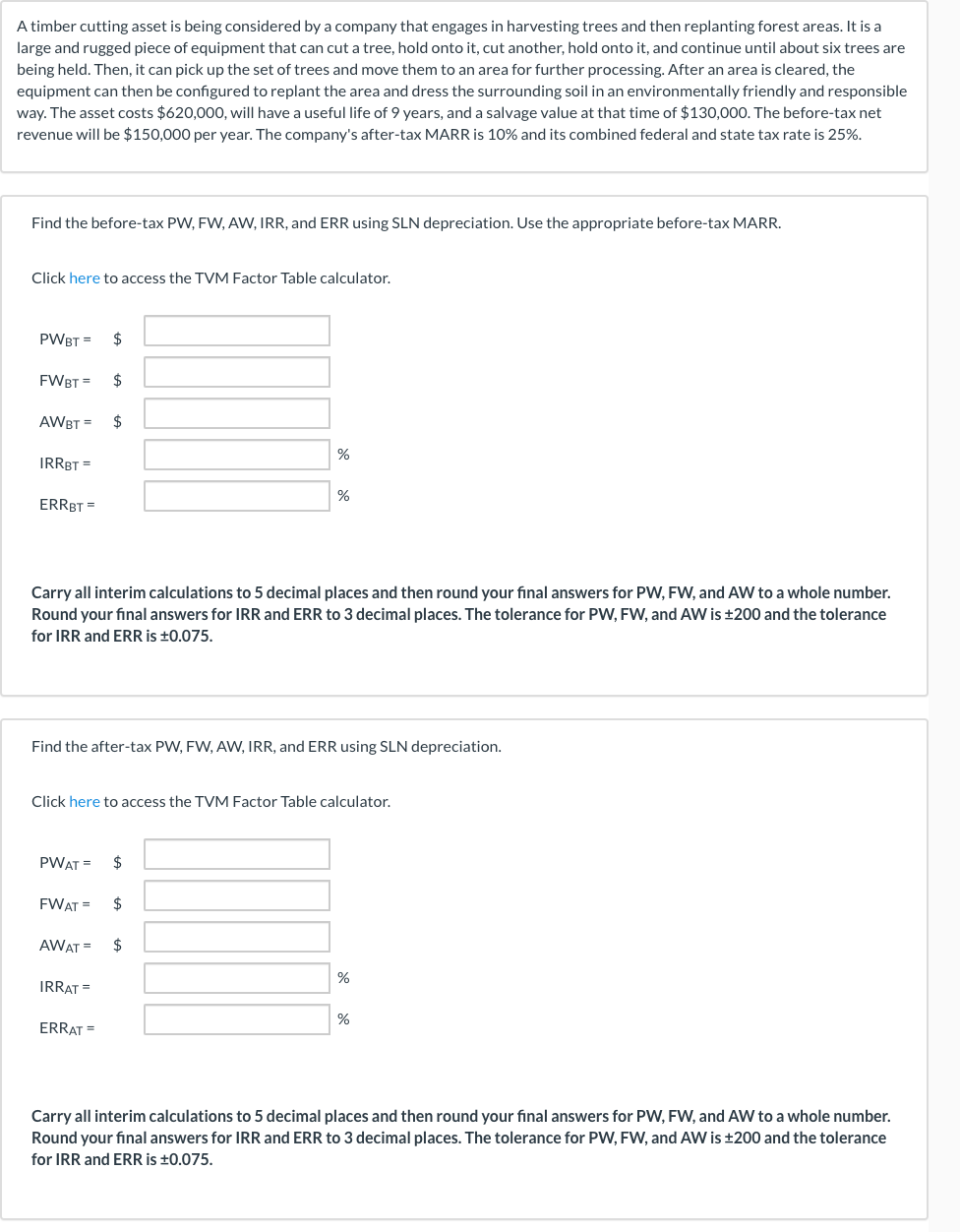

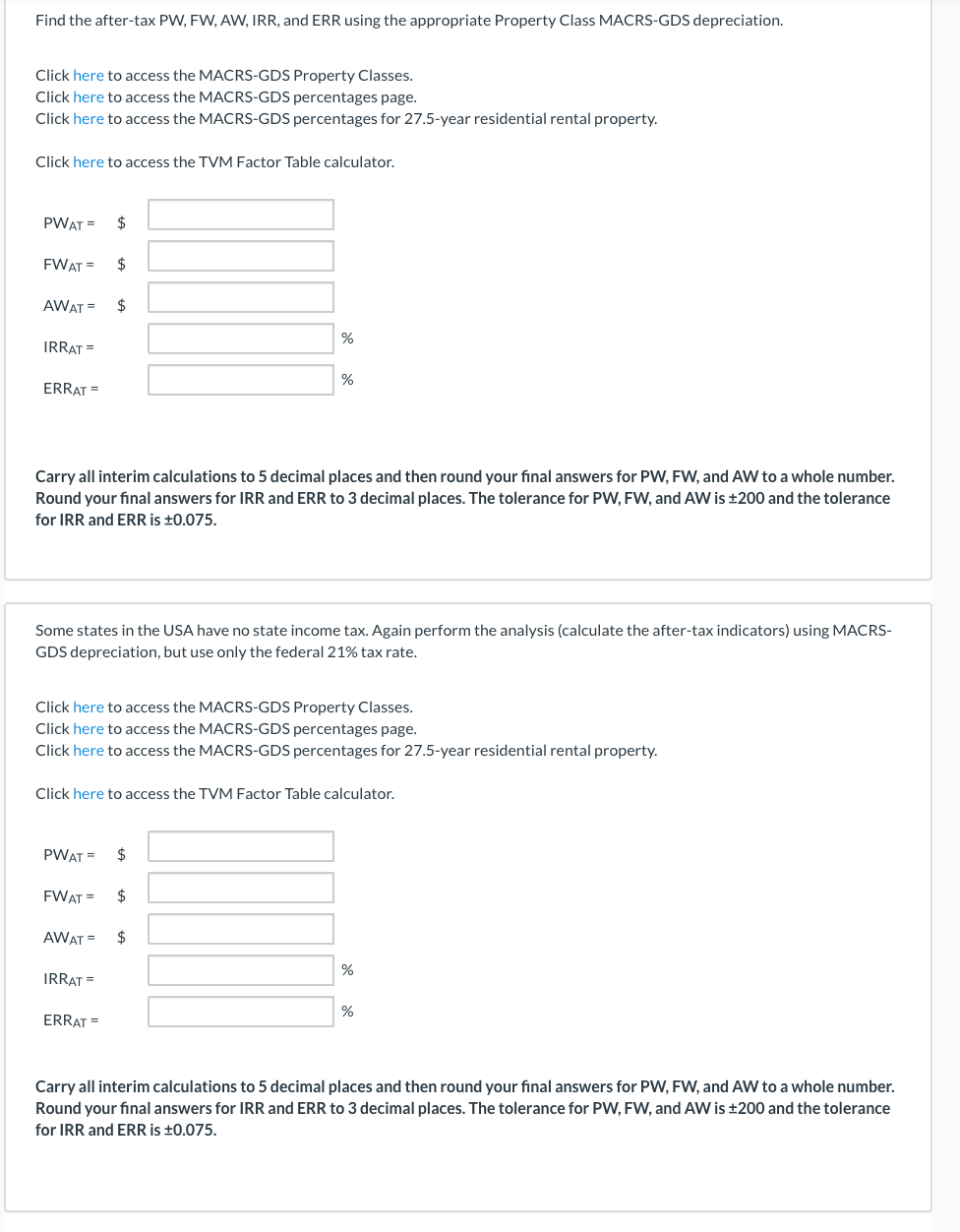

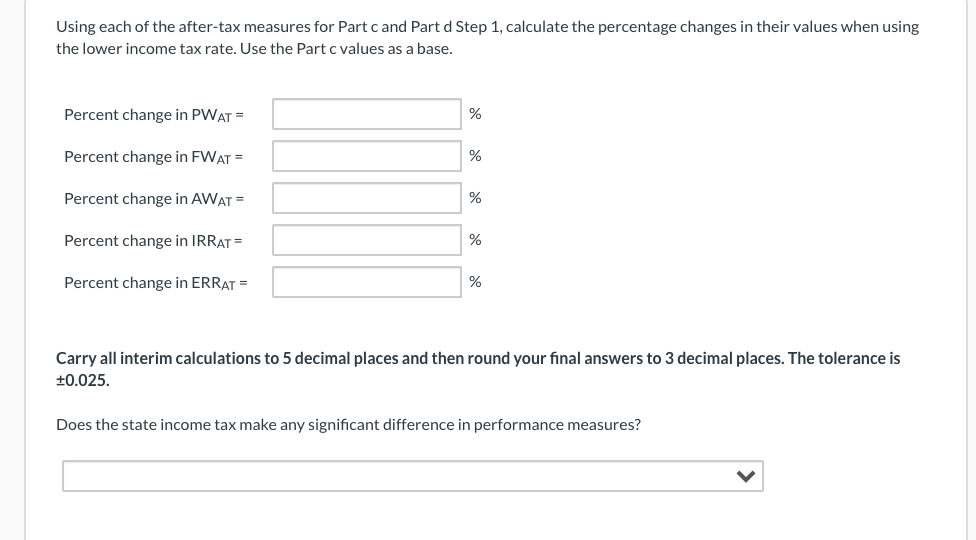

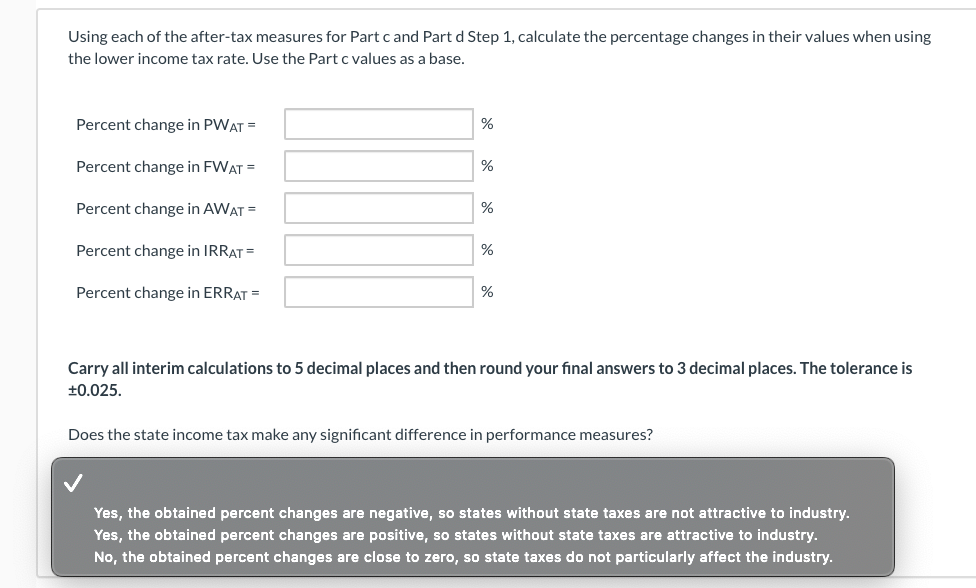

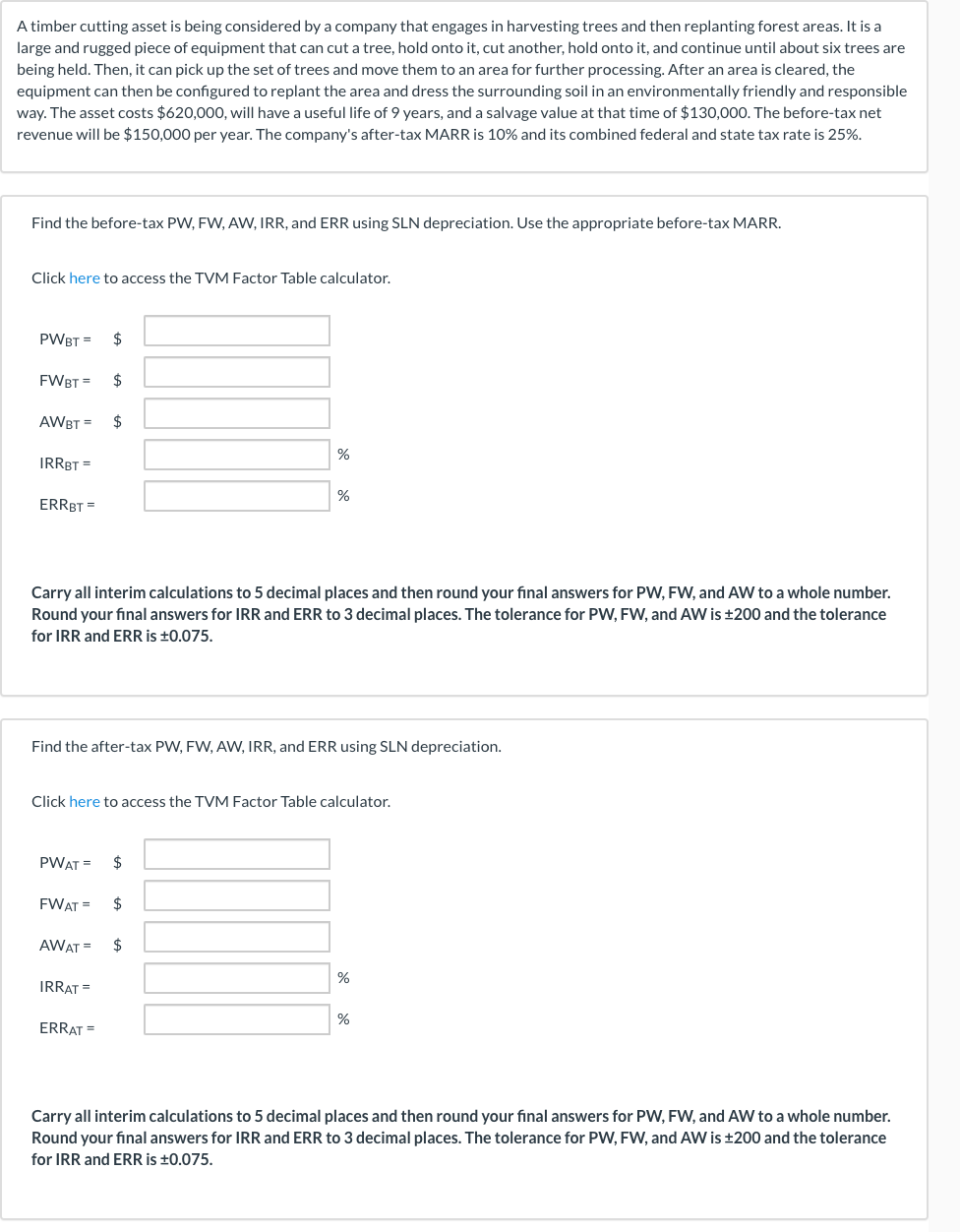

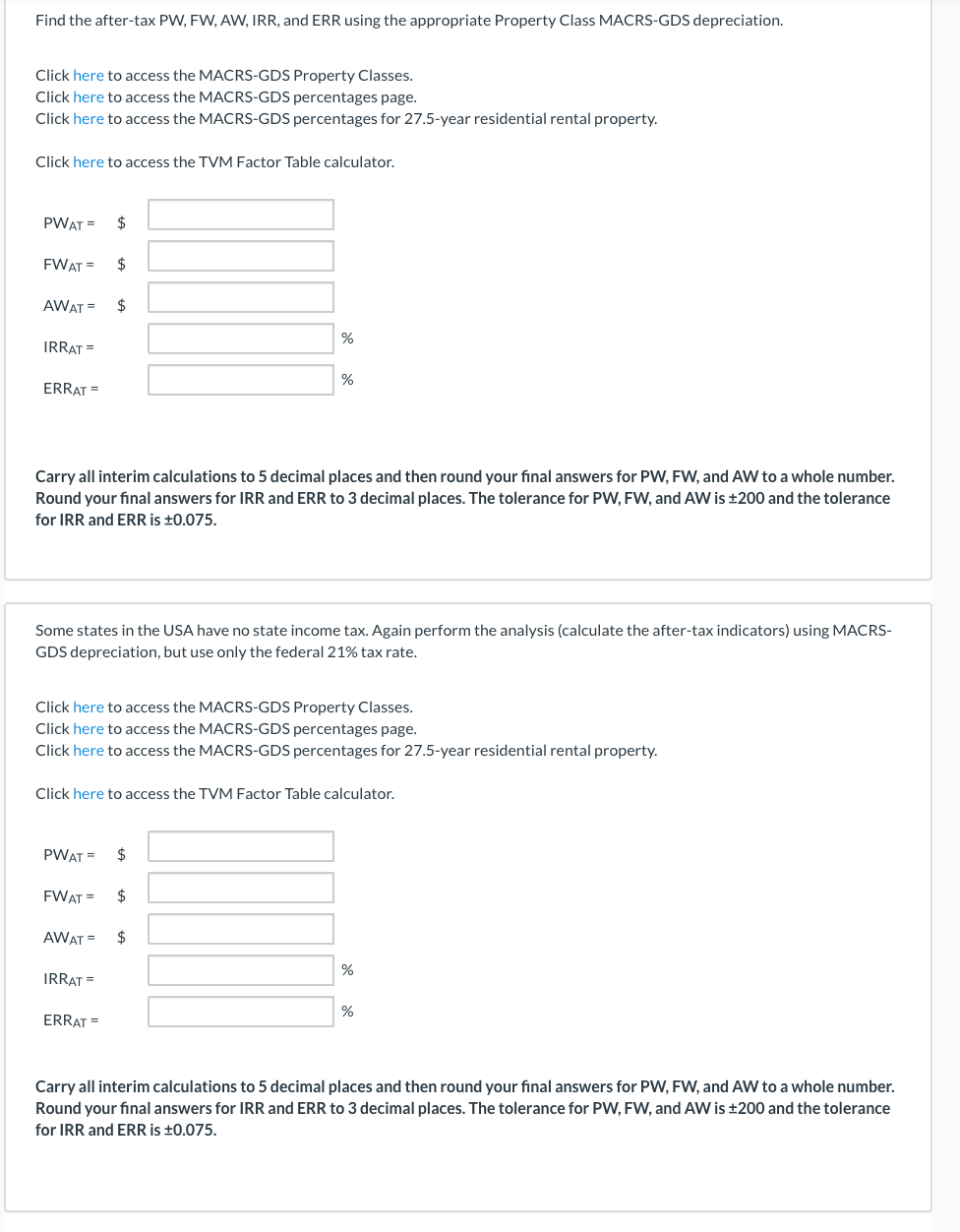

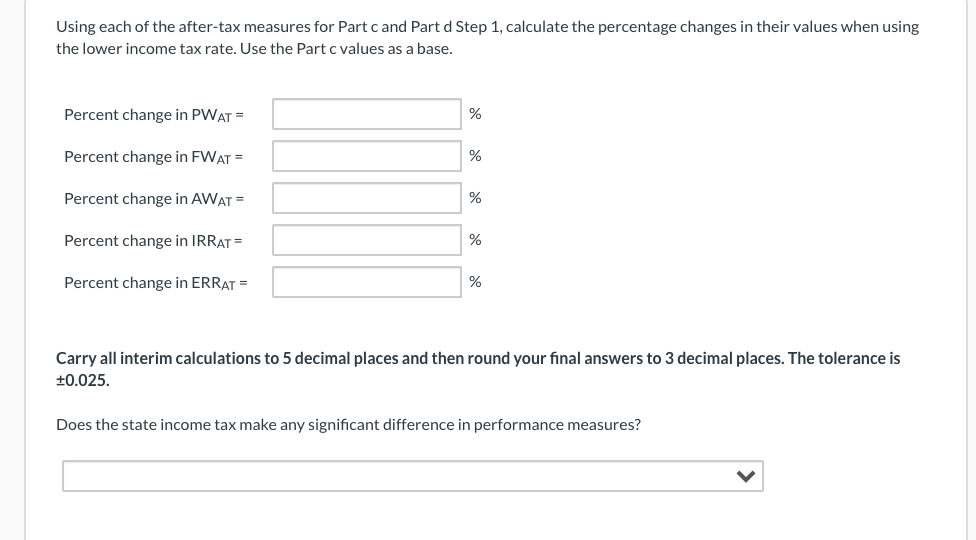

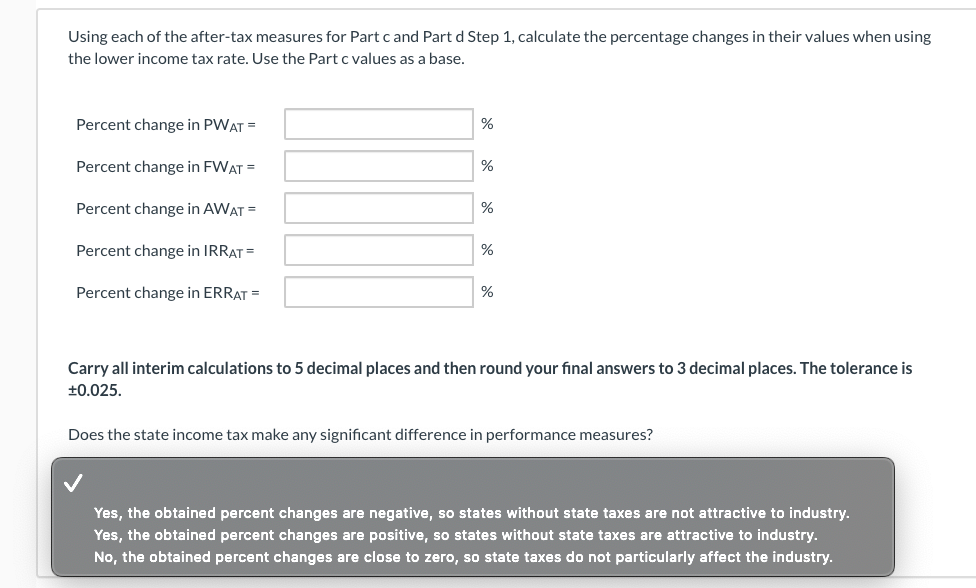

A timber cutting asset is being considered by a company that engages in harvesting trees and then replanting forest areas. It is a large and rugged piece of equipment that can cut a tree, hold onto it, cut another, hold onto it, and continue until about six trees are being held. Then, it can pick up the set of trees and move them to an area for further processing. After an area is cleared, the