Answered step by step

Verified Expert Solution

Question

1 Approved Answer

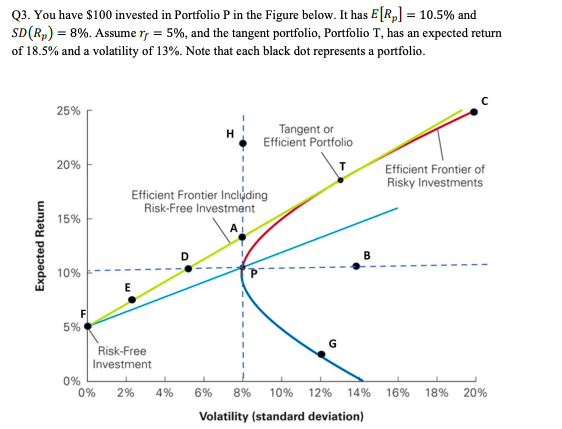

a. To maximize your expected return without increasing your volatility, which portfolio would you invest in? Explain your answer. b. To keep your expected return

a. To maximize your expected return without increasing your volatility, which portfolio would you invest in? Explain your answer.

b. To keep your expected return the same but minimize your risk, which portfolio would you invest in? Explain your answer.

c. Which portfolio is not possible to invest in? In other words, which portfolio is impossible to construct? Explain your answer

Please show all the work and referenced cell using Excel.

Q3. You have $100 invested in Portfolio P in the Figure below. It has E[Rp]=10.5% and SD(Rp)=8%. Assume rf=5%, and the tangent portfolio, Portfolio T, has an expected return of 18.5% and a volatility of 13%. Note that each black dot represents a portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started