Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A TL= 24,000,000 bTL = 2,600,000 C TL/YR = 3,000,000 D TL/YR = 11,450,000 E TL/YR = 2,600,000 : A construction machine has been purchased

A TL= 24,000,000

bTL = 2,600,000

C TL/YR = 3,000,000

D TL/YR = 11,450,000

E TL/YR = 2,600,000

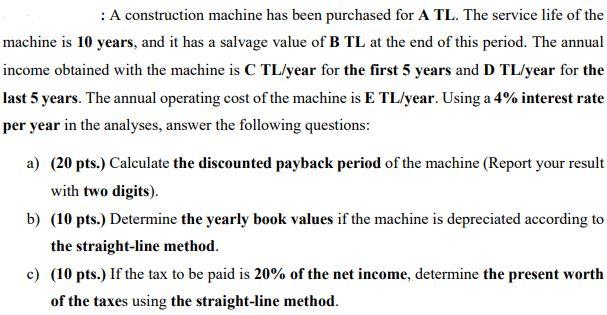

: A construction machine has been purchased for A TL. The service life of the machine is 10 years, and it has a salvage value of B TL at the end of this period. The annual income obtained with the machine is C TL/year for the first 5 years and D TL/year for the last 5 years. The annual operating cost of the machine is E TL/year. Using a 4% interest rate per year in the analyses, answer the following questions: a) (20 pts.) Calculate the discounted payback period of the machine (Report your result with two digits). b) (10 pts.) Determine the yearly book values if the machine is depreciated according to the straight-line method. c) (10 pts.) If the tax to be paid is 20% of the net income, determine the present worth of the taxes using the straight-line methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started