Tax Cash Flow Analysis 0 1 2 3 End of Year Income Statement Revenues S As calculated S Expenses Labour & Materiall S As calculated Overhead s As calculated As calculated Debt Interest S S S CCA (Building) s S CCA (Machines) S S Taxable income S As calculated Income Taxes s As calculated Net Income S As calculated Cash Flow Statement Operating Activities Net Income | Investing Activities: As calculated As calculated As calculated As calculated As calculated As calculated Investment (Building) . Investment (Machines) S Salvage Value (Building) S Salvage Value (Machines) S Disposal Tax Effect (Building) S Disposal Tax Effect (Machines) S S S Working Capital Financing Activities Borrowed Funds S Principal Repayment S As calculated Net Cash Flow (b) The Net Present Value of the project at MARR is S (c) The project should be A three-year project requires a total initial investment of $3,000,000. This investment consists of $2.200,000 to buy a building and $800,000 to purchase and install machines. 60% of the total initial investment amount is borrowed through a two-year loan with equal annual payments at 4% annual interest. Revenues are $2,600,000 in year 1, 52,800,000 in year 2 and $3,000,000 in year 3. Labour and material costs are 70% of the revenues. Annual overhead costs are constant at $30,000. The working capital investment required at the start of the project is $1,375,536. The working capital is fully recovered at the end of the project. At the end of year 3, the building is sold for $2,400,000 and the machines are sold for $100.000. The CCA rates for the building and the machines are 4% and 30%, respectively. The company's marginal tax rate is 32%, and MARR is 11%. The capital gains tax rate is 16%. (a) Complete the table below to determine the Net Cash Flows for the project. After Tax Cash Flow Analysis 0 1 2 3 End of Year Income Statement Revenues S As calculated S Expenses Labour & Materiall S As calculated Overhead s As calculated As calculated Debt Interest S S S CCA (Building) s S CCA (Machines) S S Taxable income S As calculated Income Taxes s As calculated Net Income S As calculated Cash Flow Statement Operating Activities Net Income | Investing Activities: As calculated As calculated As calculated As calculated As calculated As calculated Investment (Building) . Investment (Machines) S Salvage Value (Building) S Salvage Value (Machines) S Disposal Tax Effect (Building) S Disposal Tax Effect (Machines) S S S Working Capital Financing Activities Borrowed Funds S Principal Repayment S As calculated Net Cash Flow (b) The Net Present Value of the project at MARR is S (c) The project should be