equipment can then be configured to replant the area and dress the surrounding soil in an environmentally friendly and responsible way. The asset costs $620,000, will have a useful life of 9 years, and a salvage value at that time of $130,000. The before-tax net revenue will be $150,000 per year. The company's after-tax MARR is 10% and its combined federal and state tax rate is 25%. Find the before-tax PW, FW, AW, IRR, and ERR using SLN depreciation. Use the appropriate before-tax MARR. Click here to access the TVM Factor Table calculator. PWBT = $ FWBT = $ AWBT = $ % IRRBT = % ERRBT = Carry all interim calculations to 5 decimal places and then round your final answers for PW, FW, and AW to a whole number. Round your final answers for IRR and ERR to 3 decimal places. The tolerance for PW, FW, and AW is $200 and the tolerance for IRR and ERR is +0.075. Find the after-tax PW, FW, AW, IRR, and ERR using SLN depreciation. Click here to access the TVM Factor Table calculator. PWAT = $ FWAT = $ AWAT = $ % IRRAT = % ERRAT Carry all interim calculations to 5 decimal places and then round your final answers for PW, FW, and AW to a whole number. Round your final answers for IRR and ERR to 3 decimal places. The tolerance for PW, FW, and AW is $200 and the tolerance for IRR and ERR is +0.075. Find the after-tax PW, FW, AW, IRR, and ERR using the appropriate Property Class MACRS-GDS depreciation. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. Click here to access the TVM Factor Table calculator. PWAT = $ FWAT = $ AWAT - $ % IRRAT % ERRAT = Carry all interim calculations to 5 decimal places and then round your final answers for PW, FW, and AW to a whole number. Round your final answers for IRR and ERR to 3 decimal places. The tolerance for PW, FW, and AW is 200 and the tolerance for IRR and ERR is +0.075. Some states in the USA have no state income tax. Again perform the analysis (calculate the after-tax indicators) using MACRS- GDS depreciation, but use only the federal 21% tax rate. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. Click here to access the TVM Factor Table calculator. PWAT = FWAT = $ AWAT $ IRRAT = % % ERRAT Carry all interim calculations to 5 decimal places and then round your final answers for PW, FW, and AW to a whole number. Round your final answers for IRR and ERR to 3 decimal places. The tolerance for PW, FW, and AW is 200 and the tolerance for IRR and ERR is +0.075. Using each of the after-tax measures for Part cand Part d Step 1, calculate the percentage changes in their values when using the lower income tax rate. Use the Part c values as a base. Percent change in PWAT = % Percent change in FWAT = % Percent change in AWAT = % Percent change in IRRAT= % Percent change in ERRAT = % Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is +0.025. Does the state income tax make any significant difference in performance measures? Using each of the after-tax measures for Part cand Part d Step 1, calculate the percentage changes in their values when using the lower income tax rate. Use the Part c values as a base. Percent change in PWAT = % Percent change in FWAT = % Percent change in AWAT = % Percent change in IRRAT = % Percent change in ERRAT = % Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is +0.025. Does the state income tax make any significant difference in performance measures? Yes, the obtained percent changes are negative, so states without state taxes are not attractive to industry. Yes, the obtained percent changes are positive, so states without state taxes are attractive to industry. No, the obtained percent changes are close to zero, so state taxes do not particularly affect the industry